China-ASEAN Relations, Singapore Greenback, Indonesian Rupiah, Malaysian Ringgit, Philippine Peso – Speaking FactorsHow do adjust

China-ASEAN Relations, Singapore Greenback, Indonesian Rupiah, Malaysian Ringgit, Philippine Peso – Speaking Factors

- How do adjustments in Chinese language progress affect ASEAN FX: SGD, IDR, MYR, PHP?

- How did the commerce battle and coronavirus affect the China-ASEAN relationship?

- How the connection between China & ASEAN matches into theCore-Perimeter mannequin

The Affiliation of Southeast Asian Nations, also referred to as ASEAN, orbits the world’s second-largest economic system – China. The bloc is aimed at assisting to promote financial progress in collaborating nations similar to Indonesia, Malaysia, the Philippines and Singapore. Utilizing the Core-Perimeter mannequin, China features because the financial powerhouse (core) which ASEAN states strongly depend on as a supply of their progress (perimeter).

The Relationship Between China and ASEAN (SGD, IDR, MYR, PHP)

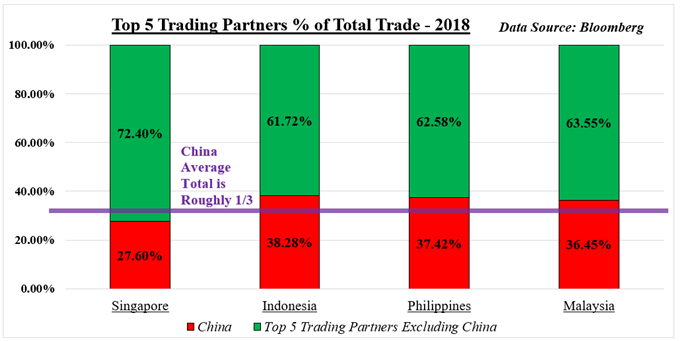

On common in 2018, China accounted for one third of whole commerce in ASEAN nations, when taking a look at their high 5 buying and selling companions. China’s economic system has been maturing and step by step shifting away from exportsand in direction of consumption as the first supply of financial progress. This makes the East Asian big comparativelymuch less delicate to exterior shocks than its ASEAN neighbors.

Significance of ASEAN Commerce With China

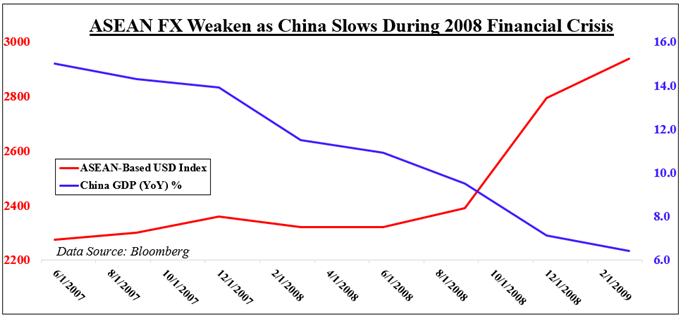

Through the 2008 monetary disaster, market temper considerably deteriorated together with the baseline outlook for progress. China’s year-on-year GDP fell from its 2007 excessive at 14 p.c right down to round 6 p.c in 2009. Over the course of the recession, ASEAN currencies plummeted as capital rushed out of the perimeter amid indicators of weaker progress from the core, the supply of the regional bloc’s financial vitality.

It’s because these perimeter economies (ASEAN) are extra vulnerable to experiencing exterior shocks that undermine their progress trajectory than the core (China) on account of their cycle-sensitive nature. The latter’s economic system has been slowly shifting in direction of a consumer-based economic system, which supplies it extra insulation to exterior shocks than outward-facing economies like these in ASEAN.

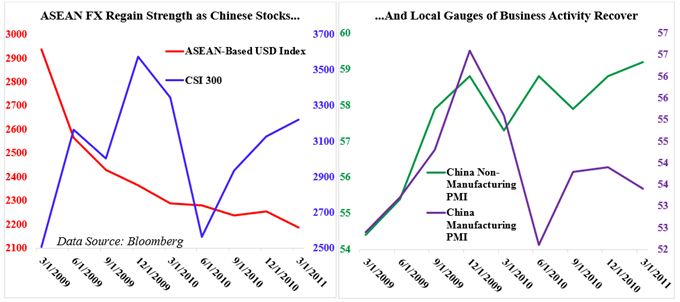

As Chinese language progress started to point out indicators of stabilization, the prospect of that constructive financial reverberation echoing out into its ASEAN neighbors precipitated a rush of capital flowing into the bloc’s belongings. TheSingapore Greenback, Indonesian Rupiah, Malaysian Ringgit, Philippine Peso all rose with different growth-oriented devices as indicators of optimism from the core gave a flicker of hope for an financial restoration within the perimeter.

The China-ASEAN dynamic has one other layer of complexity to it when contemplating how the Yuan carried out relative to its Asian neighbors. An assortment of distinctive circumstances has produced examples the place worth motion deviates from the patterns implied within the Core-Perimeter mannequin. A take a look at how these dynamics manifested in the course of the 2008 monetary disaster, the US-China commerce battle and the Covid-19 pandemic in 2020 will help buyers navigate comparable eventualities and be ready for situations when the assumptions of the Core-Perimeter framework are greatest put aside.

Key Takeaways on the China-ASEAN Relationship

- The Core-Perimeter mannequin reveals that in occasions of uncertainty, capital usually flows from the perimeter economies (ASEAN) into the core (China)

- Conversely, when danger urge for food is excessive, capital flows into perimeter (ASEAN) economies, subsequently strengthening their respective currencies

- ASEAN nations are export-oriented, making them extra weak to financial shocks versus China which is shifting to a mannequin based mostly extra on inside dynamics. This helps to insulate them from exterior financial disruptions

MORE MACRO FOREX TRADING GUIDES IN THIS SERIES

— Written by Daniel Dubrovsky, Foreign money Analyst for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFXon Twitter