GOLD PRICE FORECASTGold prices lack directional conviction ahead of key U.S. jobs dataNovember's nonfarm payrolls report may offer clues about the hea

GOLD PRICE FORECAST

- Gold prices lack directional conviction ahead of key U.S. jobs data

- November’s nonfarm payrolls report may offer clues about the health of the economy and thus the Fed’s monetary policy path

- This article looks at key price levels to watch on XAU/USD in the coming trading sessions

Most Read: Crude Oil Forecast – Prices in Freefall as Pivotal Technical Support Caves In

Gold prices (XAU/USD) moved with limited conviction on Thursday, swinging between small gains and losses as investors avoided taking large directional bets on the asset for fear of getting caught on the wrong side of the trade ahead of key U.S. jobs data before the weekend.

The November nonfarm payrolls report, due out Friday morning, could provide valuable information on the health of the labor market, helping to clarify the Fed’s monetary policy outlook. For this reason, it could be a source of volatility for major financial assets.

In terms of estimates, U.S. employers are forecast to have added 170,000 workers last month, resulting in an unchanged unemployment rate of 3.9%. For its part, average hourly earnings are seen rising 0.3% m-o-m, with the related yearly reading easing to 4.0% from 4.1% previously.

Eager to gain insights into gold’s outlook? Get the answers you are looking for in our complimentary quarterly trading guide. Request a copy now!

Recommended by Diego Colman

Get Your Free Gold Forecast

While gold retains a constructive outlook from a fundamental standpoint, many traders want more information about the state of the U.S. economy before reengaging bullish positions, especially after getting burned badly earlier in the week when a promising breakout turned into a big sell-off.

Focusing on possible scenarios, if nonfarm payrolls surprise to the upside by a wide margin, monetary policy easing wagers for 2024 could be scaled back rapidly, putting upward pressure on Treasury yields and the U.S. dollar. This could be detrimental to precious metals.

Conversely, if NPF figures disappoint in a material way, many investors could shift back to viewing a recession as their baseline case, reinforcing dovish interest rate prospects for the coming year. Against this backdrop, yields and the greenback could head lower, boosting gold prices in the process.

Acquire the knowledge needed for maintaining trading consistency. Grab your “How to Trade Gold” guide for invaluable insights and tips!

Recommended by Diego Colman

How to Trade Gold

GOLD PRICES TECHNICAL ANALYSIS

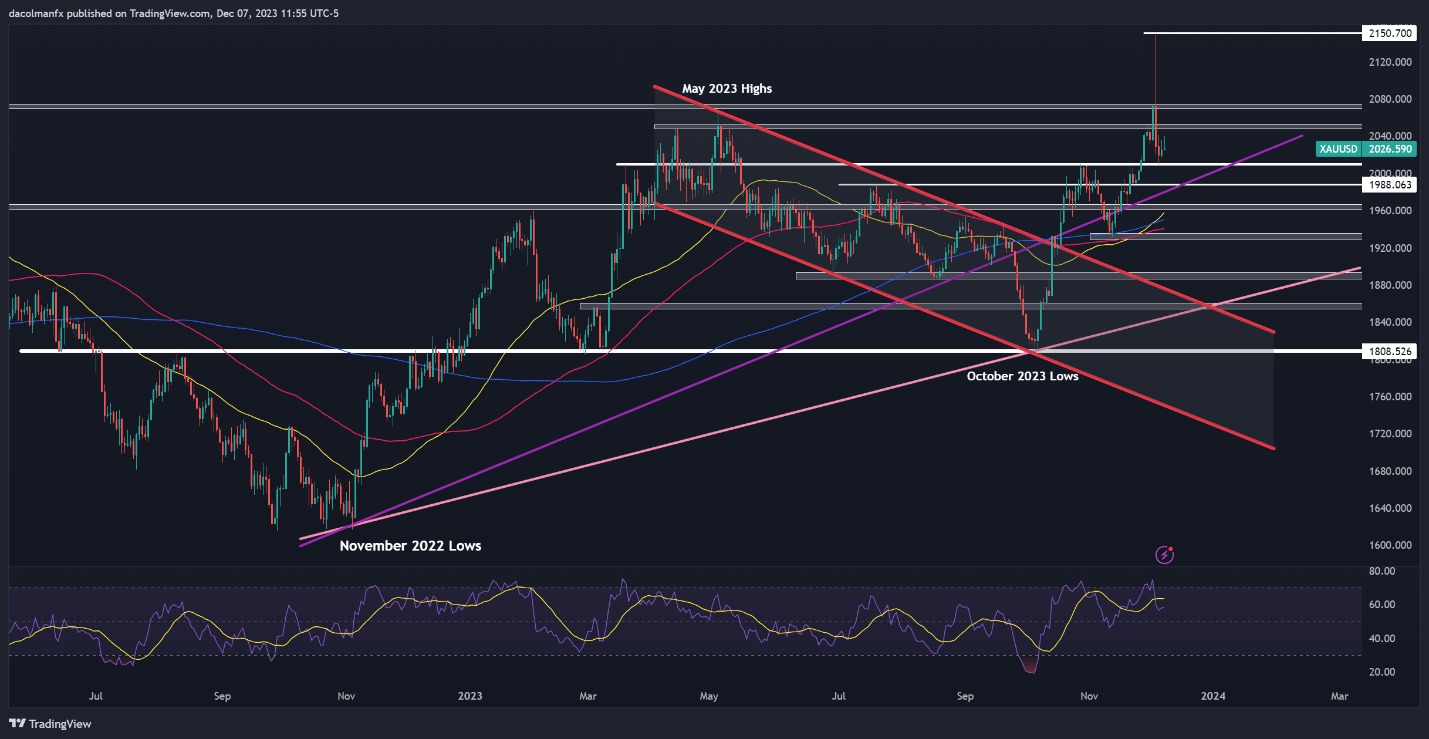

Gold (XAU/USD) broke its previous record, briefly reaching an all-time high earlier in the week, only to swiftly plummet, suggesting that the long-await bullish breakout was a fakeout.

Despite waning upward momentum, bullion retains a positive technical profile, so the path of least resistance remains to the upside. With that in mind, if the precious metal resumes its ascent, the first hurdle to overcome is positioned at $2,050, followed by $2,070/$2,075. Looking higher, attention gravitates towards $2,150.

On the other hand, if losses escalate in the coming days and weeks, support rests near $2,010. This technical zone could act as a floor in case of further weakness, but a drop below it may be the start of a bigger bearish move, with the next downside target at $1,990.

Wondering how retail positioning can shape gold prices? Our sentiment guide provides the answers you seek—don’t miss out, download it now!

| Change in | Longs | Shorts | OI |

| Daily | 8% | 0% | 5% |

| Weekly | 31% | -26% | 1% |

GOLD PRICE TECHNICAL CHART

Gold Price Chart Created Using TradingView

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS