GOLD FUNDAMENTAL OUTLOOKGold prices advance on Monday, supported by U.S. dollar softness and mostly lower U.S. Treasury yieldsThe U.S. employment repo

GOLD FUNDAMENTAL OUTLOOK

- Gold prices advance on Monday, supported by U.S. dollar softness and mostly lower U.S. Treasury yields

- The U.S. employment report, due for release later in the week, will set the tone for precious metals and the U.S. currency in the near-term

- This article looks at key XAU/USD’s technical levels to watch in the coming trading sessions

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Japan Maintain Economic Outlook, USD/JPY Catches its Breath at Weekly High

Gold prices rose slightly at the start of the new week, supported by weakness in the U.S. dollar on the back of falling U.S. Treasury yields, but broader moves were limited amid thinner liquidity with U.K. markets closed for the Summer Bank Holiday.

In early afternoon trading, XAU/USD was up about 0.50% to $1,924, consolidating above its 200-day simple moving average and steadily approaching technical resistance at $1,925-$1,930, an area that holds the potential to hinder the continuation of the nascent recovery.

Looking ahead, the precious metal will be very sensitive to incoming U.S. economic reports, given the Federal Reserve’s pledge to proceed with caution after having already delivered 525 basis points of cumulative tightening since March 2022 in its most aggressive hiking cycle in four decades.

The data-dependent approach is part of a strategy to retain maximum optionality in case the central bank needs to apply additional monetary policy firming at upcoming meetings to contain elevated inflation, which reaccelerated early in the summer and remains well above the 2.0% target.

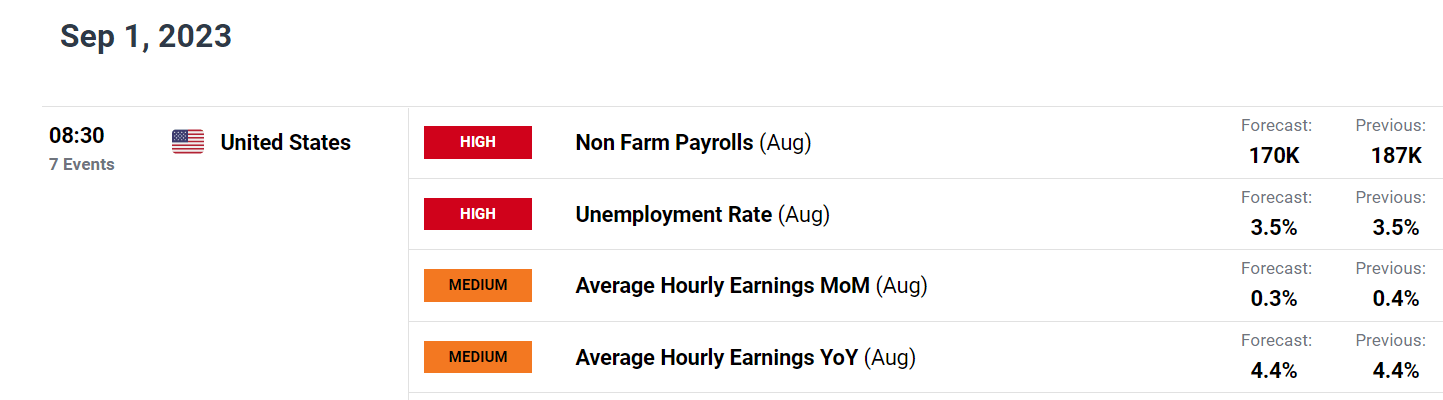

The August U.S. nonfarm payrolls (NFP) report due out on Friday, is likely to provide valuable information on the outlook and guide the FOMC’s decision-making process, so traders should follow the release closely.

In terms of expectations, U.S. employers are forecast to have added 170,000 workers this month after hiring 187,000 people in July. The jobless rate, for its part, is seen holding steady at 3.5%, signaling persistent tightness in the labor market.

Crack the code to successful gold trades by downloading your free “How to Trade Gold” guide

Recommended by Diego Colman

How to Trade Gold

UPCOMING US EMPLOYMENT REPORT

Source: DailyFX Economic Calendar

The strength or weakness of the NFP survey will be pivotal for the U.S. dollar and gold prices, significantly shaping their near-term trajectory by influencing the Fed’s tightening roadmap. That said, there are two scenarios worth highlighting:

Scenario 1: Strong job gains and elevated average hourly earnings

Employment gains above 200,000 and hot average hourly earnings will reinforce upside inflation risks, increasing the likelihood of a quarter-point hike at the September FOMC meeting. This scenario should bias Treasury yields higher, boosting the U.S. dollar and weighing on gold prices.

