GBP/USD Price, Chart, and AnalysisUK manufacturing confidence underpins Sterling.Bank of England rate hike expectations hit 100%.The final UK Markit/

GBP/USD Price, Chart, and Analysis

- UK manufacturing confidence underpins Sterling.

- Bank of England rate hike expectations hit 100%.

The final UK Markit/CIPS manufacturing PMI (January) beat earlier expectations but fell short of last month’s robust figure. The dip lower reflected slower growth or new orders and a further easing in the rate of increase in vendor lead times.

![]()

Commenting on the PMI release, Duncan Brook, group director at the Chartered Institute of Procurement and Supply wrote: ‘The UK economy continued to strengthen at the beginning of the year buoyed up by strong confidence amongst the UK’s makers, higher job creation levels and output at the strongest rate since July 2021. “There was some disappointment in the lowest levels of new orders since February 2021 but moderate improvements in export orders balanced out the weaker rise in domestic work.’

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

The eagerly awaited Sue Gray lockdown report was released yesterday but was heavily censored due to the ongoing Metropolitan Police investigation. While PM Boris Johnson remains in power, for now, the findings of the redacted report still cast a bad light on his leadership skills and authority.

UK Partygate Investigation: Heavily Censored Report Given to PM Johnson, Sterling Unchanged

Sterling continues to out-perform the US dollar over the last few days, helped by short-term weakness in the greenback. After last week’s hawkish FOMC release, the US dollar has faded lower with expectations of multiple interest rate hikes and a scaling back of the bloated balance sheet already priced into the market. While expectations are built into the US dollar, the British Pound continues to pick up a bid ahead of the BoE MPC meeting on Thursday where the central bank is 100% expected to hike rates by 25 basis points to 0.50%. Market commentators also expected the BoE to announce their own form of balance sheet tightening, adding an extra hawkish twist to the meeting.

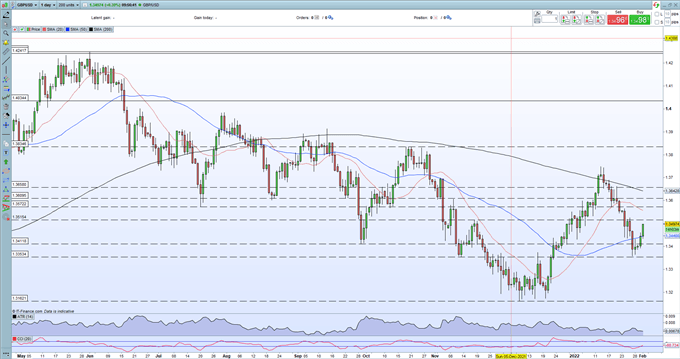

The short-term downtrend in GBP/USD has been convincingly broken this week, with the pair now testing 1.3500 after rebounding from the 1.3350 level at the end of last week. For cable to break the long-term downtrend, the January 13 lower high at 1.3750 needs to be reclaimed.

GBP/USD Daily Price Chart – February 1, 2022

Retail trader data show 57.65% of traders are net-long with the ratio of traders long to short at 1.36 to 1. The number of traders net-long is 0.27% higher than yesterday and 7.86% higher from last week, while the number of traders net-short is 11.91% higher than yesterday and 11.73% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com