GBP PRICE, CHARTS AND ANALYSIS:Read More: FOMC Preview: Hawkish Pause to Reignite the Dollar Index (DXY) Rally?GBP has struggled of late and has attem

GBP PRICE, CHARTS AND ANALYSIS:

Read More: FOMC Preview: Hawkish Pause to Reignite the Dollar Index (DXY) Rally?

GBP has struggled of late and has attempted a recovery in the early part of this week. UK inflation data is due tomorrow and following a sharp increase in headline inflation in the US and Canada, is the UK next?

Looking for Tips and Tricks to Trade GBP/USD? Download the Complimentary Guide Below.

Recommended by Zain Vawda

How to Trade GBP/USD

UK INFLATION AND BOE EXPECTATIONS

The UK still have the highest inflation rate in comparison to the Euro Area and the US which does pose a bigger challenge for the Bank of England (BoE) compared to it Central Bank counterparts. This coupled with rising unemployment and a perceived slowdown in GDP growth have market participants on the edge of their seats, as it seems likely further rate hikes may be needed to see inflation cool further. This idea has received further credence by the recent uptick in US and Canadian inflation and the rise in Oil prices.

The recent uptick in UK average earnings makes tomorrows Inflation print even more important as it comes a day before the BoE MPC meeting. An uptick in headline inflation would really ratchet up the heat on the Bank of England (BoE) particularly in light of the of the European Central Bank (ECB) surprise hike last week. I had been vocal proponent of at least one more 25bps hike from the BoE, an uptick in inflation tomorrow may give me food for thought of perhaps an added 25bps hike before 2023 is out.

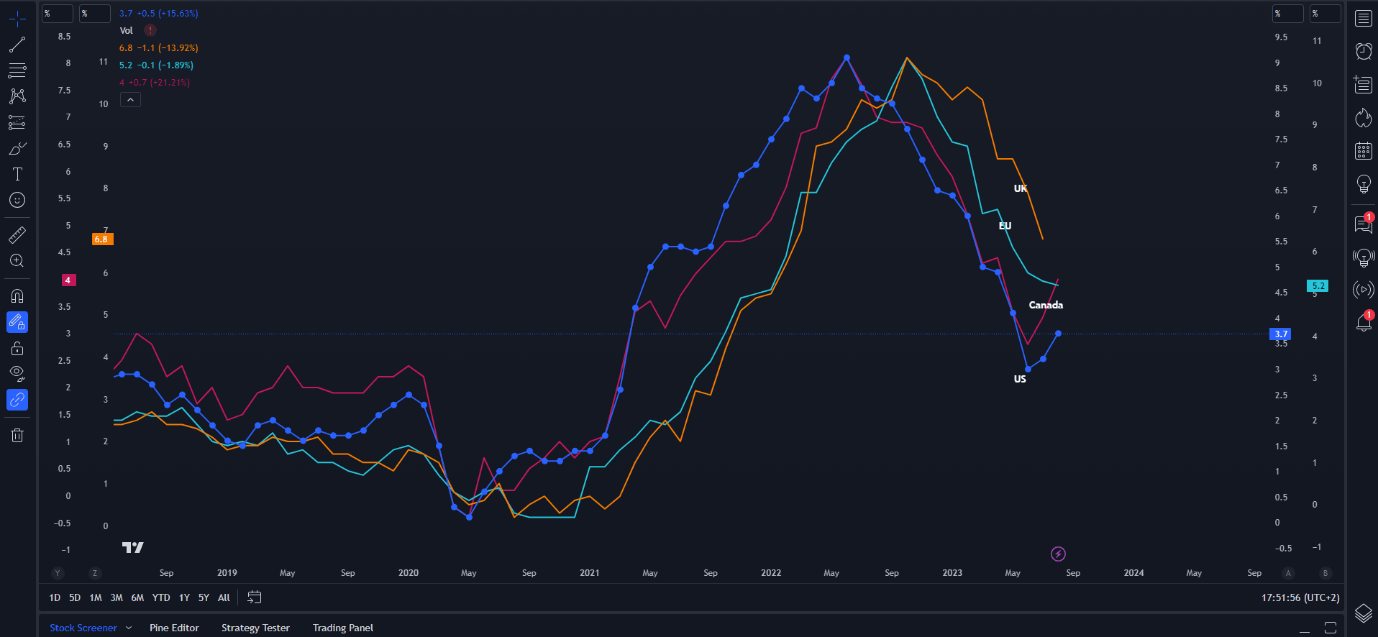

From the major global economies, we can see on the chart below the recent uptick in inflation both in the US and Canada. Canada was the first and most aggressive of the major Central Banks at the start of the hiking cycle.

Inflation comparisons between the Euro Area (Teal), US (Blue), Canada (Pink) and the UK (Orange)

Source: TradingView, Chart Created by Zain Vawda

AUSTRALIAN DATA IMPROVES AND PESSIMISM AROUND CHINA COOLS

The recent weakness in the GBP has been met with an improvement in Australian data of late. This has come at a time when Chinese authorities have been ramping up stimulus measures to boost the economy. The retail sales print from China however did paint a slightly better picture despite the ongoing woes in the real estate sector.

The China picture was one that threatened to throw markets into disarray, but we have seen an improvement in sentiment since. Initially global fund managers were looking to wind down their exposure to Chinese markets, but this trend has been arrested of late based on the data received. This has translated into Australian Dollar strength of late which has helped GBPAUD put in an impressive recovery in the month of September thus far.

For all market-moving economic releases and events, see the DailyFX Calendar

For a Full Breakdown on Trading Range Breakouts, Get Your Free Guide Below.

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

TECHNICAL OUTLOOK AND FINAL THOUGHTS

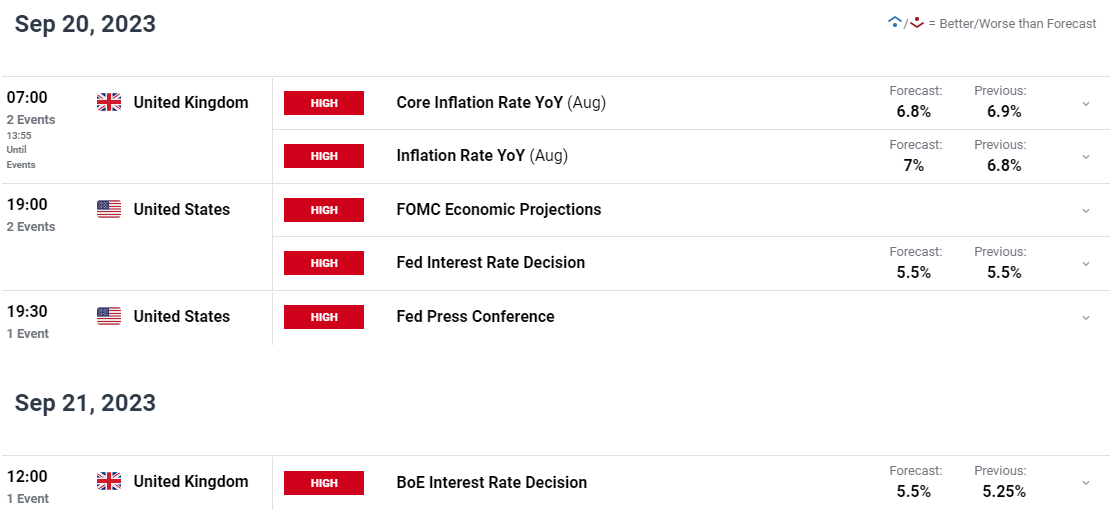

GBPUSD made an attempted run at the 200-day MA this morning. The resurgence in the US session of the DXY has seen GBPUSD surrender early session gains to trade relatively flat at the time of writing.

The deterioration in UK data of late particularly GDP has weighed on cable of late with the pair now down around 700-od pips since the July peak. GBP bulls may be in for some joy tomorrow as UK inflation looks likely to accelerate (my humble opinion) which could serve as a catalyst and catapult cable back toward the 1.2500 handle. The first area of resistance will be the 200-day MA around the 1.2434 mark before the psychological 1.2500 level comes into focus.

