As an appetiser to US inflation data due later Wednesday we had Chinese CPI (and PPI) data published. The official figures showed a rise in the CPI f

As

an appetiser to US inflation data due later Wednesday we had Chinese

CPI (and PPI) data published. The official figures showed a rise in

the CPI from June but not as much as expected (2.7% vs. expected 2.9%

& prior 2.5%), and a lower PPI in July than in June (see bullets

above for more). Core CPI in China in July fell to 0.8% y/y from June’s 1.0%. From Japan we had PPI data, in line with the central

expectation.

There

was no news flow of note.

Early in the session comments were reported from St Louis Federal Reserve branch President James Bullard – he sees rates at 3.75 – 4% by year-end (see bullets above)

Major

forex traded in relatively subdued ranges again here today. There is

barely any net change to report.

Of

note for share traders, an Elon Musk SEC (US Securities and Exchange

Commission) filing showed he has sold a further ~7.9mn TSLA shares

(around US$6.9bn worth).

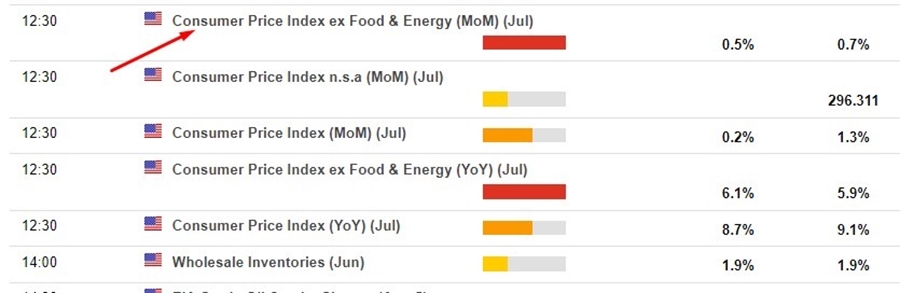

US CPI data is due at 1230 GMT, there are previews posted above in the points.

This

snapshot from the ForexLive economic data calendar, access

it here.

-

The

times in the left-most column are GMT. -

The

numbers in the right-most column are the ‘prior’ (previous

month/quarter as the case may be) result. The number in the column

next to that, where is a number, is the consensus median expected.

www.forexlive.com