The affirmation listening to of ex-Fed Chair Yellen as Treasury Secretary, and knowledge on worldwide capital flows yesterday

The affirmation listening to of ex-Fed Chair Yellen as Treasury Secretary, and knowledge on worldwide capital flows yesterday led Wall Road larger because the market eyes a hefty enlargement in stimulus beneath the Biden administration and the Democratic-led Congress.

Asian markets had been additionally supported on the entire, though there have been pockets of weak point, most notably in Japan with the Nikkei really decrease because the 2-day BoJ assembly kicks off. Stimulus hopes proceed to underpin sentiment with earnings reviews additionally including help, though virus developments additionally stay in focus and Germany’s extension of the present lockdown measures and nonetheless excessive dying depend spotlight that regardless of the rollout of vaccinations, the possibilities are nonetheless that each the Eurozone and the UK will see a technical recession over This autumn/Q1 with the companies sector particularly impacted by virus restrictions.

Netflix Inc surged in after-hours commerce, after reporting a stronger rise in prospects than anticipated. JPMorgan reported a $4.51 bln This autumn revenue, exceeding expectations and greater than doubling the revenue seen in This autumn of 2019. BofA revealed a 22% drop in This autumn earnings, however earnings per share got here in higher than anticipated. Earnings had been usually supportive.

Bloomberg confirmed that the ECB is actively focusing on spreads and thus borrowing prices for governments throughout the Eurozone, which at this stage is hardly a shock and can change into much more necessary as soon as exercise bounces again and the main focus turns as soon as once more to the debt mountain amassed through the pandemic.

-

EUR – up at 1.2153, stays beneath 38.2% fib from the 1.2380-1.2050 down leg

-

GBP – rebound continues with Cable transferring above R1 at 1.3660

-

JPY – right down to 103.70 – S1 at 103.66

-

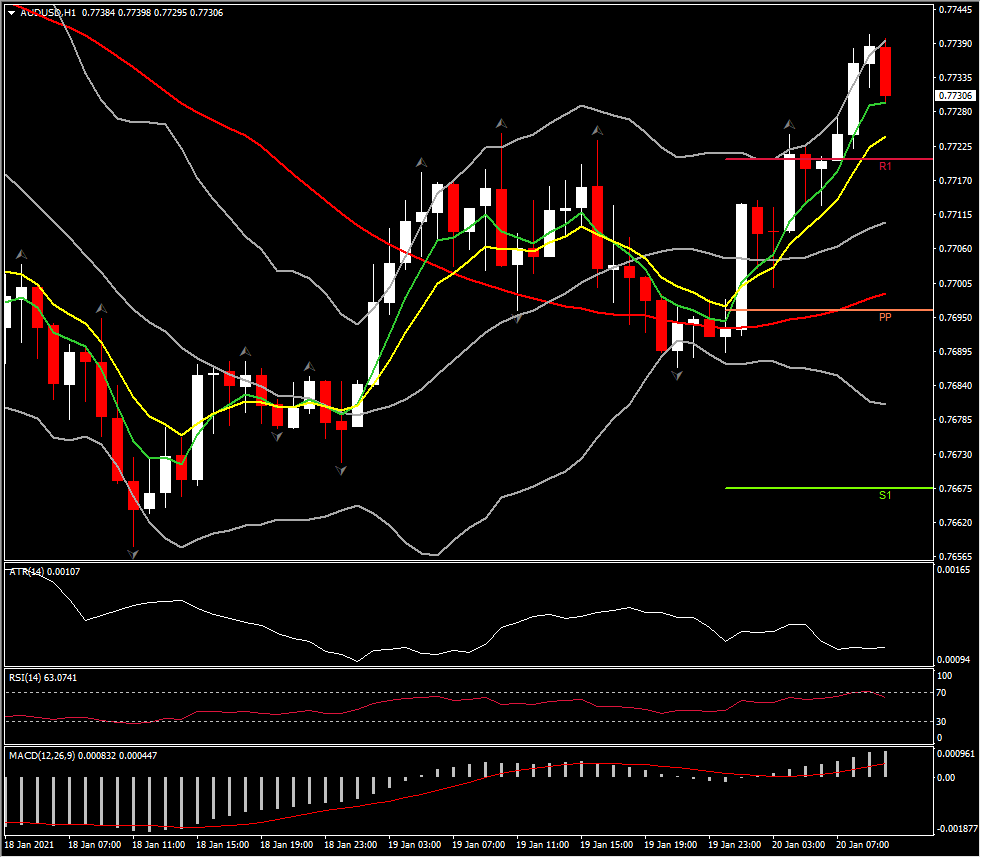

AUD – outperformed to 0.7730 – R2 at 0.7750

-

CAD – positive aspects, retreating to its place beneath 1.2700

-

GOLD – at 1854 – subsequent Resistance at 1858 (R3 and 50DMA)

-

USOil – lifted to 53.40, nonetheless renewed lockdowns have added strain on the 1st half of 2021. February contract expires as we speak so traded quantity is now within the March contract. The IEA earlier lower Q1 oil demand by 600okay bpd, and 300okay bpd for all of 2021, which was probably behind the modest dip in costs. Hopes for a faster vaccine rollout, together with new huge fiscal stimulus and robust China progress, might restrict draw back going ahead, although oil bulls will want some proof of enchancment in pretty quick order if additional important oil worth positive aspects are to be seen. For now, the $52-$54 buying and selling band seen over the previous weeks seems set to carry for now.

-

Bitcoin – turned decrease to 35.7K

In the present day: All eyes will likely be on Washington as we speak – Inauguration 16:15 GMT. The native knowledge calendar in the meantime focuses on December inflation knowledge for the UK and the Eurozone.

Largest (FX) Mover – AUDUSD (+0.51% as of 07:35 GMT) – The asset reversed its 2-day losses, because it was supported fairly properly by the 20DMA. Intraday momentum indicators and quick MAs counsel an rising constructive bias, nonetheless within the day by day timeframe constructive bias stays beneath strain. ATR H1 – 0.00107 & ATR Each day – 0.00794.