GBP/USD Analysis and ChartsBoE governor Bailey warns on UK inflation and growth.Sterling remains underpinned as rate cut hopes are pushed back.For al

GBP/USD Analysis and Charts

- BoE governor Bailey warns on UK inflation and growth.

- Sterling remains underpinned as rate cut hopes are pushed back.

For all market-moving economic data and events, see the DailyFX Calendar

Most Read: British Pound Latest – GBP/USD Boosted by Positive PMI Data

Recommended by Nick Cawley

How to Trade GBP/USD

Bank of England governor Andrew Bailey today warned that getting inflation back down to target (2%) will be difficult and take time and that the current restrictive policy is hurting economic growth. In an interview with ChronicleLive, Mr. Bailey warned that if the central bank doesn’t get inflation down to target, ‘it gets worse’ adding,

“By the end of the first quarter next year, when a lot of that (energy price) unwind will have happened, we may be a bit under 4% but we’ll still have 2% to go, maybe. And the rest of it has to be done by policy and monetary policy. And policy is operating in what I call a restrictive way at the moment – it is restricting the economy. The second half, from there to two, is hard work and obviously we don’t want to see any more damage.’

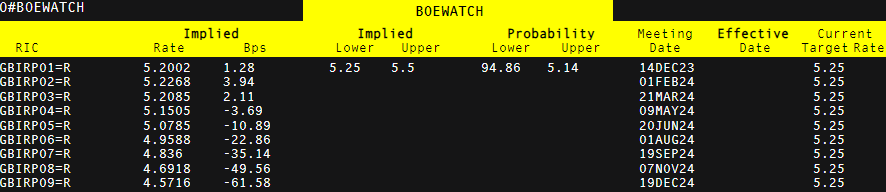

Market rate expectations last week pointed to between 90 and 100 basis points of rate cuts in 2024, the current probabilities show around 61 basis points.

Recommended by Nick Cawley

Trading Forex News: The Strategy

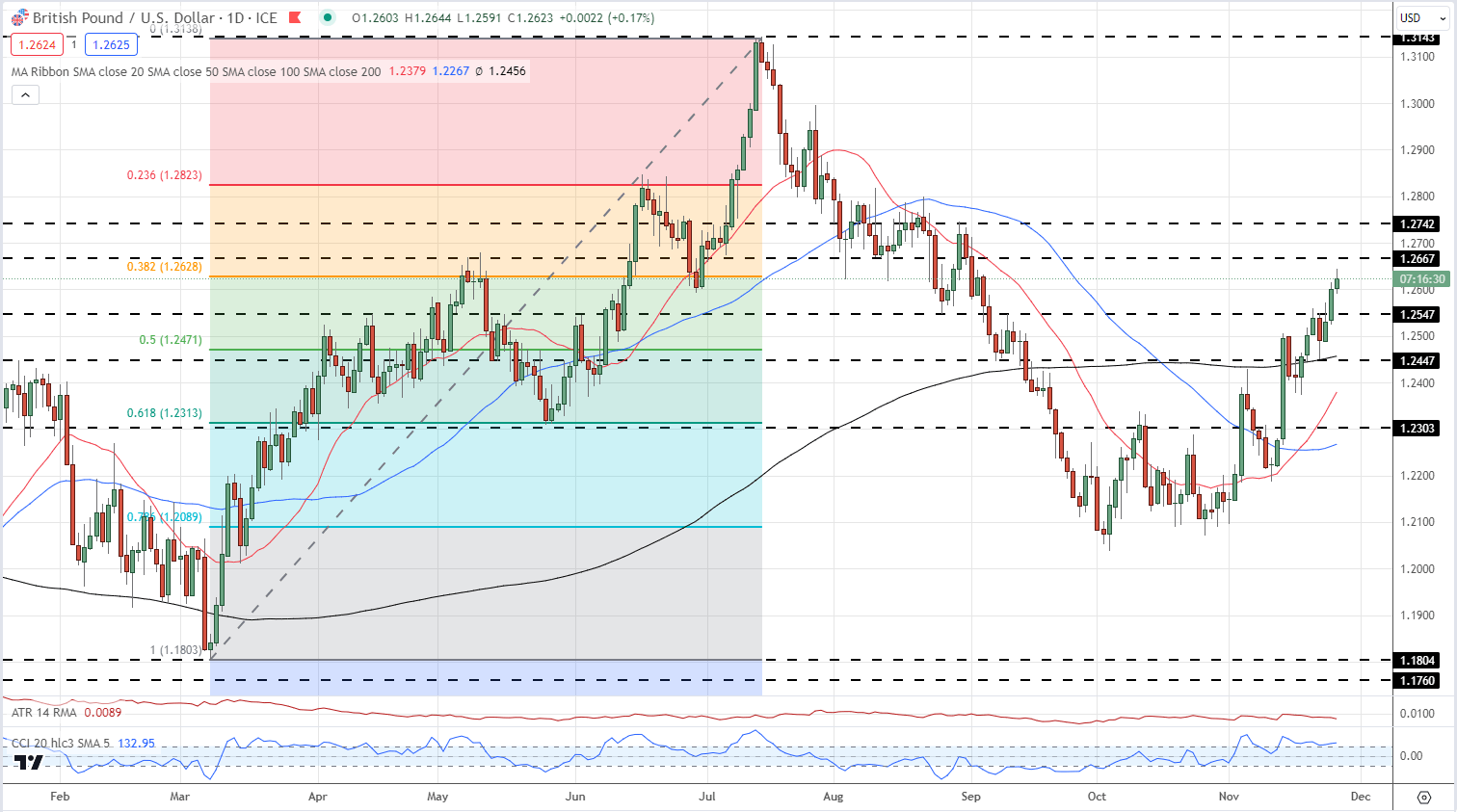

GBP/USD posted a fresh near-three-month high of 1.2644 earlier in the session, helped by governor Bailey’s comments and a soft US dollar, before drifting back to 1.2620 as the greenback made a slight recovery. Resistance is seen at 1.2667 and 1.2742, while support at 1.2547 guards a zone of support between 1.2471 (50% Fib retracement) and 1.2447.

GBP/USD Daily Price Chart

Retail trader data show 45.17% of traders are net-long with the ratio of traders short to long at 1.21 to 1.The number of traders net-long is 11.86% higher than yesterday and 10.00% lower than last week, while the number of traders net-short is 7.45% higher than yesterday and 29.10% higher than last week.

What Does Changing Retail Sentiment Mean for Price Action?

| Change in | Longs | Shorts | OI |

| Daily | 13% | 7% | 10% |

| Weekly | -13% | 25% | 4% |

Charts using TradingView

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS