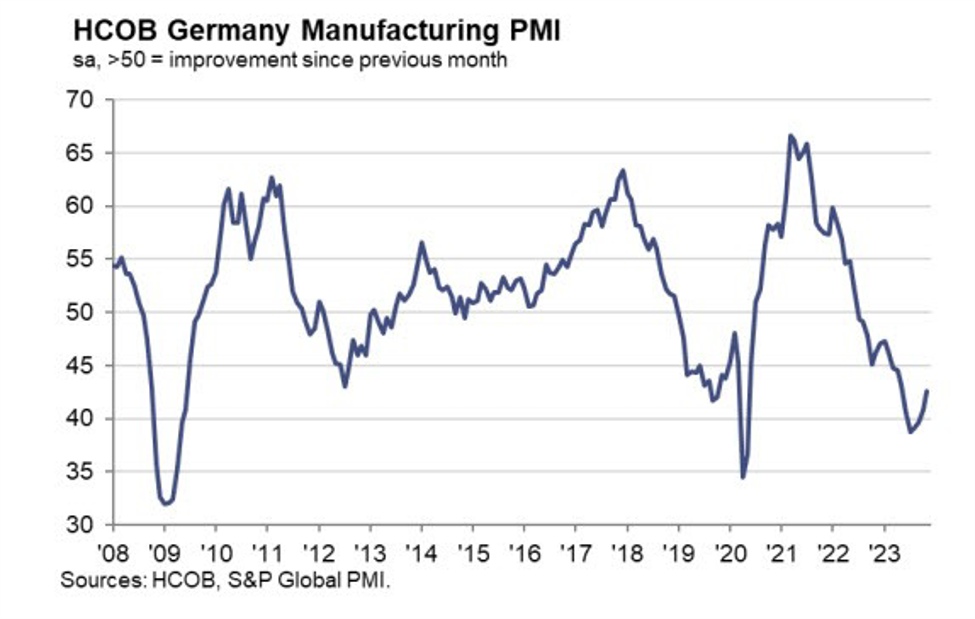

The reading may be an improvement to initial estimates but it still shows that output and new orders are at their weakest in six months. Meanwhile, jo

The reading may be an improvement to initial estimates but it still shows that output and new orders are at their weakest in six months. Meanwhile, job cuts are also seen accelerating on the month as the recession in the manufacturing sector is starting to bite at employment conditions. HCOB notes that:

“There is a flicker of hope in the German manufacturing sector. Even though the November data still places the sector in the

recession arena, the rate of output decline is tapping the brakes compared to the previous month. Surely it could be

premature to conclude that a trend is underway considering it is only the second consecutive month of improvement in the

output index. However, almost all activity-related subindices rose, except for the lagging indicator of employment.

“New orders are still sliding at a brisk pace, but we are confident that growth in new orders is not very far away. The

reduction in new orders has eased for three months straight, mirroring similar trends in export orders and purchases of

inputs. Still, a strong rebound is not what we expect as the world economy – the driver for German manufacturers – will most

probably grow only modestly again next year.

“We see tentative signs that the stock cycle is about to turn the corner. Stocks of purchases are still shrinking, but the index

has increased significantly after lingering at levels reminiscent of past recessions, from the internet bubble burst to the euro

crisis and the Covid-19 pandemic. If we take a cue from these historical phases, companies might just start to normalize

their stocks during the first half of next year. This would be supportive to growth.

“The current production situation remains gloomy for firms producing intermediate goods. Here, output plunged further. By

contrast, producers of consumer goods and investment goods scaled back output at a gentler pace compared to previous

months. The forward-looking new orders index paints a somewhat brighter picture for the intermediate goods sector,

indicating a softer decline than in the other two sectors and the weakest fall overall since April.

“Companies are dialing back on the pessimism when it comes to future output. However, we have to consider that the

German constitutional court’s bombshell regarding debt brake compliance was only partly considered during the November

survey period. We see considerable downside risk as important investments and subsidies which were to be financed via

off-balance vehicles may be dropped. In this respect, the industry might be at the forefront of this judicial budget storm.”

www.forexlive.com

COMMENTS