Commodity Update: Gold, Oil AnalysisGold heads lower on a stronger dollar and pulls back from overbought territoryGold volatility (GXZ) has witnessed

Commodity Update: Gold, Oil Analysis

- Gold heads lower on a stronger dollar and pulls back from overbought territory

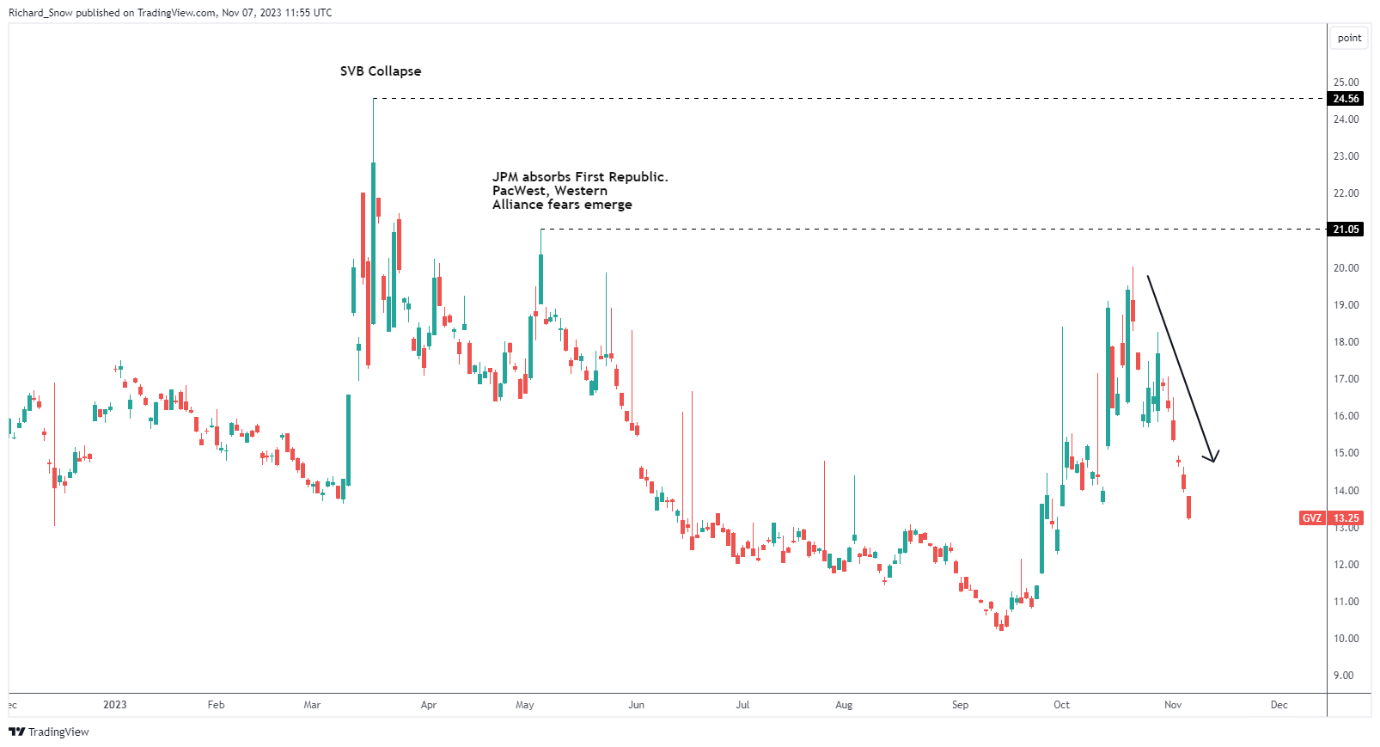

- Gold volatility (GXZ) has witnessed a sharp decline after approaching levels synonymous with the banking turmoil earlier this year

