Gold, XAU/USD, US Dollar, China, Yuan, Treasury Yields, DXY Index, GVZ - Talking PointsThe gold price headwinds persist as Treasury yields push highe

Gold, XAU/USD, US Dollar, China, Yuan, Treasury Yields, DXY Index, GVZ – Talking Points

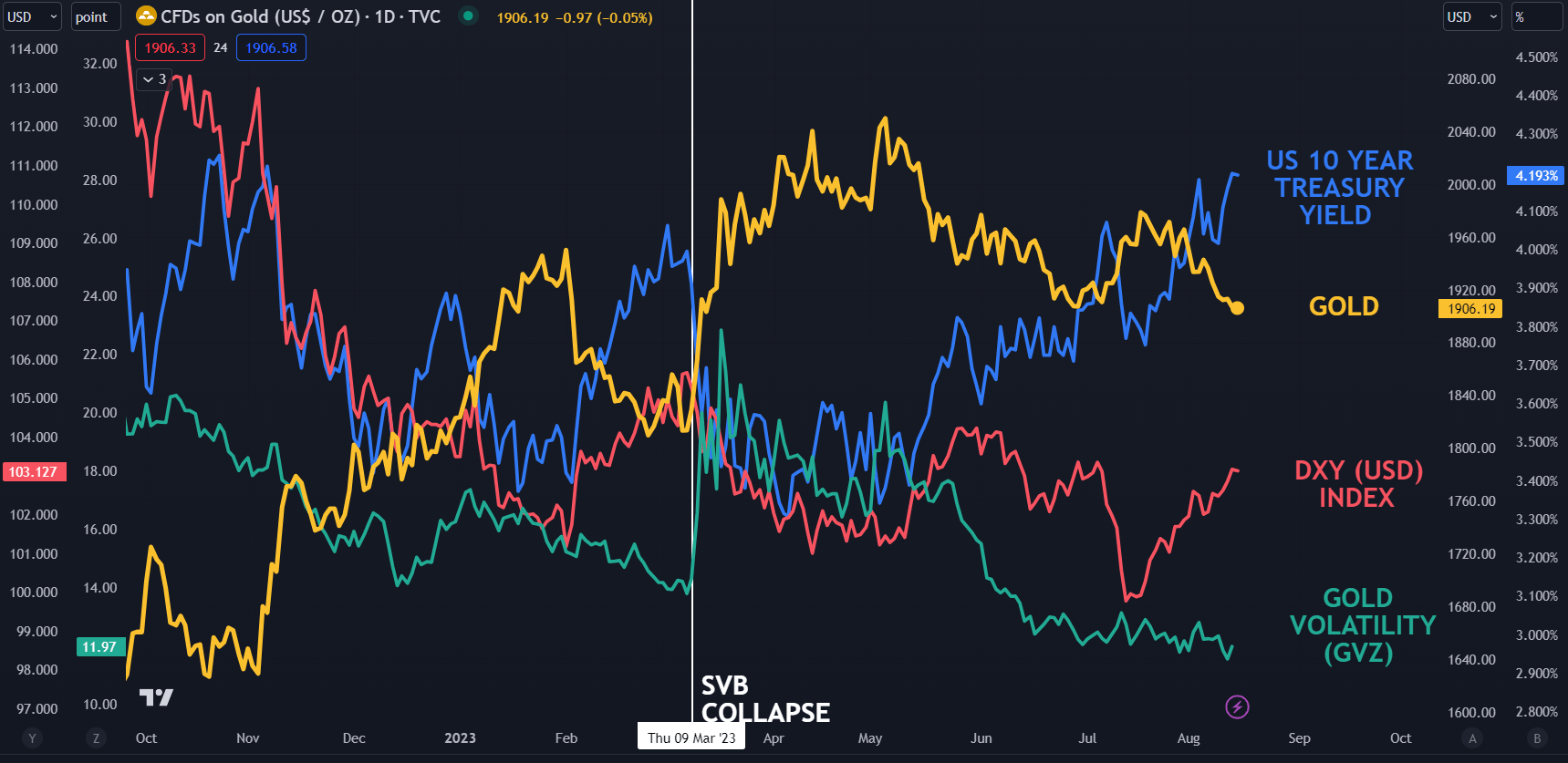

- The gold price headwinds persist as Treasury yields push higher, boosting USD

- The PBOC has adjusted policy as the outlook for China faces challenges

- Volatility remains low but has inched up slightly. If it goes higher, where to for XAU/USD?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The gold price continues to languish going into Tuesday’s trading session as the US Dollar pursues higher ground, assisted by rising Treasury yields.

The metals complex is generally weaker across the board, impeded by the stronger Dollar and deteriorating appetite for risk and growth-orientated assets.

Industrial metals have been hit harder than the yellow metal with the outlook for China facing increased scrutiny.

Generally weaker economic data there last week has been compounded by property groups Country Garden and Ocean Sino missing debt payments.

Country Garden defaulted on US Dollar coupon payments last week and this week saw trading in its onshore debt suspended alongside Ocean Sino.

The market is awaiting concrete action from authorities to deal with the economic uncertainty.

A plethora of Chinese data will be closely inspected for further clues on the state of the world’s second-largest economy. The details can be viewed here.

The People’s Bank of China (PBOC) fixed the Yuan stronger today at 7.1768 per USD. The bank also cut the medium-term lending facility rate to 2.50% from 2.65%.

Recommended by Daniel McCarthy

How to Trade Gold

While that is unfolding, the benchmark 10-year Treasury note is surging above 4.20% for the first time since November last year after dipping to 4.73% a month ago.

The Treasury curve seems more firmly anchored with the market now viewing the Federal Reserve as near the end of its tightening cycle.

The 2-year bond is nearing 5.0%, still some way from the peak of 5.11% seen last month.

This appears to have underpinned the DXY (USD) index. At the same time, forward-looking gold volatility has been languishing of late, but it has inched up in the last few trading sessions. This may hint toward some uncertainty within the market and a significant move in price might be in the offing.

The GVZ index is a measure of implied volatility for gold that is calculated in a similar way to the VIX index’s interpretation of volatility for the S&P 500.

Looking ahead, the precious metal has held up reasonably well given the state of play, but if these headwinds persist it could be further undermined.

{{GUIDE|HOW_TO_TRADE_}}

SPOT GOLD AGAINST US 10-YEAR TREASURY YIELD, DXY (USD) INDEX AND GVZ INDEX

Chart created in TradingView

Recommended by Daniel McCarthy

Building Confidence in Trading

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS