There was a continuation at least in the stock and bond markets today chair Powell's speech at Jackson Hole. On Friday, both bond prices (higher yield

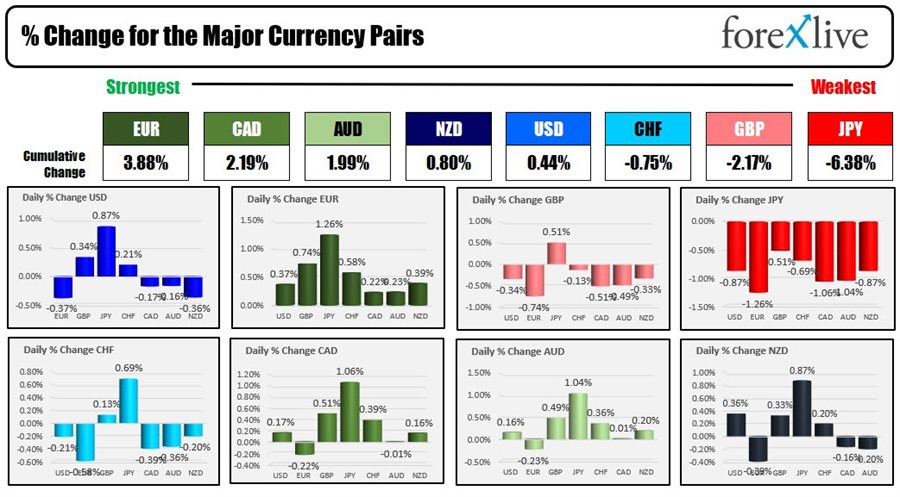

There was a continuation at least in the stock and bond markets today chair Powell’s speech at Jackson Hole. On Friday, both bond prices (higher yield) and stocks fell sharply. Today, stocks and bonds continued their moves. The US dollar was mixed with gains vs. the GBP, JPY and CHF. The USD did decline vs the EUR, CAD, AUD and NZD however.

The strongest to the weakest of the major currencies

The EUR was the strongest of the major currencies . Over the weekend ECBs Schanbel basically reiterated some of Powell’s sentiments when she spoke on Saturday which helped to support the EUR. In her speech she said:

- “Even if we enter a recession, we have little choice but to continue the normalization path,”

- “If there was a de-anchoring of inflation expectations, the effect on the economy would be even worse.”

- Said rates need to stay high, cautioned against pausing on early signs of a potential turn in inflationary pressures – central bank rate setters should instead signal their “strong determination” to bring inflation back to target quickly

Although the EURUSD moved lower early in the session, the pair did bottom and bounce higher. The move was able to extend above the 100 hour MA in the European session and stay above. The higher 200 hour MA at 1.0010 currently was broken on three separate hourly bars, but each stalled a few pips above the break and ahead of the next target at the Thursday last week high at 1.00328. The current price is trading at 0.9998, back below the parity level. IN the new day if the price can stay below the 200 hour MA/1.00328 level, the sellers area still in more control. On the downside the 100 hour MA at 0.99698 is support with a break below increasing the bearish bias. So technical bias levels are close by and traders will battle to see if the selling from Friday continues.

The JPY was the weakest and the USDJPY showed a strong move to the upside in the Asian session.There was a dip in the USD session which saw the pair retrace 50% of the gains (see post here), but bounce off the level. The topside highs for the day did find willing sellers just ahead of the high for the year at 1.39384, and the highest level since 1998. Get above that level opens the door for more upside. ON the downside, the 138.25 followed by 137.91 would be downside targets that would need to be broken to increase the bearish bias.

THe USDCAD rotated lower as it reacted to the higher oil prices. The 100/200 hour MAs are still below at 1.2979. That will be a key support/bias defining level.

The USDCHF is closing above the 100 day MA for the 2nd time in the last week. That MA comes in at 0.9667. The 100 hour MA is at 0.9654. It would take a move below each to increase the bearish bias going forward.

Finally, the AUDUSD moved highere today but did stall the rally naar the 200/100 hour MAs at 0.6913 and 0.69226 respectively. The price is at 0.6900 into the close. Stay below the MAs is needed to keep the sellers more in control from a short term technical perspective.

A look at other markets shows:

- Spot gold is unchanged at $1737.60

- Spot silver is down $0.11 or -0.60% at $18.76

- Crude oil is trading up $3.86 at $96.92

- Bitcoin traded as low as $19,557. It is currently trading back above the $20,000 level at $20,178

- Natural gas is trading up $0.02 at $9.28

US stocks traded lower for the 2nd consecutive day adding to the sharp declines from chair Powell’s Jackson Hole speech on Friday with the Dow fell over 1000 points. All the major indices close below their 100 day moving averages:

- Dow industrial average fell -184.41 points or -0.57% at 32099.00

- S&P index fell 27.06 points or -0.67% at 4030.60

- NASDAQ index fell -124.03 points or -1.02% at 12017.68

- Russell 2000 fell -16.88 points or -0.89% at 1882.94

In the US debt market, yields moved higher. The 2 year yield traded to its highest level since November 2007

- 2 year 3.429%, +2.6 basis points

- 5 year 3.256%, +4.8 basis points

- 10 year 3.108%, +6.5 basis points

- 30 year 3.246%, +5.3 basis points

www.forexlive.com