Cable has an interesting couple of days ahead with UK inflation followed by the Fed rate decision tomorrow. Then Thursday brings the BoE MPC decision, the positive being that by the end of Thursday we may have a clearer picture of where GBPUSD may head to as we approach Q4.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

- 1.2434 (200-day MA)

- 1.2500 (Psychological Level)

- 1.2540 (20-day MA)

GBP/USD Daily Chart

Source: TradingView, Created by Zain Vawda

IG CLIENT SENTIMENT DATA

IG Retail Trader Sentiment shows that 69% of traders are currently NET LONG on GBPUSD.

For a more in-depth look at GBP/USD sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -7% | -1% |

| Weekly | 4% | -8% | 0% |

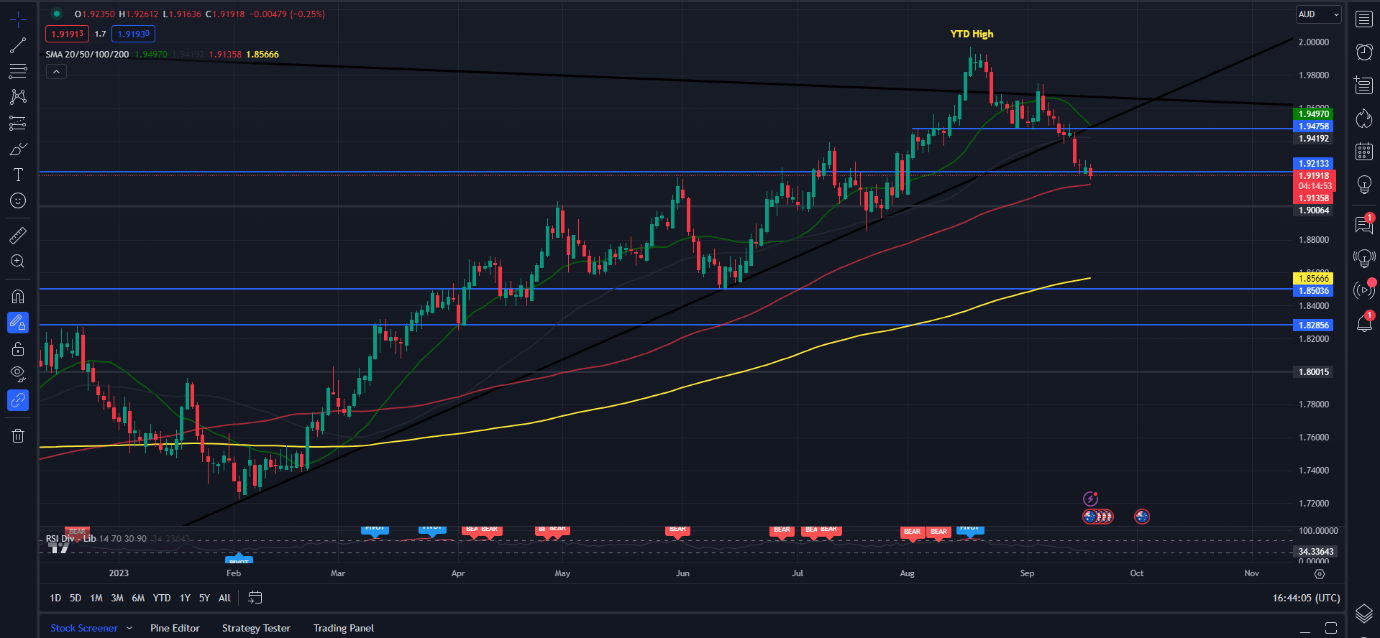

GBPAUD had been on a tear this year but has faced significant selling pressure of late. We are in for an interesting couple of days for GBPAUD as it is just hovering above the 100-day MA which could serve as a key area of support. Having broken the ascending trendline a retracement all the way down to the 200-day MA around the 1.8560 handle resting just above the psychological 1.8500 mark.

Alternatively, a hawkish BoE could see GBP bulls come to the fore we could be in for a retracement back toward the 20-day MA around the 1.9500 mark. A lot to digest here as well with the technical picture facing some overriding fundamental factors for the rest of the week. A rare upside however rests with the fact that the following the data we may finally have some clarity on where to next for GBPAUD.

GBPAUD Daily Chart

Source: TradingView, Created by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS