The CPI rate in Japan’s capital Tokyo hit a 42-year high in January. The inflation data from Tokyo is published about 3 weeks ahead of nationwide CPI

The

CPI rate in Japan’s capital Tokyo hit a 42-year high in January.

The inflation data from Tokyo is published about 3 weeks ahead of

nationwide CPI and serves as a guide to what to expect. The Bank of

Japan have insisted, over and over, that current high levels of

inflation in Japan are transitory only, driven by cost-push factors.

Indeed, the BOJ forecasts that inflation will begin to slow from

around September/October this year. Other DM central banks, of

course, also held onto the ‘transitory’ explanation only to

experience skyrocketing inflation and being forced into rapid rate

hike cycles.

Some

reduction in easy BOJ policy are

expected by

many in the market

from some time after April, when Bank of Japan Governor Kuroda’s

term expires and a new Governor is appointed. If today’s jump in

Tokyo inflation is reflected in the nationwide data to come it’ll

increase the pressure even more on the BOJ to dial back its easy

monetary policy.

Elsewhere

from

the region

today

we had data showing an improvement in the ANZ New Zealand business

survey. Its still showing deep pessimism just not so much as in the

previous survey.

We

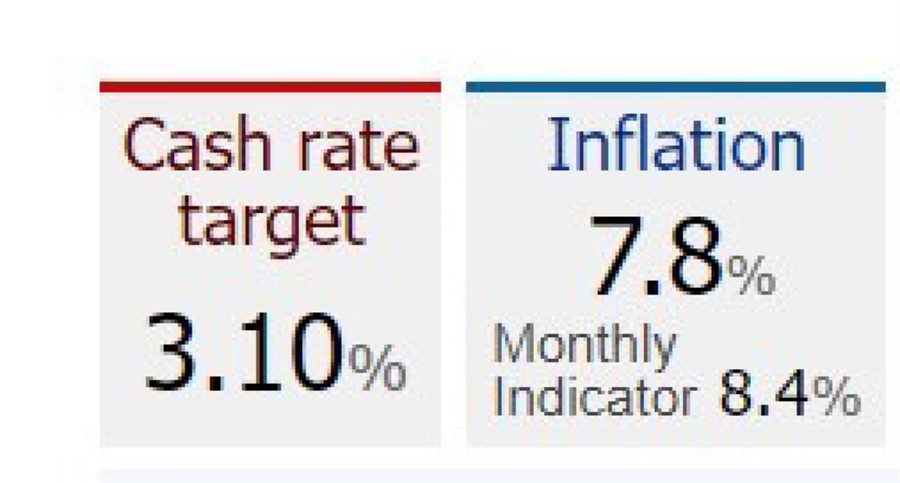

also had Australian PPI data for Q4, which fell back a little from Q3

and is an encouraging sign that perhaps inflation has peaked. Earlier

in the week the Australian Bureau of Statistics released the latest

quarterly and monthly CPI data, which

scaled new highs to 7.8%

and 8.4% respectively. A slowing would be very welcome but both are a

long, long way above the top end of the Reserve Bank of Australia’s

2 to 3% target band for inflation. The Bank meet on February 7 and it

would seem they’d be ignoring their mandate were they

not to

raise the cash rate from its current 3.1% level. Pic is from the

front page of the RBA website and shows how far behind the RBA cash

rate is:

news.google.com