Fitch affirms China A+ rating but lowers its outlook to negativeChina vehicle sales rose in March, bouncing back from FebruaryBig Federal Reserve day

- Fitch affirms China A+ rating but lowers its outlook to negative

- China vehicle sales rose in March, bouncing back from February

- Big Federal Reserve day coming up – CPI, then Bowman, Barkin, Goolsbee, & March minutes

- NZD/USD trading higher after the RBNZ statement (TL;DR on rates is ‘higher for longer’)

- Reserve Bank of New Zealand leaves it cash rate at 5.5%, as widely expected

- BoJ Gov Ueda comments on challenges of prolonged deflation, low inflation

- ICYMI – What to watch in Japanese comments for USD/JPY selling intervention getting closer

- PBOC sets USD/ CNY central rate at 7.0959 (vs. estimate at 7.2300)

- BoJ Governor Ueda says won’t change monetary policy just to deal directly with FX moves

- “Putin and Xi’s Unholy Alliance”

- More from BOJ’s Ueda – wanted to move before trend inflation hit 2%

- PBOC is expected to set the USD/CNY reference rate at 7.2300 – Reuters estimate

- BoJ Ueda anticipates accommodative financial conditions will be maintained for time being

- Japan data: March PPI +0.2% m/m (expected +0.3%)

- US CPI data due Wednesday, the ranges of estimates (& why they’re crucial to know)

- Goldman Sachs on the largest selling of stocks by hedge funds in 3 months – short sales

- ICYMI from the SNB – vice chairman Schlegel on intervention

- ICYMI – Morgan Stanley raised its Brent crude oil price forecast as high as $94 (from $90)

- Forexlive Americas FX news wrap 9 Apr: The FX mkt has volatility ahead of key events

- Oil – private survey of inventory shows a headline crude oil build greater than expected

- US stocks recover from declines to close higher

- Trade ideas thread – Wednesday, 10 April, insightful charts, technical analysis, ideas

The

New Zealand dollar was an outperformer during the session, rising

towards 0.6075 on the back of the Reserve Bank of New Zealand April

monetary policy statement (officially this was a Monetary Policy

Review (MPR), not a Monetary Policy Statements (MPS). Review’s are

briefer that Statements). The Bank left its official Cash Rate

unchanged at 5.5% and wrapped up its statement with the hawkish:

- The

Committee agreed that interest rates need to remain at a restrictive

level for a sustained period to ensure annual consumer price

inflation returns to the 1 to 3 percent target range.

Bolding

is mine.

Across

other major FX ranges were tight, with traders now awaiting the US

CPI report due at 8.30 am US Eastern time (1230 GMT).

We

had remarks from Bank of Japan Governor Ueda (see points above). Most

notably he said that the Bank of Japan will consider a policy change

if the weak yen causes inflation to overshoot. Japanese Government

Bond 10 year yield rose to its highest since March 15.

Fitch

(rating agency) revised its outlook on China to negative, while

affirming the country at ‘A+’ rating. In downgrading its outlook Fitch cited increasing risks to China’s public finance outlook (more in the bullet point above).

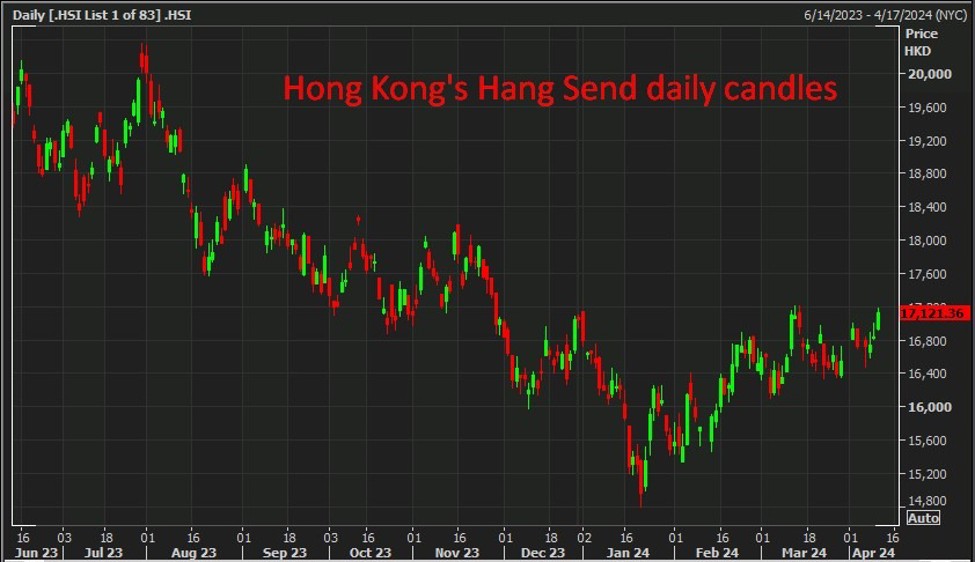

In

regional equities, Hong Kong’s Hang Seng performed well:

www.forexlive.com

COMMENTS