By Subhadip Sircar The expansion shock to India’s financial system from the Covid-19 pandemic will set off extra weak point within the rupee, dragg

The expansion shock to India’s financial system from the Covid-19 pandemic will set off extra weak point within the rupee, dragging it towards an unprecedented 80-per greenback degree.

That’s the view from Venkat Thiagarajan, who has traded foreign money markets for 26 years, and most not too long ago served as the top of foreign exchange at Reliance Industries Ltd., which runs India’s largest company treasury. The rupee, he argues, has a stronger hyperlink with financial progress, and metrics like the present account, stability of funds and international greenback dynamics have a marginal affect within the medium time period.

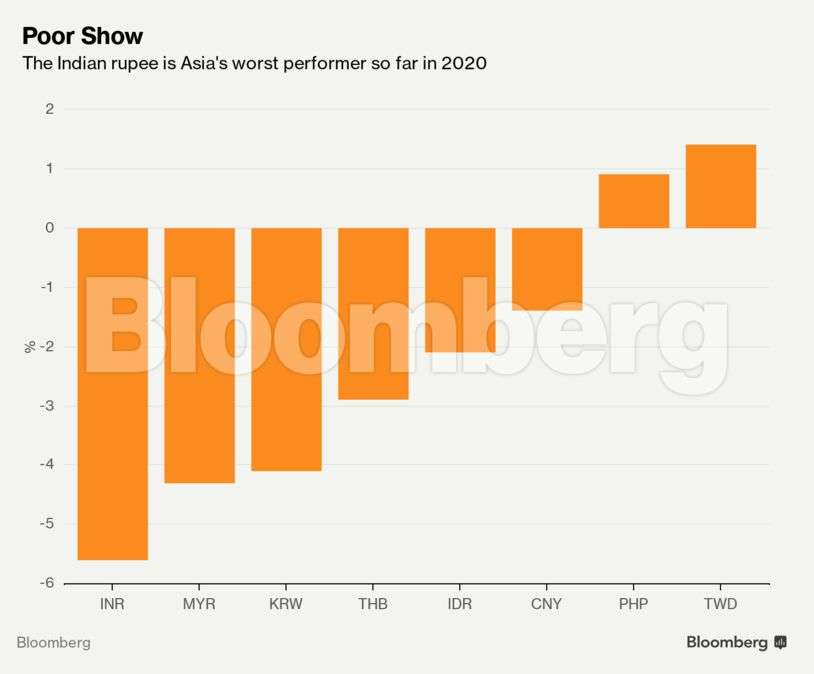

Thiagarajan’s bearish outlook stands out as there’s rising market consensus that the rupee — Asia’s worst performer this yr — will rebound on the again of sturdy abroad flows into Indian shares and a chunky international direct funding into Reliance’s digital unit. That’s because the financial system is about for its first annual contraction in additional than 4 a long time this yr.

Bloomberg

“Within the context of extreme progress contraction that one has by no means evidenced up to now, the rupee would are likely to depreciate consistent with that historic dynamic,” stated Thiagarajan, 61, who retired final month from Reliance. “The well-anticipated and well-advertised flows received’t swing the needle.”

His feedback carry weight. Thiagarajan has seen Reliance emerge as one of the vital prolific issuers and debtors within the international debt markets throughout his 17-year stint on the oil-to-telecom large. Managed by Mukesh Ambani, Asia’s richest man, Reliance alone accounts for about 10% of India’s exports, which explains why merchants intently watch its foreign exchange flows. Final yr, the corporate is claimed to have offered bulk of the $5 billion in a foreign exchange swap with the central financial institution.

World funds have piled $4.5 billion into native shares this quarter, the very best within the area. A piece of these flows is owing to a rights providing by Reliance and stake gross sales in Kotak Mahindra Financial institution Ltd. and Bharti Airtel Ltd. One other $15.2 billion is seen coming in by the use of FDI inflows, due to a flurry of offers for Ambani’s digital unit, Jio Platforms Ltd.

‘Extraordinarily Tough’

But, the portfolio inflows have executed little to arrest the decline within the rupee, which is down virtually 6% in 2020. It’s the solely Asian foreign money to have weakened in opposition to the greenback this quarter whilst its friends have rebounded sharply from the virus-induced selloff seen earlier within the yr.

Bloomberg

Analysts have been citing the central financial institution’s aggressive mopping up of {dollars}, which has taken India’s foreign-exchange reserves previous a report $500 billion, as one massive cause for the foreign money’s sustained weak point.

With the virus outbreak including strain on the monetary sector already strained by a shadow-banking disaster, authorities might choose a weaker foreign money, stated Thiagarajan.

“Progress contraction of such extreme proportion has made coverage making extraordinarily troublesome and within the absence of incremental room in fiscal and financial insurance policies, exchange-rate depreciation is the way in which of stimulating the financial system,” he stated.

Not Tenable

Fitch Rankings Ltd. final week minimize India’s outlook to damaging, citing weak financial progress prospects and rising public debt, transferring the nation’s credit score rating a step nearer to junk. Moody’s Traders Service downgraded India’s score to the bottom funding rating earlier within the month.

Debt ranges within the financial system are excessive and as non-public sector struggles to service the debt amid the sharp slowdown, the banking sector stays underneath stress, stated Thiagarajan.

The rupee will finish the yr at 75 per greenback, based on the median estimate in a Bloomberg survey, largely round Wednesday’s shut of 75.12. The foreign money hit a report low of 76.9088 in April.

“A stronger foreign money may not be tenable in an financial system with a weaker monetary sector,” he stated.

–With help from Masaki Kondo.