Here's what it's essential know on Thursday, August 13: The US greenback is on the again foot after the big bond public sale

Here’s what it’s essential know on Thursday, August 13:

The US greenback is on the again foot after the big bond public sale and as optimism prevails in markets regardless of the fiscal deadlock in Washington. Sino-American tensions and a US-EU are eyed forward of weekly jobless claims.

Traders are pushing bond yields down as soon as once more – after a document $38 billion public sale. In flip, the pendulum is swinging towards the dollar after it rose earlier within the week. One other issue weighing on the world’s reserve forex is market optimism about reaching a vaccine. The upbeat temper is diminishing demand for the safe-haven greenback.

The S&P 500 Index briefly topped the earlier all-time excessive recorded in mid-February. Sturdy earnings from tech corporations have underpinned the positive aspects, along with hopes for a restoration.

Gold is holding onto its restoration, buying and selling round $1,930. It shed $200 earlier within the week and is now rising with different belongings.

See Gold Worth Evaluation: $1907 is the final straw for the XAU/USD bulls – Confluence Detector

On the similar time, Democrats and Republicans stay far aside on the subsequent fiscal stimulus bundle, as described by each side. The longer the deadlock continues, the extra important the harm to the world’s largest financial system.

Officers on the Federal Reserve have urged lawmakers to behave and supply help. The record consists of Mary Daly, Robert Kaplan, and most vocally, Eric Rosengren, President of the Boston department of the Federal Reserve. who mentioned that is an applicable time to take sturdy fiscal actions.

After inflation figures beat estimates in July, the main focus shifts to weekly jobless claims, that are projected to stay round 1.1 million.

See Jobless Claims Preview: If larger claims are proof of an financial slowdown are decrease an indication of an acceleration?

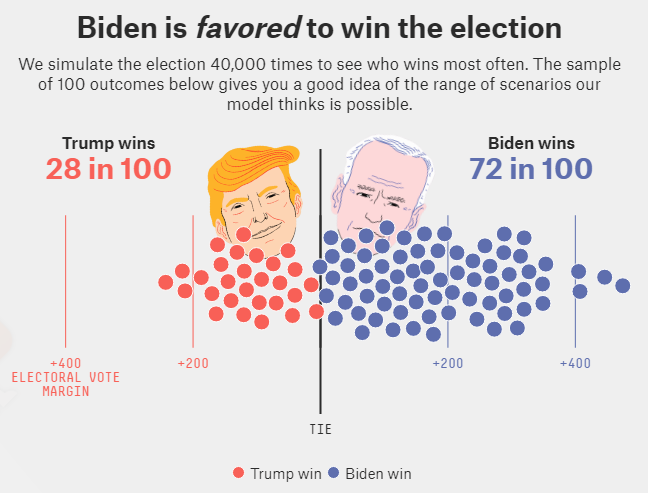

The US electoral marketing campaign heats up after Democratic Challenger Joe Biden made his first look with Senator Kamala Harris, his working mate. The extremely regarded election forecast by FiveThirtyEight has been printed and it reveals Biden main over President Donald Trump, albeit with a excessive stage of uncertainty at this level.

Supply: FiveThirtyEight

Sino-American tensions stay elevated forward of a commerce evaluate by the world’s largest economies. China goals to place America’s sanctions on TikTok and WeChat on the desk. Washington slapped tariffs Berlin and Paris, associated to the long-running dispute round Airbus.

AUD/USD is on the rise amid sturdy employment figures – Australia gained 114,700 jobs in July and the unemployment charge fell to 7.5%.

NZD/USD is on the again foot after Younger Ha, the Reserve Financial institution of New Zealand’s Chief Economist, mentioned that his establishment would love a weaker kiwi. The nation reported 14 extra coronavirus instances with Auckland, the biggest metropolis, remaining underneath lockdown.

Oil costs are holding onto excessive floor with WTI buying and selling close to $43. USD/CAD is altering arms beneath 1.33.

Cryptocurrencies have stabilized, with Bitcoin buying and selling round $11,500.

Extra Merchants are wanting on the shiny factor and never the large image