Newest FX financial institution evaluation: Exce

Newest FX financial institution evaluation: Excessive positioning maintains short-term EUR/USD correction dangers, greenback struggling to capitalise amid fiscal impasse

The very robust Euro shopping for by hedge-funds leaves EUR/USD weak to a pause at greatest and sharp correction at worst, however there are nonetheless doubts whether or not the US greenback can capitalise and safe greater than non permanent respite. Relative coronavirus instances might show an vital issue.

Picture: EUR/USD trade charge chart

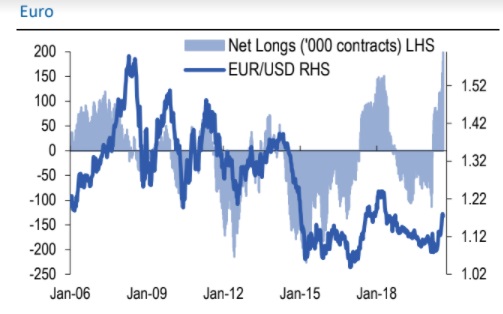

COT lengthy Euro positions hit document excessive

The most recent COT information from the CFTC reported a rise in lengthy, non-commercial Euro positions to a document excessive at 200,00zero contracts. This excessive positioning will go away the Euro weak to a correction and offset weak greenback fundamentals.

RBC famous; “For the week ending August 11, USD shorts elevated once more (up 23Ok to -208Ok). EUR longs continued to development larger to a brand new record-high of 200Ok.

Picture: COT euro

Credit score Agricole CIB Analysis sees scope for a consolidation part within the near-term, particularly with optimistic already priced in to the pair.

Credit score Agricole CIB Analysis sees scope for a consolidation part within the near-term, particularly with optimistic already priced in to the pair.

“In all, we doubt that additional sustained EUR/USD upside is probably going within the very close to time period. Certainly, we notice that some positives appear to already be within the value of the one foreign money.

It forecasts EUR/USD at 1.1800 on the finish of 2020.

Goldman Sachs considers that momentum-based greenback promoting will offset the stress for a masking of Euro shorts.

“Though CTAs are in all probability already quick {dollars}, we see scope for additional weak spot as (i) recent shorts might be triggered quickly and (ii) longer-term traders begin to take part as properly, notably within the Euro and different European belongings.” Goldman nonetheless forecasts a 6-month charge of 1.2000.

Morgan Stanley considers that the greenback will likely be weak if Wednesday’s Fed minutes point out a shift in the direction of common inflation charge concentrating on by the US central financial institution.

The greenback can even be in danger if financial information surprises underpin world danger urge for food.

“We proceed to see draw back dangers for USD however are hesitant to advocate outright quick positions as a result of already-short USD positioning.”

The financial institution has a year-end forecast of 1.1600 with web positive aspects in 2021 to a peak at 1.23 on the finish of subsequent 12 months.

Euro-zone has its personal basic considerations, coronavirus instances in focus

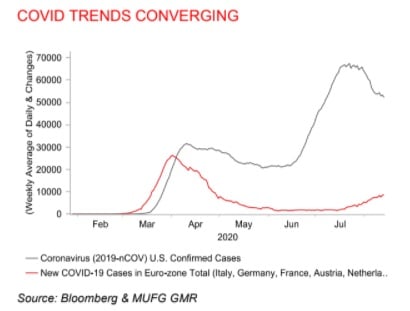

The Euro-zone economic system has recovered strongly from the primary coronavirus outbreak, however the improve in instances over the previous few weeks and recent imposition of journey restrictions has triggered reservations. The variety of US instances has additionally began to average.

Picture: covid comparability

MUFG feedback; “On the similar time, there may be constructing concern over the renewed unfold of COVID-19 in Europe which may take some shine away from the EUR.”

Rabobank considers that the Euro-zone nonetheless faces important challenges. “Moreover, the formation of the Italexit social gathering on July 23rd means that fears of anti-EU sentiment can’t be completely dismissed.”

“We see danger of pullbacks in EUR/USD although recent path could also be absent till liquidity returns to regular ranges in September. We count on a transfer again to the EUR/USD 1.16/1.15 space on a three-month view.”

MUFG additionally seems on the regional dangers posed by the Turkey; “The sharpening unload within the Turkish lira in current weeks may present the catalyst to set off a correction decrease for the EUR. The Euro underperformed throughout the lira foreign money disaster in 2018 which highlights draw back dangers going ahead if historical past is repeated.

The financial institution summarises; “The developments are rising the danger of a correction decrease for EUR/USD within the near-term. A break under assist at 1.1700 will, nonetheless, be required to set off a deeper correction.”

Scotiabank is optimistic on the Euro, particularly if restoration optimism is sustained, though a rise in coronavirus instances may pose important dangers.

“We anticipate {that a} sooner[Euro-zone] restoration than within the US amid strong revenue/job helps schemes and a greater management of the outbreak will proceed to assist the EUR vs the dollar—though it could wrestle to interrupt out of its 1.17-1.19 vary within the short-term. A leap in instances in Germany may be retaining EUR-positive sentiment at bay however Friday’s PMIs launch ought to give the foreign money a lift.”

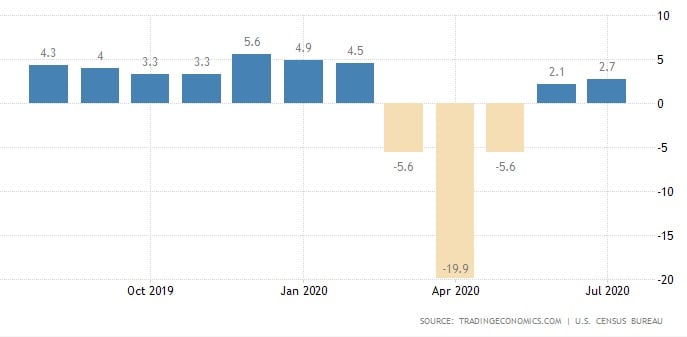

US development developments optimistic….

US retail gross sales total was above market expectations and labour-market information has beat consensus forecasts.

Picture: us gross sales

MUFG notes; “Tentative indicators are actually rising that US economic system is regaining upward momentum once more though it’s nonetheless early days. The sharp drop in weekly preliminary claims to under 1.zero million offered an encouraging sign that the US labour continues to heal.”

Stronger information may assist underpin yields and assist assist the US foreign money. It will, nonetheless, be depending on the US securing a extra complete fiscal assist package deal.

In response to JP Morgan, the accelerated greenback weak spot has been as a result of confidence in a world ‘V-shaped’ restoration, elevated confidence within the Euro-zone and uncertainty over US fiscal coverage.

The financial institution expects that confidence within the Euro-zone outlook is unlikely to drive additional short-term positive aspects whereas confidence within the world economic system is liable to falter. These components ought to reduce Euro assist.

…. however no settlement on recent fiscal stimulus

There has, nonetheless, been no additional fiscal stimulus with Congress doubtlessly getting back from recess late this week in an try to re-start negotiations.

JP Morgan, nonetheless, expects that US considerations will proceed as delays in re-instating unemployment advantages will set off downgrades to the expansion outlook.

“On web, ongoing drag from the US fiscal ought to preserve the greenback below stress, although extra narrowly versus different reserve currencies.”

The financial institution has elevated its year-end EUR/USD forecast to 1.20 from 1.13 beforehand, however expects the pair to weaken subsequent 12 months.

Is the greenback nonetheless king?

In response to Rabobank, the US basic have weakened, however the dominance of the US greenback is prone to stay unchallenged.

Terence Wu, FX strategists at OCBC Financial institution, notes; “The draw back seems muted at greatest with traders targeted on fiscal impasse in Washington. All in all, a transfer in the direction of 1.19 is on the playing cards.”

Credit score Suisse seems on the technical outlook; “EUR/USD maintains a bullish “reversal day” after holding key value assist at 1.1697 and though the specter of a prime can nonetheless not be dominated out, the speedy bias stays seen larger for a retest on the top quality at 1.1916/26.”

It considers the most certainly final result is a high-level consolidation part previous to a core uptrend finally resuming.

Commercial

Get monetary savings in your foreign money transfers with TorFX, voted Worldwide Cash Switch Supplier of the 12 months 2016, 2017 and 2018. Their aim is to attach shoppers with extremely aggressive trade charges and a uniquely devoted service whether or not they select to commerce on-line or over the phone.

Discover out extra right here.