- Brent crude oil drops as global growth outlook outweighs supply concerns

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Gold Forecast

Gold heads lower on a stronger dollar and recovers from overbought territory

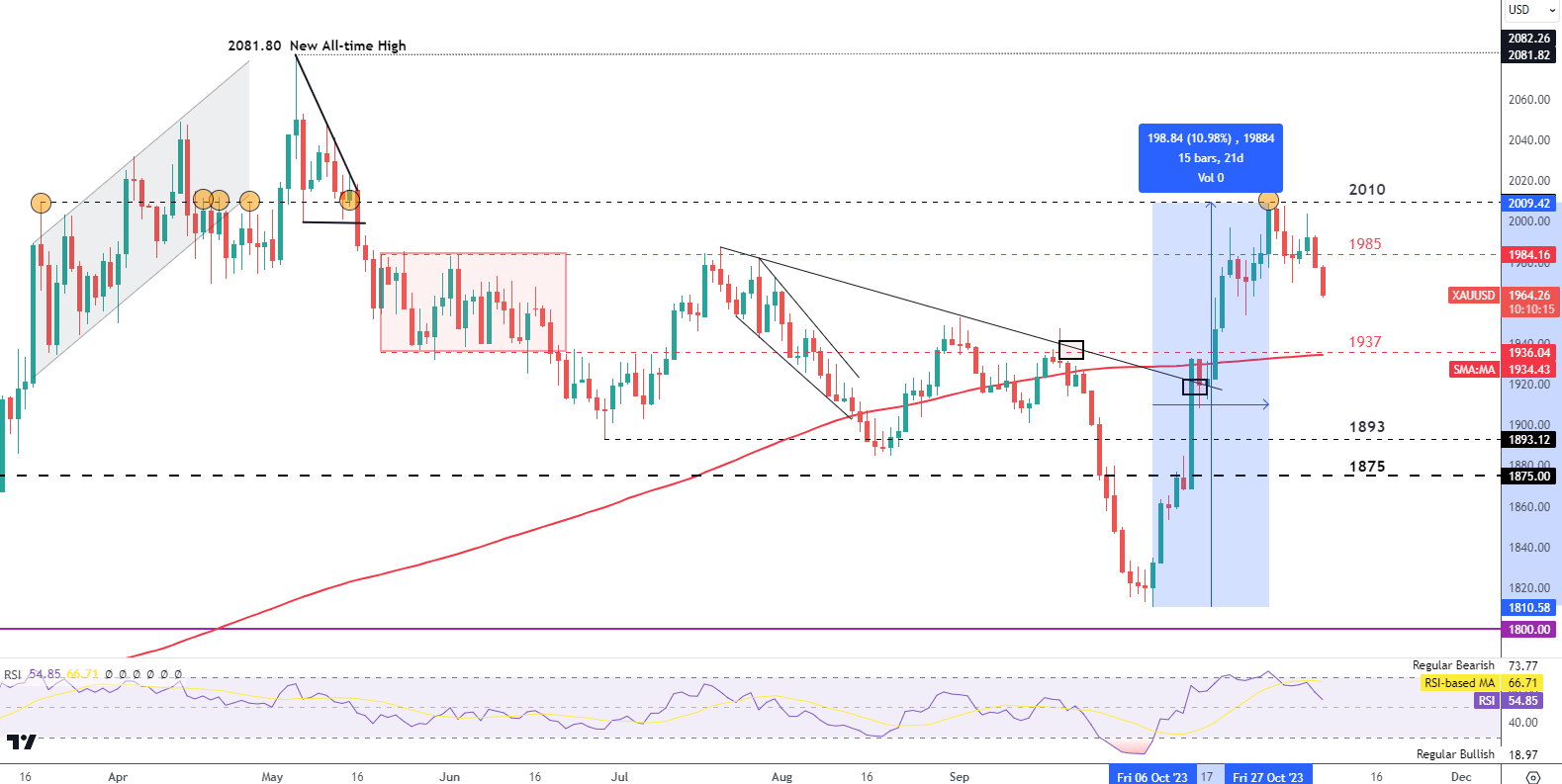

gold has put in an impressive performance rising just short of 11% when measured from the October swing low but has given back some of those gains more recently as the precious metal appears less sensitive to the ongoing conflict in the Middle East.

Gold rose exponentially, bursting through the 200 simple moving average with ease but appears to have turned after tagging the $2010 level of resistance, with the latest move marking a 2-day decline.

After dipping below $1985, the metal now looks to target the recent swing low and potentially the $1937 level which currently coincides with the 200 SMA – a widely observed yardstick for the long-term trend. gold is being influenced by a multitude of factors none more so than the conflict in the Middle East but recent developments have had very little effect in extending the prior bullish advance. It is with this observation that one may deduce that gold traders are potentially becoming desensitised to the potential threat of escalation in the region, or more realistically the decline could be attributed to a recovering U.S. dollar and a gold market that was due a correction after rising exponentially.

$1985 is the immediate level of resistance while $1937 presents a convenient level of support coinciding with the 200 simple moving average.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

30-day implied gold volatility has fallen sharply, nearly reaching levels last witness in May when the regional banking turmoil reared its head once again. In the early days of the conflict, gold volatility ramped up as the Israeli Prime Minister warned that this would be a long war. The lower volatility suggests that gold prices would require another catalyst to see it retest the recent highs and the all-time high of $2081.80.

30-Day Implied Gold Volatility (DVZ) Daily Chart

Source: TradingView, prepared by Richard Snow

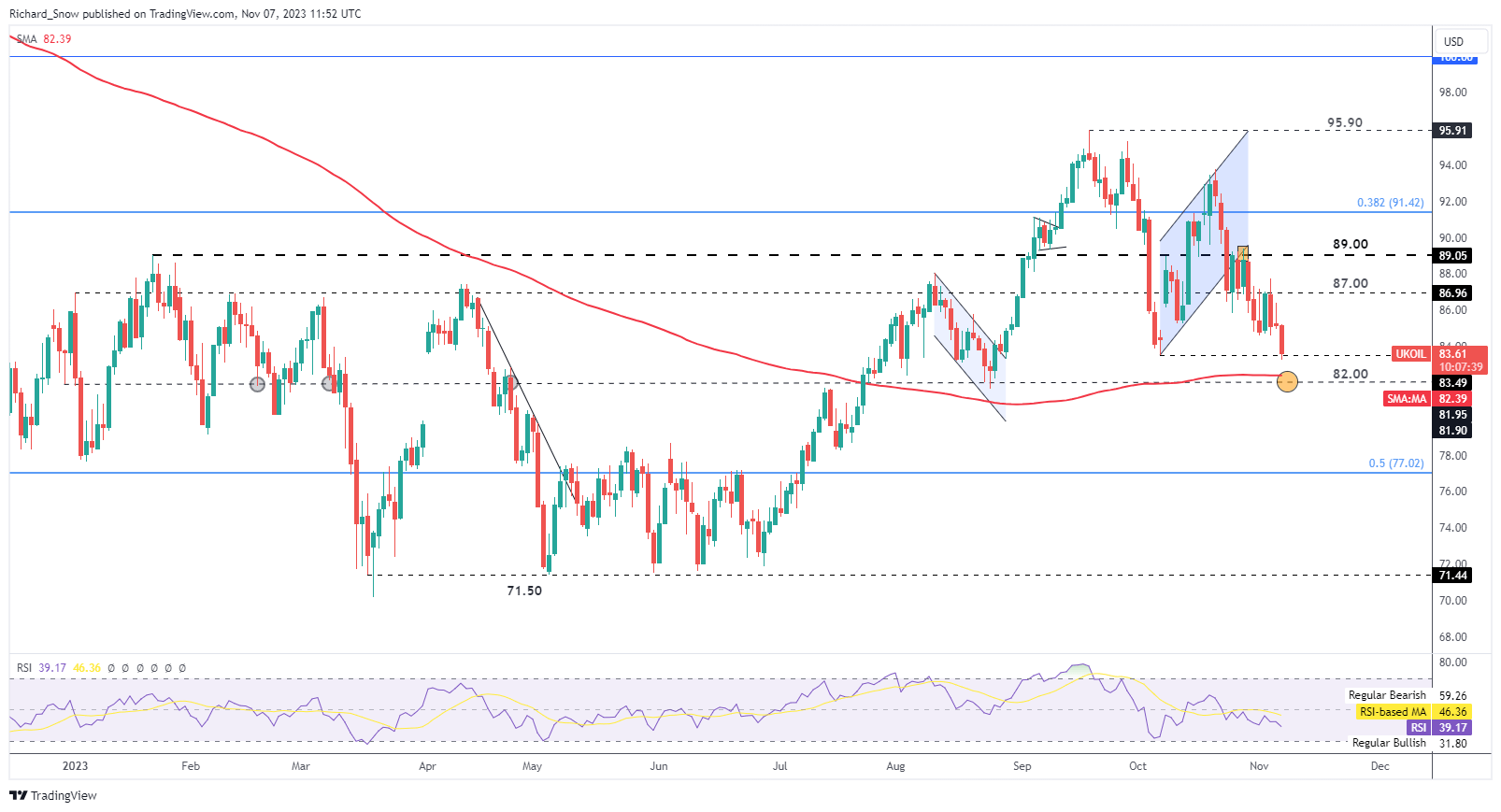

Brent Crude Oil Drops as the Global Growth Outlook Outweighs Supply Concerns

Brent crude oil continues to plunge lower and now tests the October swing low. The energy commodity has been on the decline since mid-October as concerns around the global outlook have ramped up in recent weeks.

The FOMC’s hawkish message with a dovish undertone was the latest in a series of underwhelming fundamental data from the US. Markets no longer price in a realistic chance of another rate hike, and in fact, have anticipated potential rate cuts to be implemented as early as the end of Q2 next year.

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

Global growth also continues to slow particularly in Europe where it appears as if Q3 brought on a contraction. Adding to this is the Fed’s very own forecast for Q4 which has been revised sharply lower to levels around 1.2%, down from figures around 4% previously. Something else to note recently from the October NFP print is that the job market is softening – something the Fed has welcomed as it has been calling for such an outcome for months to bring down inflation.

$83.50 is the immediate level of support followed by $82. A breach of the 200 SMA may be cause for concern for oil bulls but will bode well for the Biden administration ahead of next year’s presidential elections.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS