GBP PRICE, CHARTS AND ANALYSIS:GBP/USD Bulls Return as Cable Retests the 1.2750 Mark in Early European Trade.Choppy Price Action May be Down to Season

GBP PRICE, CHARTS AND ANALYSIS:

- GBP/USD Bulls Return as Cable Retests the 1.2750 Mark in Early European Trade.

- Choppy Price Action May be Down to Seasonality as the US CPI and UK GDP Releases are Sorely Needed to Stoke the Volatility and Provide Direction.

- Eyes on a Potential Range Breakout of the 100-Pip Range Which Has Been Prevalent This Week.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Recommended by Zain Vawda

Get Your Free GBP Forecast

Read More: Gold (XAU/USD) Remains Subdued as the DXY Continues to Advance

Cable has enjoyed a mixed week thus far as a resurgent US Dollar has kept the pair from gaining significant momentum in either direction. Heading into a busy end to the week GBPUSD is trapped in a 100-pip range between the 1.2680 and 1.2780 handles with price action choppy as well.

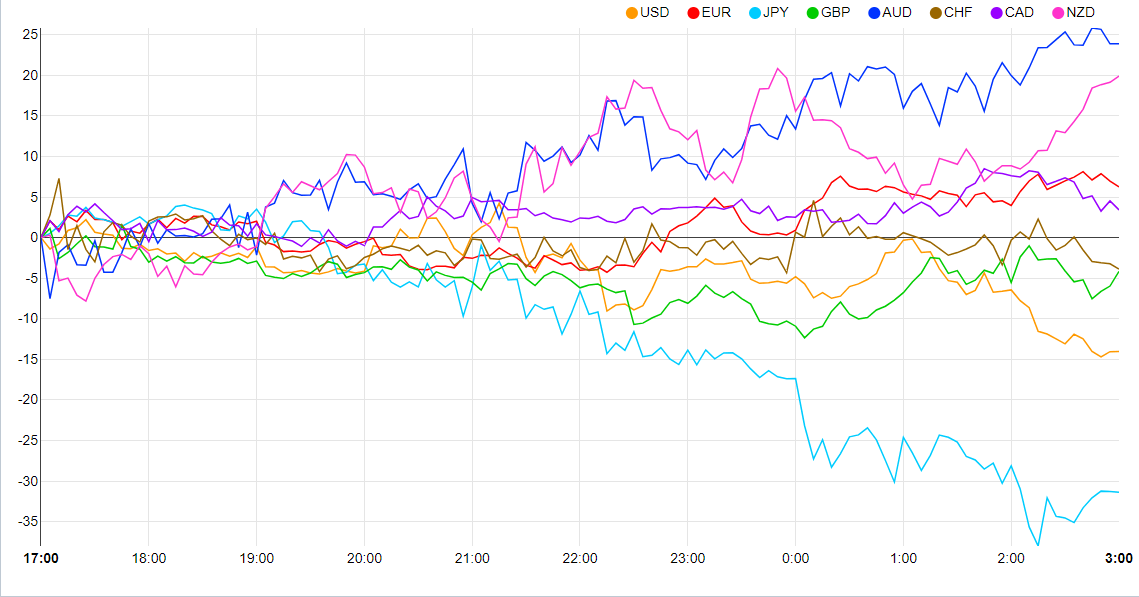

Currency Strength Chart: Strongest – AUD, Weakest – JPY.

Source: FinancialJuice

US CPI AND UK GDP DATA AHEAD

GBPUSD has been struggling since the fresh highs printed on July 13 with a steady move lower ever since. The recent bout of consolidation which seems to be across many asset classes could have an element of seasonality to it, as August has proved a choppy month historically speaking.

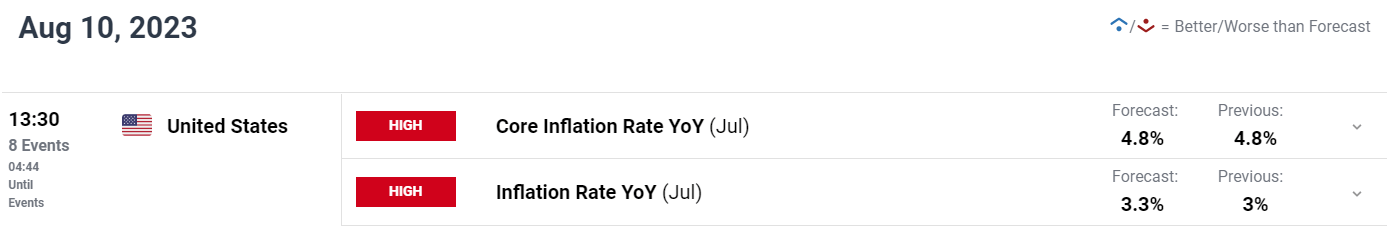

US CPI later today is sure to add some fireworks, however, will it have enough to give GBPUSD impetus for a sustained range breakout. As we saw at the back end of last week as price dipped below key support at the 1.2680 handle and was met with significant buying pressure. The longer price lingers above this support handle the more likely we are to see an explosive break to the upside; this might still require a catalyst though and increases the significance of today’s US CPI and tomorrows UK GDP data.

For a Full Breakdown on Trading Range Breakouts, Get Your Free Guide Below

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

The potential for a softer US inflation print could be just what Cable requires to reignite the bullish move to the upside. US inflation has shown a significant drop off over the past 3 months with forecasts suggesting more of the same. Once more Core CPI will be key as it has remained more stubborn than headline inflation with markets keen to see if last month’s steep drop was a once off or the start of a consistent fall. A rise in the Core or Headline Inflation print could offer the US Dollar some renewed support as the risk off sentiment which propped the US Dollar up earlier in the week appears to have run its course, for now.

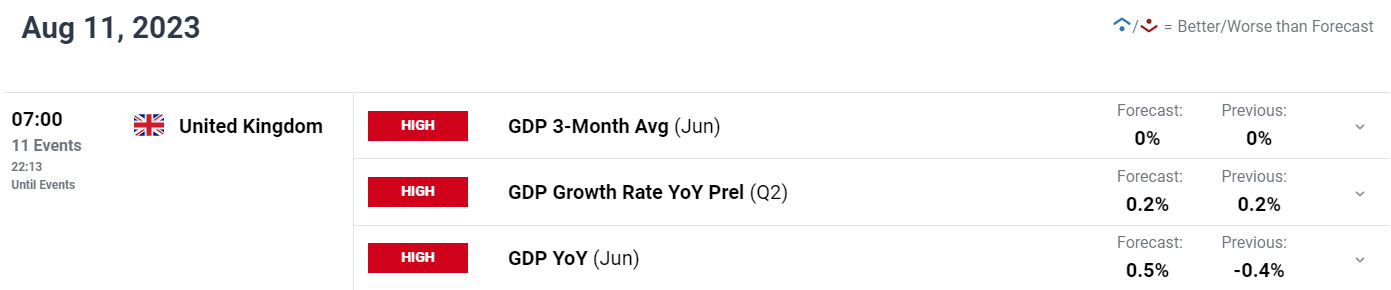

UK GDP data is on the docket for tomorrow and will be key for the Bank of England’s (BoE) and its rate hike path. Given the announcement around data dependency there is a chance that a stark slowdown may see the BoE temper its policy path moving forward and could see sterling face some short-term selling pressure. A positive GDP print on the other hand could see market participants reprice the probability of rate hikes as well as the size of said hikes moving forward and keep Cable on the front foot.

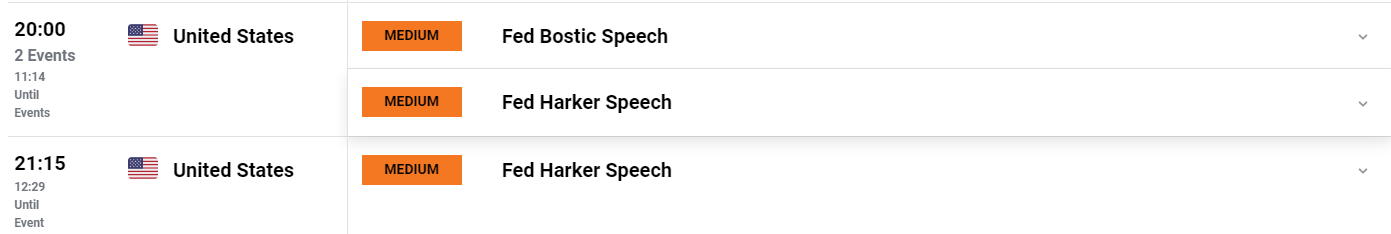

We also have a host of US Federal Reserve policymakers speaking later today post the CI release and this could further add to volatility in the US session.

For all market-moving economic releases and events, see the DailyFX Calendar

Two other developments around the UK worth mentioning come in the form of the UK’s leading thinktank, the National Institute of Economic and Social Research (NIESR). The NIESR stated their belief that inflation is likely to hover above the BoE target of 2% for the next four years. This in theory could see a stronger Pound moving forward as other Central Banks reach their peak rates.

There has also been rumors around M Rishi Sunak looking at a potential ban on British investment in China with the technology, AI, chipmaking and quantum computers areas of concern. This would see the UK adopt a similar approach to the US as the global AI race begins to heat up. These two events are however geared more toward a longer-term outlook for GBP as well as the potential risks facing the currency.

TECHNICAL OUTLOOK AND FINAL THOUGHTS

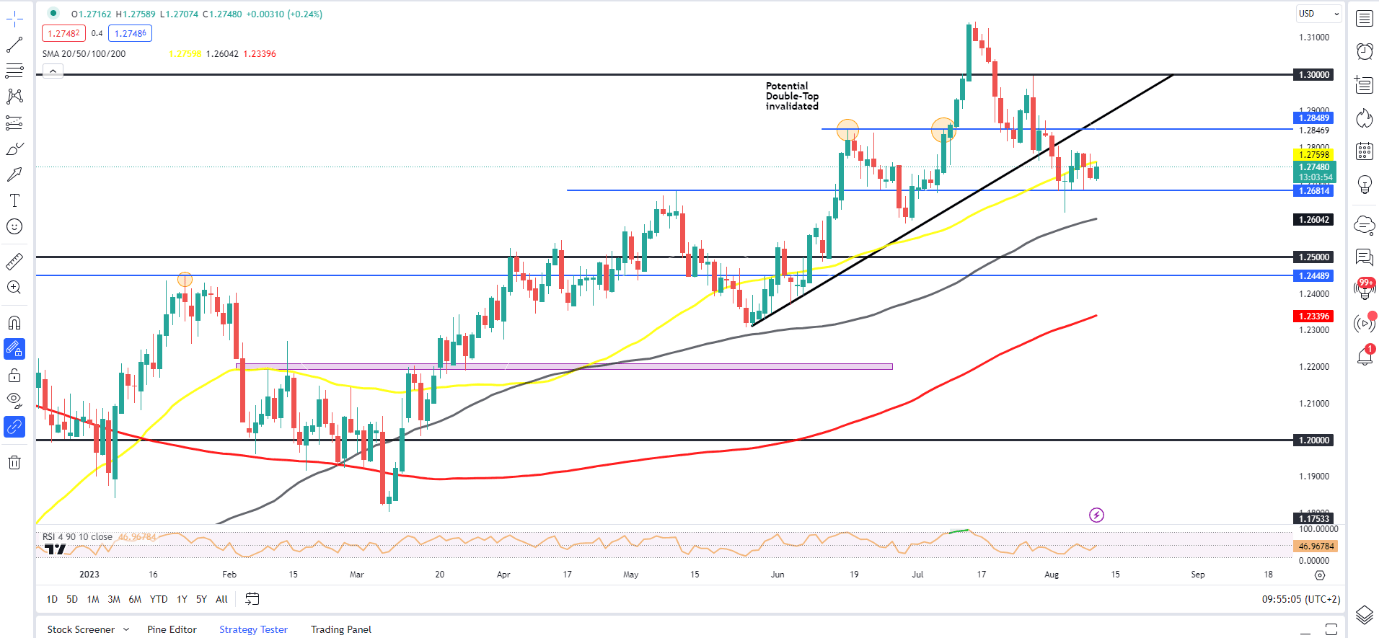

GBPUSD has been ticking lower since the fresh YTD high on July 13. Price does appear to be running out of momentum though with the 1.2680 handle proving a tough nut to crack. This week has seen a mixed bag with Cable just slightly higher than the Monday open as we have had two successive days of losses.

Looking ahead and the range between the 1.2680 and 1.2780 handles continues to hold with a daily candle close below or above the level required. An upside breakout could facilitate a quick run up toward the 1.3000 psychological level with the longer-term prospects for bulls remain promising.

Alternatively, a downside breakout faces a hurdle with the 100-day MA resting around the 1.2600 level before a push to the 1.2500 handle becomes a possibility.

Key Levels to Keep an Eye On:

Support levels:

- 1.2680

- 1.2600 (100-day MA)

- 1.2500

Resistance levels:

- 1.2780

- 1.2850

- 1.3000 (psychological level)

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

IG CLIENT SENTIMENT DATA

IGCS shows retail traders are 56% net-long with the ratio of traders long to short at 1.27 to 1.

For a more in-depth look at GBP/USD sentiment, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 9% | -3% | 4% |

| Weekly | 3% | 0% | 2% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com