Article by IG Chief Market Analyst Chris BeauchampFTSE 100, Dow Jones, DAX 40, Analysis and ChartsFTSE 100 steady after recent rebound.The surge

Article by IG Chief Market Analyst Chris Beauchamp

FTSE 100, Dow Jones, DAX 40, Analysis and Charts

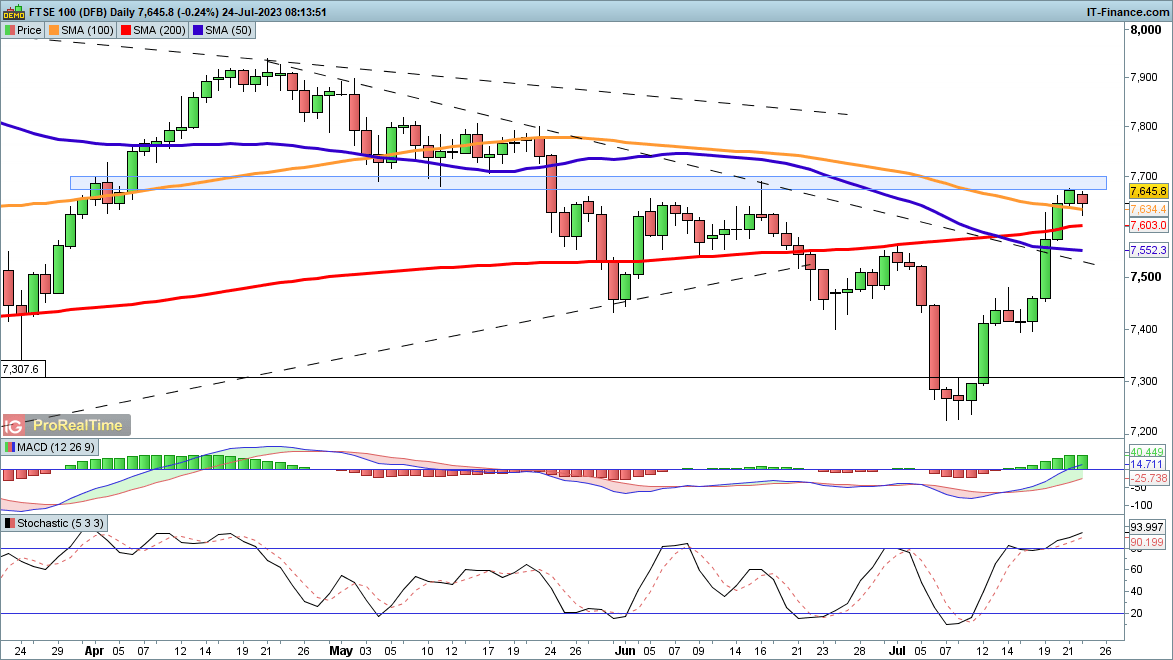

FTSE 100 steady after recent rebound.

The surge of the past two weeks has carried the index to its highest level since late May. The price rallied above the 100-day SMA on Friday, and after gaining around 400 points it is perhaps not surprising to see some weakness enter the picture. Nonetheless, this looks more like consolidation at present. The key battleground will be the 7700 area. This was support in early May and resistance in June, so a close above 7700 would mark a fresh bullish development. From here the index might then move on to 7800 and then on towards the April highs around 7900.

A move back below 7550 and the 50-day SMA would be needed to dent the bullish view, and a close back below downtrend resistance from the April highs would put the sellers back in charge.

FTSE 100 Daily Price Chart

Recommended by IG

Traits of Successful Traders

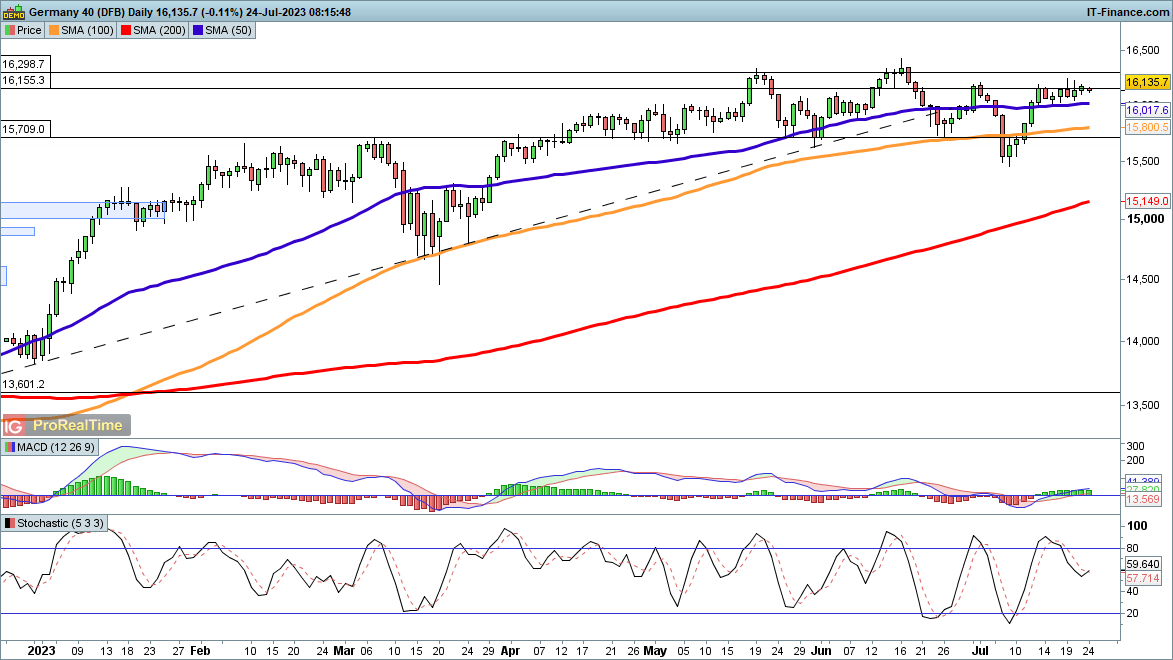

DAX 40 aiming for another attempt to break 16,200.

Consolidation continues to be the theme here, after the recovery from the early July lows.Upside progress has stalled around 16,200, though the index remains close to its record highs near 16,400. This is the first destination in any move higher, with further gains then taking the index into fresh uncharted territory.

A close back below 16,000 might suggest another drop back towards the all-important 15,700 support level.

DAX 40 Daily Price Chart

Recommended by IG

Traits of Successful Traders

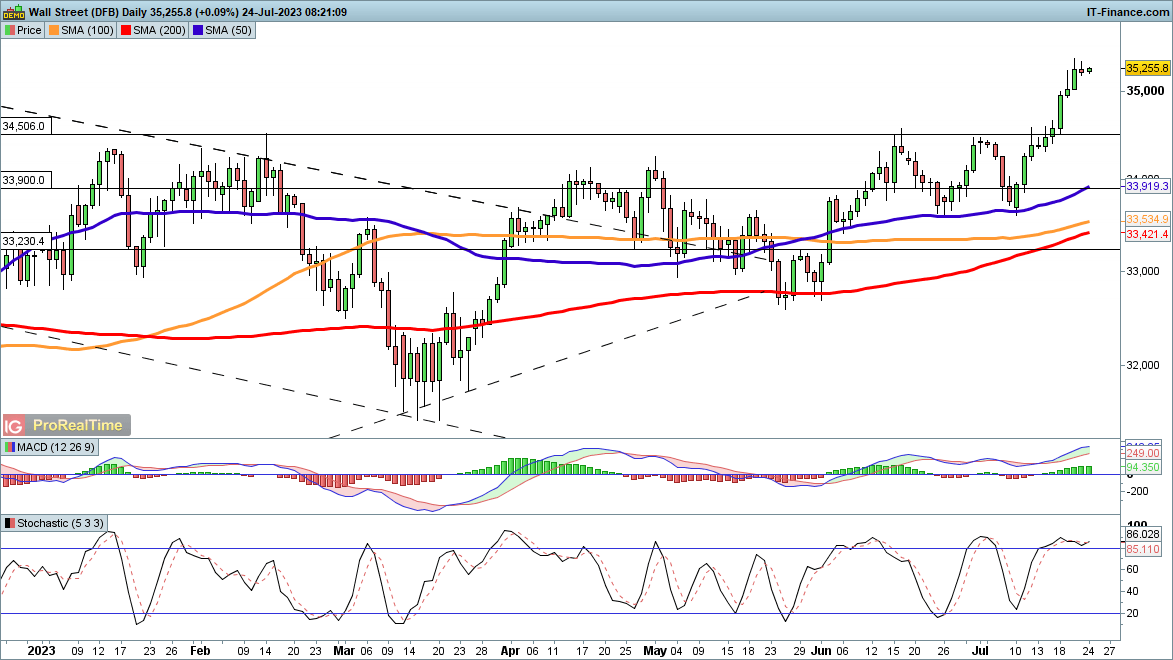

Dow Jones holding firm around 2023 highs

Over the past two weeks the index has finally found the strength to move to the upside, rallying to its highest level since April 2022. The next two weeks are packed with earnings updates, economic data, and central bank decisions. This may militate against any further upside in the short-term, but further gains might target the February 2022 high at 35,860, and then on towards 36,465, the November 2021 peak.

Consolidation may develop from here as the market digests all the news expected over the coming two weeks. Some support might be expected around 34,500, which was previously resistance in February and June.

Dow Jones Daily Price Chart

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com