Throughout Friday’s Asian buying and selling session, the secure haven steel gold succeeded in breaking above the $1,800 mark, hitting the best ran

Throughout Friday’s Asian buying and selling session, the secure haven steel gold succeeded in breaking above the $1,800 mark, hitting the best ranges since February. Nonetheless, the bullish bias surrounding the bullion costs was primarily sponsored by the optimistic U.S. financial information, which pushed the benchmark U.S. 10-year Treasury yield to a two-week low and U.S. greenback one-week low. In easy phrases, the bearish bias surrounding the U.S. greenback was seen as one of many crucial elements that lend some extra assist to the dollar-denominated commodity. Furthermore, the intensifying US-China tussle and the escalating coronavirus (COVID-19) woes additionally lend extra assist to the secure haven GOLD .

Conversely, the upbeat market sentiment, backed by the mixture of things, turns into one of many key elements that saved the lid on any extra features within the secure haven steel. Within the meantime, the features have been additionally capped by the stories suggesting that the U.S. and the European Union’s (E.U.) are as much as assist the coronavirus (COVID-19) vaccine patents. On the explicit time, the bullion value is buying and selling at 1,819.39 and consolidating within the vary between 1,812.94 and 1,822.34. Wanting ahead, the merchants appear cautious to position any sturdy place forward of the important thing U.S. information, which is because of be launched later within the day.

Regardless of the ever-increasing coronavirus (COVID-19) fears and the Western tussle with China, the market buying and selling sentiment managed to increase its in a single day bullish efficiency and keep firmer round 4,200, up 0.16% on the day because the beforehand launched upbeat U.S. financial information means that the world’s largest financial system is on the way in which to restoration. 498,000 preliminary jobless claims have been filed over the previous week on the information entrance, the bottom quantity since mid-March 2020 when COVID-19 was declared a pandemic.As well as, the upbeat temper is also tied to the stories suggesting that the U.S. and the European Union’s (E.U.) are as much as assist the coronavirus (COVID-19) vaccine patents which in flip, helped merchants to settle down. Throughout the ocean, the Federal Reserve (Fed) policymakers’ latest rejection of the rate-hike fears was additionally seen as one of many key elements behind the newest market optimism. Nonetheless, the prevalent shopping for bias surrounding the market buying and selling temper was seen as one of many key elements that saved the lid on any extra gold costs.

On the USD entrance, the broad-based U.S. greenback did not cease its early-day unfavourable efficiency and dropped to a one-week low amid prevalent market upbeat temper, which undermined the secure haven demand available in the market and contributed to the U.S. greenback losses. In the meantime, the benchmark U.S. 10-year Treasury yield dropped close to the two-week low within the wake of optimistic financial information from the U.S., which put additional strain on the U.S. greenback. Subsequently, the losses within the U.S. greenback have been seen as one of many key elements that assist the yellow steel to remain bid as the value of GOLD is inversely associated to the value of the U.S. greenback.

Furthermore, the ever-increasing coronavirus circumstances in Asia, particularly in Japan, Canada, and India, probe the market risk-on temper, which was seen as one other key issue that reinforces the secure haven steel costs. Aside from this, U.S. funding limits on Chinese language firms additionally weigh available on the market threat tone. Within the meantime, Beijing didn’t present any curiosity in speaking enterprise to Australia, which additionally difficult the market’s upbeat temper and helped the gold costs to remain bid.

Transferring on, the sunshine calendar will provide a boring buying and selling day forward. Nonetheless, the market merchants will hold their eyes on the important thing U.S. information, commerce numbers from China and Germany, that are due later within the day. Aside from this, the political headlines from the U.Okay., the E.U., and the U.S. could entertain markets. In the meantime, the U.S. greenback value motion will proceed to play an important function within the gold route.