Scenario 2: Soft employment growth and modest rise in wages

Job figures below 150,000 and subdued growth in wages will raise concerns about the health of the economy, leading traders to price out further monetary tightening. In these circumstances, nominal yields could fall, dragging down the U.S. dollar. These market dynamics would stand to benefit precious metals.

Elevate your trading game by downloading your third-quarter fundamental and technical outlook for gold prices

Recommended by Diego Colman

Get Your Free Gold Forecast

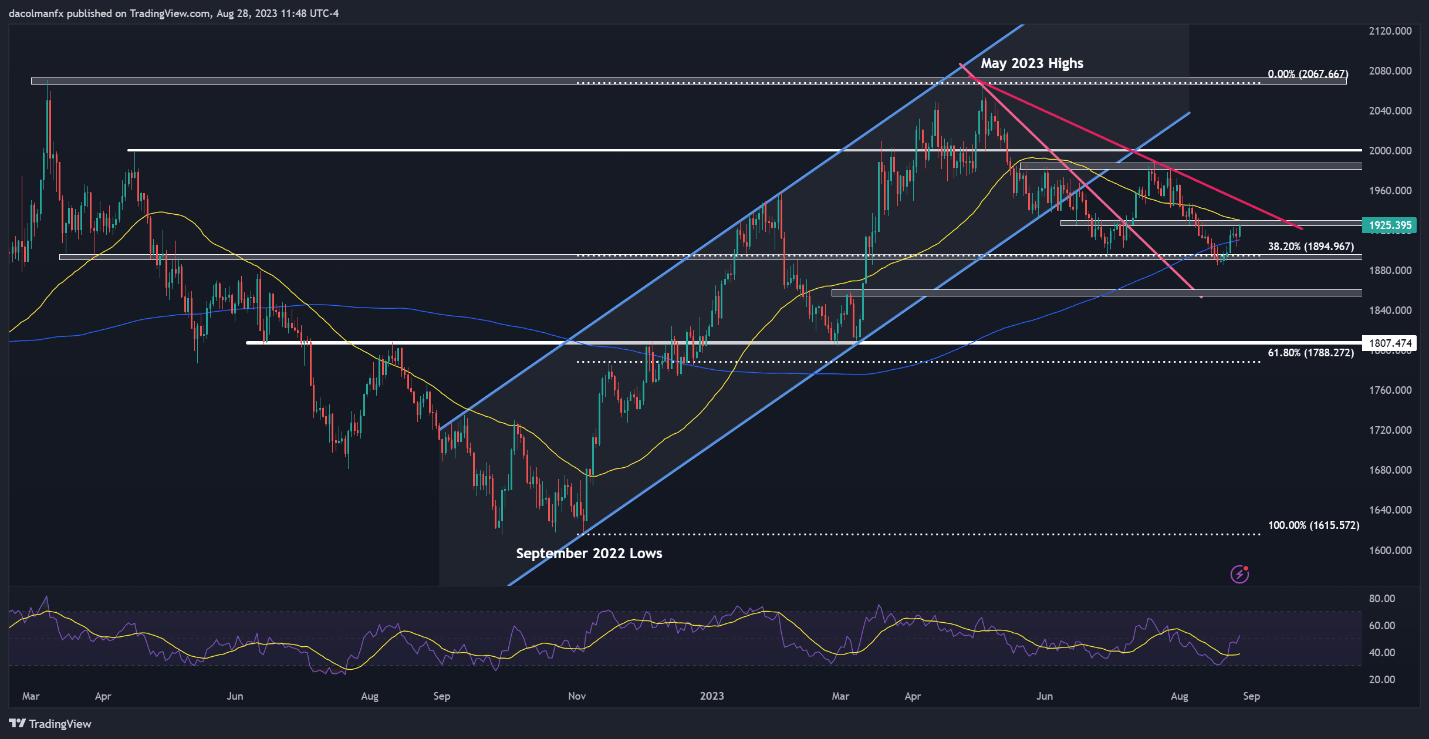

GOLD PRICES TECHNICAL ANALYSIS

Earlier this month, gold fell sharply, undermined by the U.S. dollar upward impetus and soaring real yields. XAU/USD, however, has begun to recover in recent days after bouncing off Fibonacci support at $1,895, with the metal reclaiming the 200-day simple moving average last week.

While gold’s near-term bias remains somewhat bearish, the outlook could become more benign if prices manage to clear a key barrier, stretching from $1,925 to $1,930 soon. If this scenario plays out, bullish momentum could gather pace, setting the stage for a rally toward trendline resistance at $1,950.

On the flip side, if the nascent recovery stalls and sellers seize on the opportunity to regain control of the market, initial support appears at $1,910, followed by $1,895. The bears will have a hard time taking out the $1,895 floor, given its technical importance, but in the event of a breakdown, a pullback towards $1,855 should not be ruled out.

GOLD PRICES TECHNICAL CHART

Gold Prices Chart Created Using TradingView

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS