Here's what you'll want to know on Friday, July 3: Markets have stabilized as buyers digest the better-than-expected Non-Farm

Here’s what you’ll want to know on Friday, July 3:

Markets have stabilized as buyers digest the better-than-expected Non-Farm Payrolls figures, an upbeat Chinese language survey and People take pleasure in a protracted weekend. Considerations concerning the surge in US coronavirus circumstances are retaining the safe-haven greenback and gold bid.

US Non-Farm Payrolls figures confirmed a leap of 4.eight million jobs, far above three million projected and the Unemployment Price dropped to 11.1%. Then again, a rise in everlasting layoffs and the timing of NFP surveys – from June 12, earlier than the current surge.

See NFP Evaluation: Good, however nearly as good because it will get, re-closing is quickly ravage reopening beneficial properties

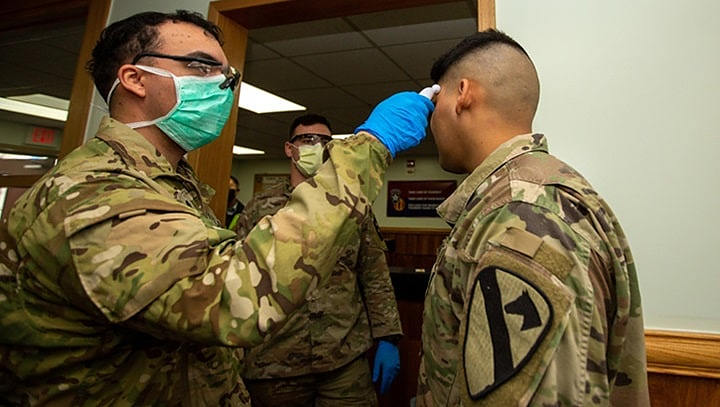

US coronavirus circumstances have hit yet one more each day excessive above 50,000, with Florida topping 10,000 infections per day amid an rising optimistic take a look at fee. Dr. Anthony Fauci, the highest US epidemiologist, stated that the US reopened too quickly earlier than the virus got here below management and that it might mutate.

Texas has mandated face masks below sure situations and different states additionally imposed restrictions. Excessive-frequency indicators corresponding to gasoline consumption, restaurant reservations, and foot site visitors information are pointing to a major slowdown. Weekly jobless claims for the week ending June 26 remained stubbornly excessive.

Traders are considerably cheered by the Chinese language Caixin Non-Manufacturing Index, which surged to 58.Four factors.

Brexit talks between high negotiations have been postponed to subsequent week amid disagreements and a “lack of divergence.” Then again, each the EU and the UK expressed hope of reaching a “touchdown zone.” GBP/USD is buying and selling under 1.25 forward of ultimate Providers Buying Managers’ Index figures.

EUR/USD is again to its morning vary of 1.12-1.1250 as European leaders have but to agree on the EU Fund. Dutch Prime Minister Mark Rutte stated a compromise will be achieved. Closing companies PMIs will possible present a cautious restoration.

AUD/USD is advancing after Australia’s ultimate retail gross sales figures for Might got here out at 16.9%, higher than the unique rating.

WTI Oil is altering palms above $40, extending its upward transfer.

Cryptocurrencies suffered a knee-jerk sell-off late on Thursday earlier than digital currencies discovered their toes. Bitcoin is hovering above $9,000 as soon as once more.

US markets shall be closed for the Independence Day weekend, retaining volumes and liquidity skinny later within the day.

Extra Non-Farm Payrolls: Immense uncertainty stays prevalent, markets could react