Markets are coming back from the lengthy vacation weekend! The greenback has began the brand new 12 months with a declining b

Markets are coming back from the lengthy vacation weekend!

The greenback has began the brand new 12 months with a declining bias, which is after all the place it left off final 12 months, wagering the world’s pandemic restoration will drive different currencies increased.

2020 ended on a bullish notice for Treasuries and equities. Yields completed barely richer on the day, and measurably decrease on the 12 months. Optimism for 2021 supported Wall Road the place the USA30 and the USA500 climbed to new all-time peaks. The three indexes collectively managed to set 102 report closing highs final 12 months amid unprecedented financial and financial help, together with vaccines and therapeutics. Nonetheless, there are renewed worries given the brand new virus strains and extra stringent lockdowns.

Japan stated Tokyo and a few surrounding districts might need to declare a state of emergency and the US additionally warned that issues might worsen in coming weeks. Nikkei misplaced -0.8%. China’s manufacturing PMI in the meantime dropped again in December, however nonetheless signaled growth, whereas the Dangle Seng and CSI 300 lifted 0.7% and 1.1% respectively. Lockdowns and restrictions received’t go away any time quickly, even when there’s now mild on the finish of the tunnel.

Buying and selling could possibly be constrained right this moment forward of the Georgia Senate runoff elections tomorrow that may decide management of the Senate and thus the legislative agenda.

Forex market replace

-

EUR – as much as 1.2265 above PP

-

GBP– retesting 1.3700 (R1) since this morning

-

JPY – extending positive factors towards USD – beneath 103.00

-

CAD – at present at 1.2690

-

AUD –entered 2017 space – prolonged to 0.7730

-

GOLD – broke 6-month downwards channel, above 1900 – at present at 1924.84

-

USOil – re-entered pre-Covid disaster ranges in current weeks. It’s at $49.44, with a full OPEC assembly scheduled for right this moment, amid warnings of loads of draw back dangers for the primary half of the 12 months.

-

BTC – rallied to yet one more report peak. Cryptocurrencies look seemingly see far more upside amid indicators that long-term institutional funding managers have been shopping for and holding bitcoin and different main cryptocurrencies as an inflationary hedge

Right now – The calendar right this moment primarily focuses on ultimate manufacturing PMI readings for December, with each UK and Eurozone numbers anticipated to verify a strong tempo of expansions and the truth that the prospect of vaccinations lifted spirits that month. Additionally now we have US building spending and the OPEC assembly.

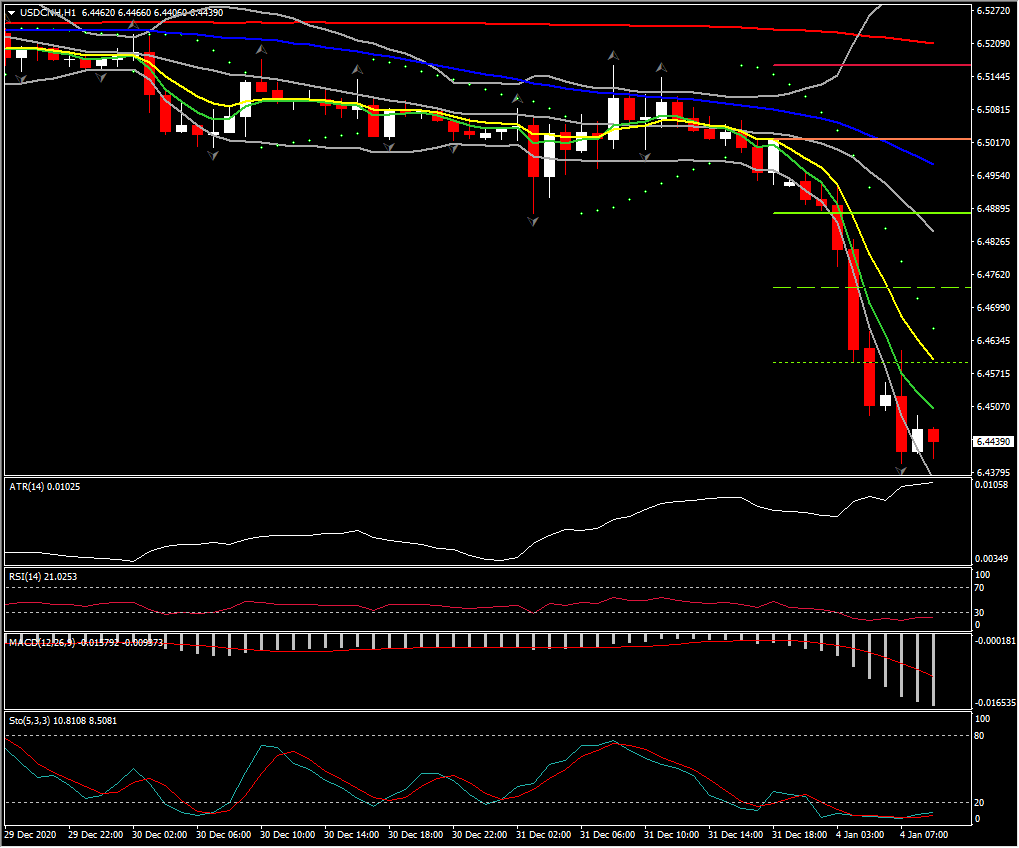

Greatest (FX) Mover – USDCNY ( -1.02% as of 09:50 GMT) – It continued aggressively southwards for the 8th month in a row, reversing greater than 75% of its 3-year positive factors. It set at 6.4445. Technical indicators on lengthy and brief time period are negatively configured with any rebound implying a correction of the sharp selloff. ATR 0.01035, Each day ATR 0.02629.