Gold Worth Forecast Speaking Factors:Gold costs set a recent seven-month-low final Thursday. This low printed round an enormous z

Gold Worth Forecast Speaking Factors:

- Gold costs set a recent seven-month-low final Thursday.

- This low printed round an enormous zone of confluent assist that’s since helped to deliver a bullish response into the matter.

- The evaluation contained in article depends on worth motion and chart formations. To be taught extra about worth motion or chart patterns, take a look at our DailyFX Training part.

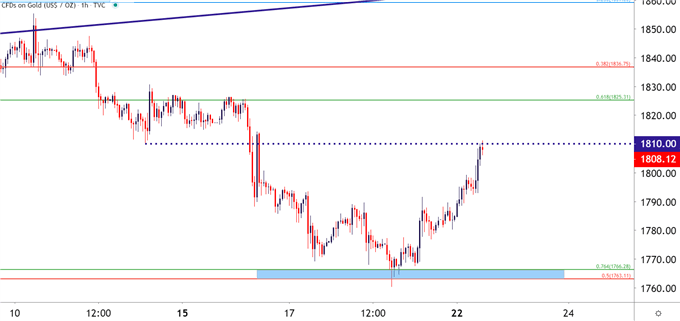

Gold costs are bid in the present day because the yellow metallic extends a bounce from a key space of assist on the chart. The zone from 1763-1766 was checked out a few weeks in the past. This space incorporates two totally different Fibonacci ranges and when it got here into play in late-November, it helped to deliver patrons again into the combo, and that led right into a bounce that entailed a run of greater than $200 in a bit of over a month as patrons backed the bid coming into 2021.

However New Yr worth motion hasn’t been all that pleasant to Gold bulls, as a downdraft developed in January that’s lasted by means of the majority of February. Final Thursday noticed costs develop a recent seven-month-low, briefly testing under this confluent zone of assist; and bulls have since come again into the matter to push costs again above the 1800 psychological degree.

Gold Hourly Worth Chart: Assist Bounce

Chart ready by James Stanley; Gold on Tradingview

Gold Energy: Can Gold Bulls Push Even with Rising Charges within the US?

On the supply of that current weak point in Gold has been the worry of diminished actual charges, introduced upon by a free and passive FOMC that’s avoiding tighter coverage, even within the occasion that inflation begins to rise. That worry round inflation stays a hot-button merchandise in the mean time, and this may be witnessed within the US Treasury curve because the 10-year word has risen to its highest ranges for the reason that pandemic got here into the equation final March.

Beneficial by James Stanley

Obtain our Gold Forecast

A plethora of US information factors on the calendar for this week can serve to maintain these themes within the highlight, with the Friday launch of PCE numbers, the Fed’s most well-liked inflation gauge, probably garnering appreciable consideration.

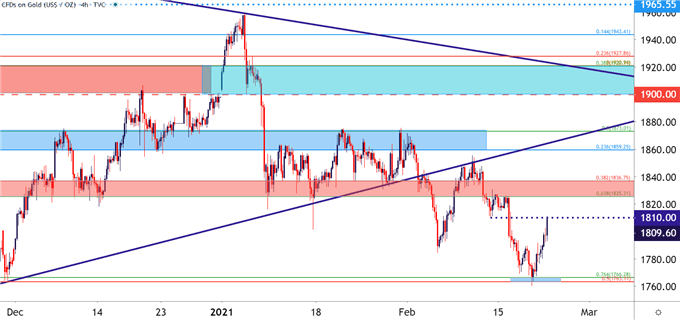

For Gold worth motion – costs have already caught a fast little bit of resistance from a previous swing-low round 1810. However simply forward is a big zone of potential resistance, as taken from assist between two totally different Fibonacci ranges operating from 1825-1836.

Gold 4-Hour Worth Chart

Chart ready by James Stanley; Gold on Tradingview

Gold Worth Technique Transferring Ahead

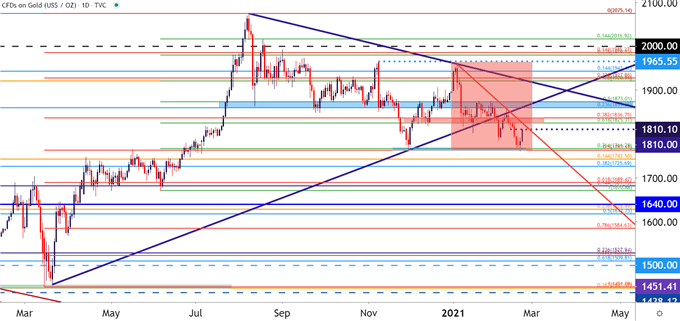

Going again to the Day by day chart to get some scope on the matter, and that is nonetheless a bear market bounce following the early-February extension of the sell-off. Worth motion broke under a symmetrical triangle formation earlier this month and after a fast check-back for resistance, continued the sequence of lower-lows and lower-highs till the present zone of assist got here into play.

To be taught extra in regards to the symmetrical triangle, be part of us in DailyFX Training

At this level, the bearish aspect of the matter can stay fascinating, particularly if sellers can take-over at or earlier than a take a look at of the resistance zone from 1825-1836.

For indicators of bullish themes returning, a breach by means of the 1859-1873 zone may make issues look significantly totally different however, till then, there’ll nonetheless be some conjecture as as to if bears are in management on condition that current sequencing of lower-highs and lower-lows in worth motion.

Gold Worth Day by day Chart

Chart ready by James Stanley; Gold on Tradingview

— Written by James Stanley, Senior Strategist for DailyFX.com

Contact and comply with James on Twitter: @JStanleyFX