UK GDP, Pound Sterling News and AnalysisUK GDP reveals further signs of concern ahead of final central bank meetings for 2023Pound sterling depreciat

UK GDP, Pound Sterling News and Analysis

- UK GDP reveals further signs of concern ahead of final central bank meetings for 2023

- Pound sterling depreciates ahead of FOMC later this evening

- Will the Bank of England acknowledge weaker growth data and notable progress on inflation or will a hawkish message help stabilise the pound?

UK GDP Reveals Further Signs of Concern Ahead of Major Central Bank Meetings

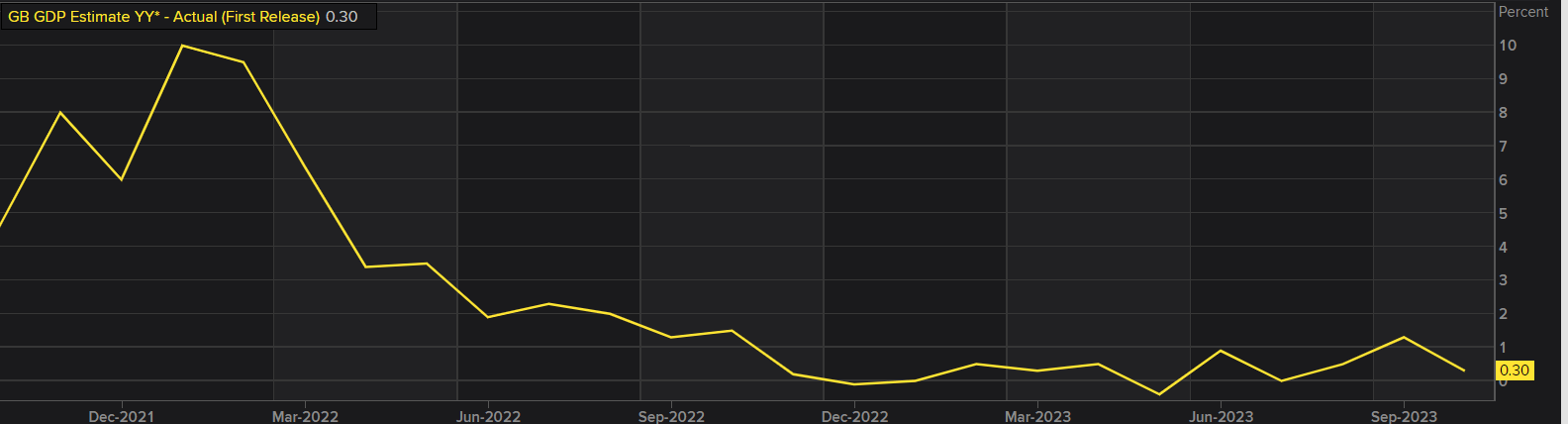

UK GDP disappointed across multiple measures of GDP growth, coming in at 0.3% compared to October last year and printing flat on average over the last 3-months. Growth has been a major concern in the UK, something that the UK government has attempted to address via its Autumn Statement where it outlined its plans to reinvigorate the UK economy.

Customize and filter live economic data via our DailyFX economic calendar

However, with interest rates expected to remain in restrictive territory for a prolonged period, strain in the economy was inevitable. The Bank of England meets tomorrow to set monetary policy and provide an update on the monetary policy committees thinking as we close out 2023.

UK GDP Growth, Year on Year (October)

Source: Refinitiv, prepared by Richard Snow

Recommended by Richard Snow

Trading Forex News: The Strategy

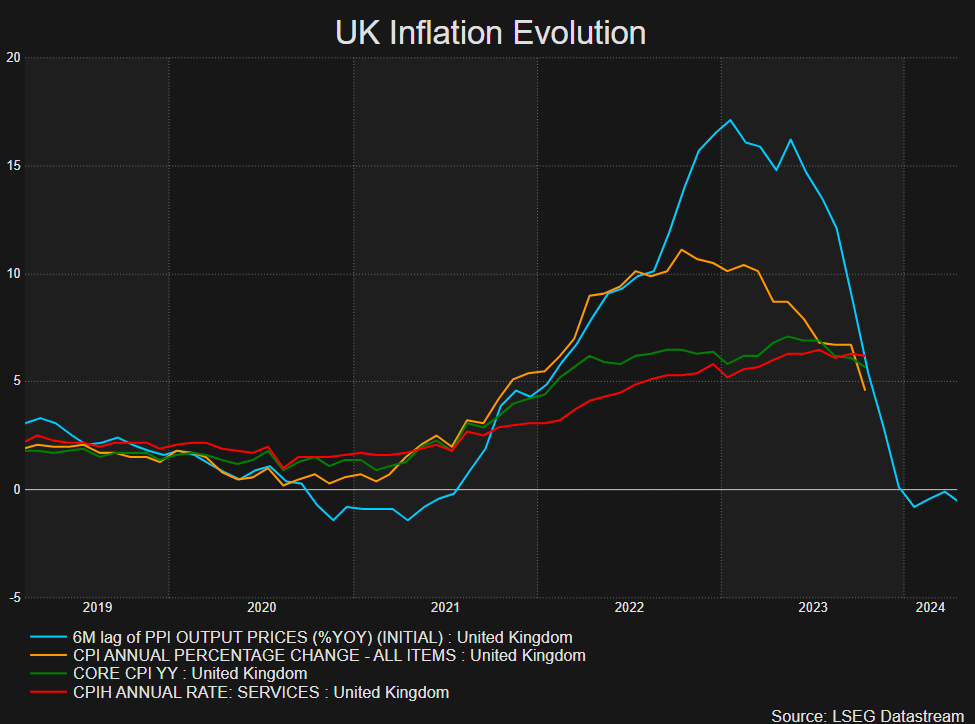

Inflation showed drastic improvement in October (orange line), the first substantial drop since the BoE anticipated large price declines all the way back in the first half of the year. The difficulty now for the BoE is to assess whether determinants of price pressures like those in the services sector (red line) are dropping at a satisfactory rate to be able to alter their hawkish tone. Thus far progress has been limited.

Source: Refinitiv, prepared by Richard Snow

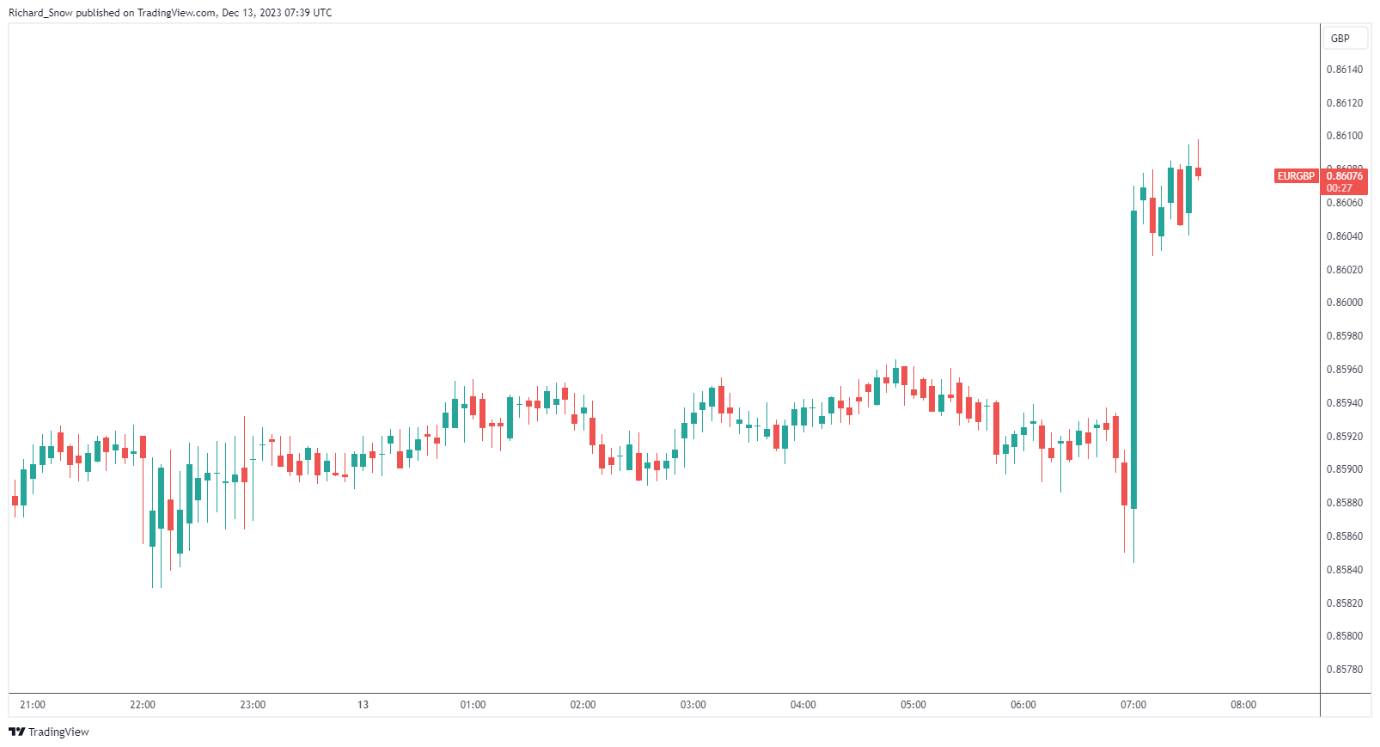

Immediate Market Response

EUR/GBP rose, marking a second day of gains should we close in positive territory today. The pair has suffered a massive sell-off as markets anticipate drastic interest rate cuts for the euro area next year on the back of the worsening economic outlook. A marginal recovery in EU sentiment data and German manufacturing PMI data suggests the euro may get a little bit of help if the worst appears to be behind us.

EUR/GBP 5-minute chart

Source: TradingView, prepared by Richard Snow

Are you new to FX trading? The team at DailyFX has curated a collection of guides to help you understand the key fundamentals of the FX market to accelerate your learning:

Recommended by Richard Snow

Recommended by Richard Snow

FX Trading Starter Pack

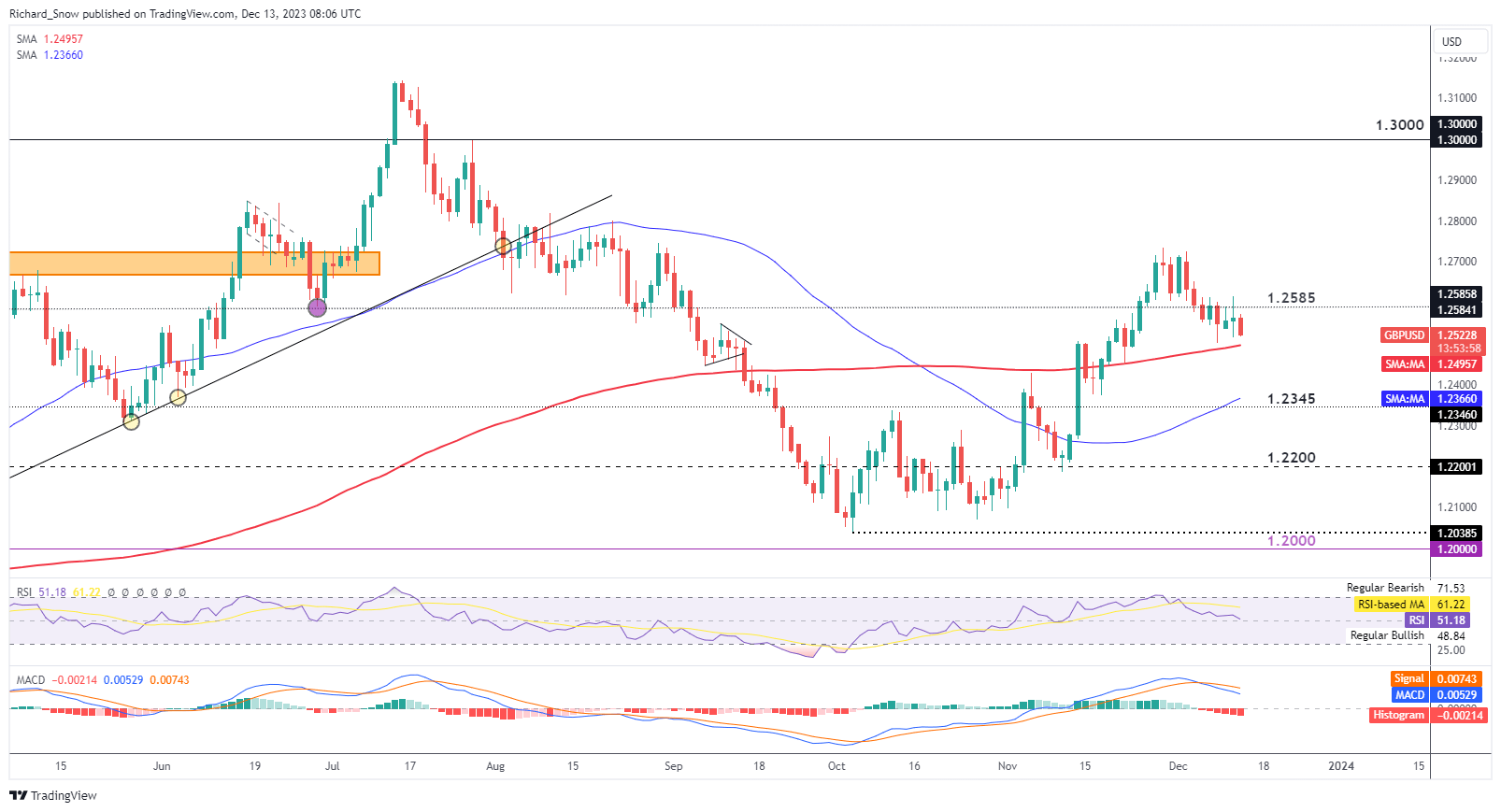

GBP/USD eased after the GDP print, heading towards the significant 200-day simple moving average as a dynamic level of support. The FOMC statement and press conference is due later today where there is a fair amount of repricing risk should the Fed stick to its prior forecast of only 50 basis points worth of cuts in 2024, which could see USD strength and a move lower in GBP/USD.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS