Gold technical outlook: XAU/USD short-term trade levels Gold prices rebound off technical support- threatens breakout of March opening-range

Gold technical outlook: XAU/USD short-term trade levels

- Gold prices rebound off technical support- threatens breakout of March opening-range

- XAU/USD rally testing initial resistance- constructive while above the yearly opening

- Resistance 1865, 1877, 1900– support ~1845, 1823/26 (key), 1807

Gold prices marked a third consecutive advance today with XAU/USD rallying nearly 3.5% off the yearly low. A reversal off support is now approaching a key pivot zone and we’re on the lookout for possible price inflection. These are the updated targets and invalidation levels that matter on the XAU/USD short-term technical chart.

Discuss this gold setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold short-term price outlook we noted that the XAU/USD sell-off was approaching a key pivot zone at, “the August 2022 high at 1807 and 1787/91- both levels of interest for possible downside exhaustion IF reached.” Price briefly registered a low at 1805 into the close of February before reversing sharply with a re-test of the lows this week now rallying into initial resistance at 1865. Ultimately a topside breach / close above the November 2021 highs at 1877 is needed to fuel the next leg higher in price.

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD trading within the confines of a newly identified ascending pitchfork formation. Its still too early to rely on this but for now, the upper parallel further highlights resistance around 1865. Initial support now rests with the median-line (currently ~1845) with short-term bullish invalidation now set to the objective yearly / monthly open at 1823/26.

A topside breach of this formation would likely fuel another accelerated rally with such as scenario exposing the 61.8% Fibonacci retracement of the February decline at 1900 and key resistance at the 2023 & 2021 high-day closes at 1912/18– look for a larger reaction in price there IF reached.

Bottom line: Gold is attempting to breakout of the March opening-range with the advance now testing near-term uptrend resistance. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to the yearly open IF price is indeed heading higher with a close above 1877 needed to clear the way.

Review my latest Gold weekly technical forecast for a longer-term look at the XAU/USD trade levels.

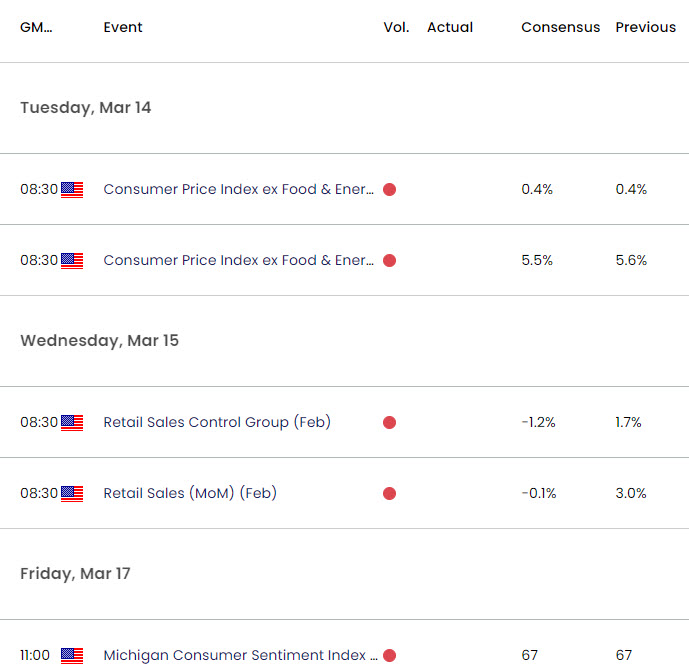

Key Economic Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

Active Short-term Technical Charts

— Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex

www.forex.com