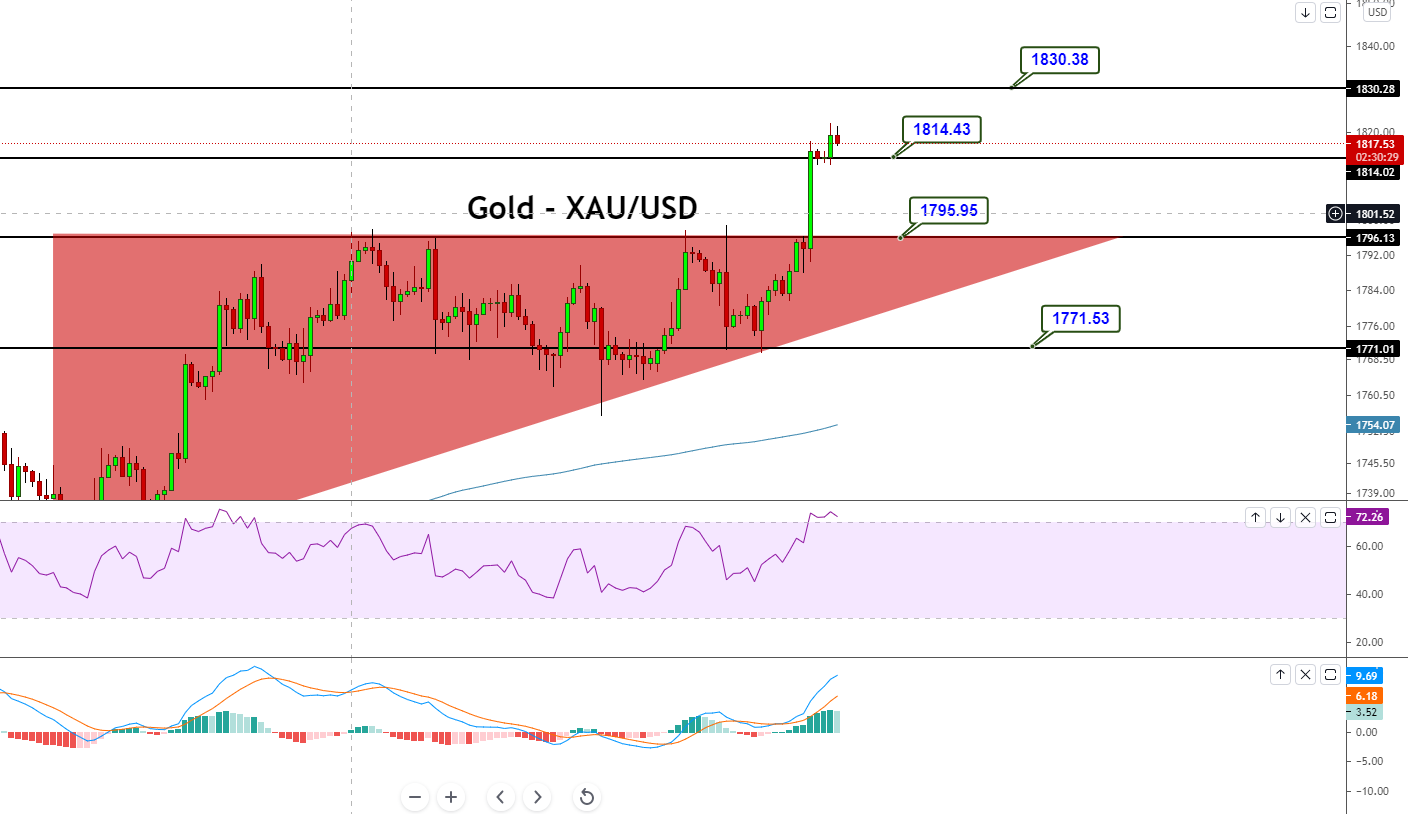

S2 1776.73

S1 1795.9

Pivot Level 1807.02

R1 1826.19

R2 1837.31

R3 1867.6On the technical facet, GOLD is buying and selling with a powerful bullish bias at 1,817 stage, having violated an ascending triangle sample on the 4-hour timeframe. On the upper facet, the valuable steel is more likely to face resistance at 1,830 stage. Gold has closed a bullish engulfing adopted by ascending triangle breakout; subsequently, the chances of bullish bias stay sturdy. On the decrease facet, the XAU/USD pair can take a dip till the following assist space of 1,814 stage, and beneath this, the following assist is more likely to be discovered round 1,795. A bullish breakout of 1,821 ranges can lead the steel in direction of a 1,830 stage on the upper facet. Let’s contemplate taking a purchase commerce over 1,807 stage immediately. Good luck!