Greenback turns to Fed minutes as merchants name price bluff – Foreign exchange Information Preview Posted

Greenback turns to Fed minutes as merchants name price bluff – Foreign exchange Information Preview

Posted on April 6, 2021 at 2:49 pm GMTMarios Hadjikyriacos, XM Funding Analysis Desk

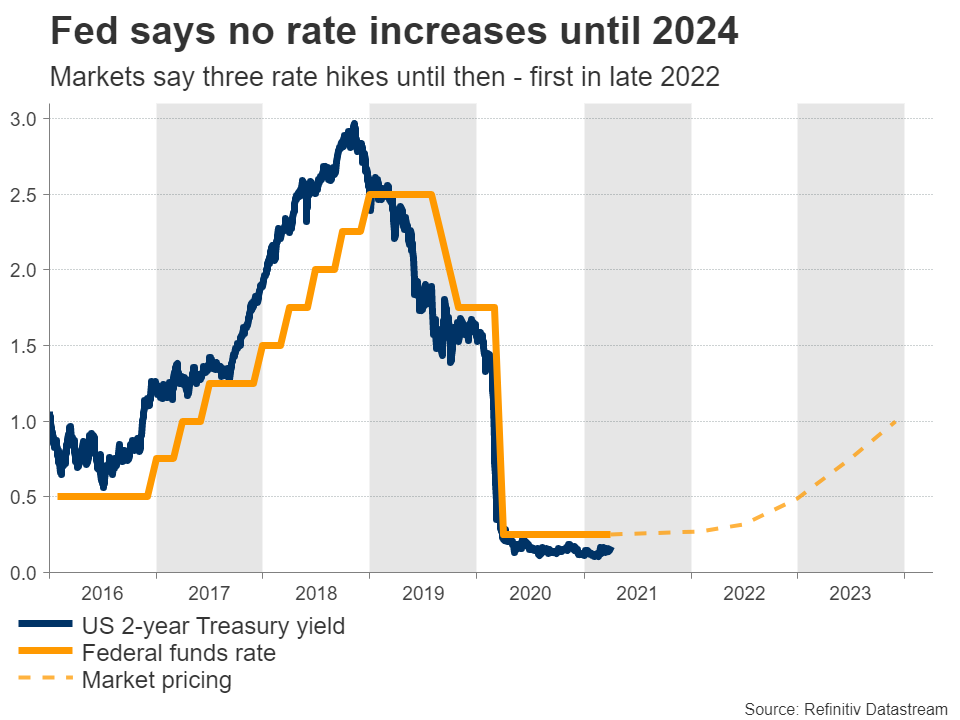

The minutes of the newest FOMC assembly might be launched at 18:00 GMT Wednesday. The Fed went out of its solution to sign that charges will stay on the ground till 2024, regardless of the trillions in spending from Congress and the accelerated vaccination program. Nevertheless, merchants are saying that’s a bluff. Market pricing nonetheless implies a price enhance by late 2022. Even when the minutes reaffirm the Fed’s cautious message, the general image for the greenback nonetheless appears optimistic.

Markets vs Fed

There’s a clear dichotomy between what the Fed is saying and what markets consider goes to occur. Again at its March assembly, the central financial institution revised its financial forecasts increased, because of all of the federal spending that Congress has unleashed. Nevertheless, a majority of policymakers nonetheless indicated that rates of interest is not going to be raised till 2024.

This sign was met with disbelief by buyers, who appear to consider {that a} roaring economic system goes to drive the Fed to hike charges a lot earlier. Super quantities of cash have been thrown on the disaster, nearly half the nation has already obtained the primary vaccination jab, and a number of other customers are merely ready to be unchained. Markets have priced within the first price hike by the top of 2022, and one other two in 2023.

The Fed says it is going to be affected person. Inflation will doubtless speed up quickly – because of a cocktail of provide disruptions, hovering commodity costs, and direct cash transfers – however policymakers consider this might be a transitory episode. Plus, they’ve dedicated to permitting inflation to overshoot their 2% goal for a while with out performing.

The talk boils right down to this: will any inflation episode actually be short-lived? The central financial institution thinks long-term structural forces will in the end pull inflation again down. Globalization and technological developments, an ageing inhabitants, and the shortage of employee bargaining energy in wage negotiations suggest low inflation over time. The counter is that we have now by no means given cash straight to individuals and that globalization has been slowing for a while now.

What do the minutes maintain?

The minutes will give us a way of the place the complete Committee stands on inflation and the timeline of price will increase. As an illustration, if the minutes present that a number of members would assist an earlier price enhance than advised by their forecasts in case the economic system is stronger, that might vindicate market pricing and increase the greenback.

Taking a technical have a look at euro/greenback, preliminary assist to declines could possibly be discovered close to the 1.1785 zone.

However, if the minutes merely reaffirm that any inflation overshoot might be momentary and that charges most likely gained’t rise for a number of years, then market pricing may come nearer to the Fed and the greenback may drop somewhat. On this case, euro/greenback may edge increased in direction of the 1.1880 area.

Both method, the minutes are unlikely to maneuver the needle a lot, and any market response could possibly be minor. The Fed has already telegraphed what it believes, and the market isn’t shopping for it. Incoming financial knowledge will show who is correct.

Total greenback outlook appears vivid

Within the greater image, it’s troublesome to be pessimistic in regards to the greenback. The American economic system is presently stronger than Europe’s because of fewer lockdowns, is miles forward within the vaccination race, and has far more stimulus coming. Finally, all this interprets into the Fed elevating charges years earlier than the European Central Financial institution does.

The principle counterargument is that the majority of this narrative is already priced in now. Nevertheless, contemplating that leveraged funds are nonetheless net-long the euro, there may be doubtless extra scope for euro/greenback to retreat from right here, as speculative positioning approaches impartial ranges.

Lastly, be aware that Chairman Powell may also ship some remarks at round 16:00 GMT on Thursday.

EURUSDFed