The United States greenback versus the Japanese yen forex pair, at first look, appears to be in bullish finger

The United States greenback versus the Japanese yen forex pair, at first look, appears to be in bullish fingers. However is it so?

Lengthy-term perspective

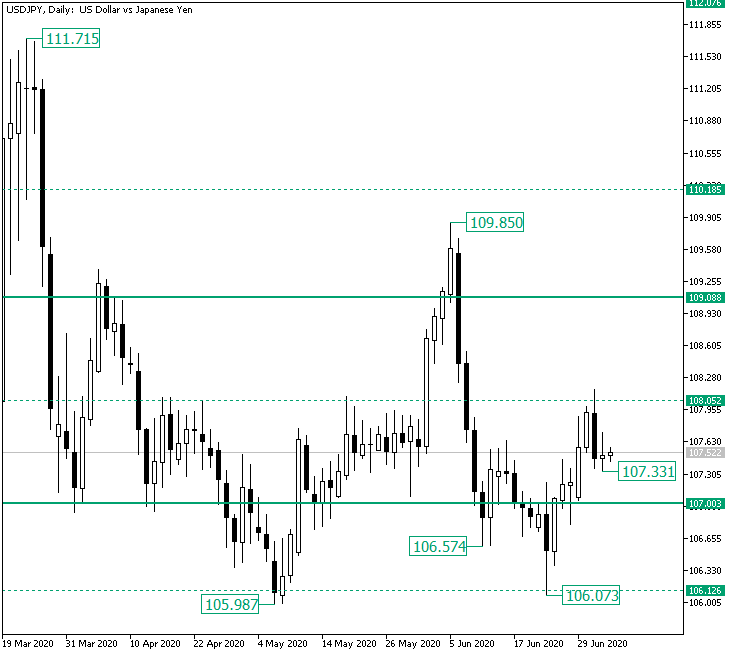

The fall that began from the 109.85 excessive prolonged, in a major section, till the 106.57 agency stage, being rejected by its supportive position. Nonetheless, the bears continued pressuring the worth, thus drawing one other leg down and etching the 106.07 low.

Since 106.07 could be very near the earlier one, at 105.98, and as a result of the latter one had the energy to flip across the drop that adopted the affirmation of 107.00 as resistance on April 20, the 106.07 space stayed full of bulls, as it may be seen from the sturdy rejection and the appreciation that introduced the worth above the 107.00 psychological stage and across the 108.05 middleman stage.

Now, by contemplating the lows on the chart, one can see the 106.57 as the first shoulder and the low of 106.07 as the head of a head and shoulders sample that may have its second shoulder at the 107.33 low and the neckline at 108.05.

If that is the case, then the bulls may anticipate that an appreciation ought to be in the playing cards. It might come with out printing a decrease low, with respect to 107.33, or with a retracement that validates 107.00 as help and defines the second shoulder in the course of. In this situation, 108.05 is a partial revenue reserving space, whereas the principal bullish purpose sits at 109.08.

On the different hand, the bearish engulfing from 108.05 spells a heavy doable depreciation. By checking the chart, it may be seen that the 108.05 stage is, though an middleman one, additionally an vital one, serving as a good reference level for totally different previous actions. So, the drop signaled by the candlestick sample might fulfill itself however be restricted by the 107.00 stage, which in flip triggers the aforementioned bullish situation, or it may be that sturdy that it pierces 107.00 and leads the worth as soon as extra to 106.12.

Brief-term perspective

After virtually touching the vital 106.02 help stage, the worth began an appreciation highlighted by the ascending trendline.

Even when the bulls managed to conquer the 106.77 and 107.34 middleman ranges, the robust resistance of 108.02 restricted additional progress and despatched the worth beneath the ascending trendline, casting the finish — or at least a pause — of its corresponding development.

This drop stopped at 107.34, in order lengthy as the stage performs out as help, the bulls might attempt to drive the costs increased. Even so, as 108.02 serves as a first cease, it may be an space that facilitates the formation of a topping sample. Contemplating that, if 107.34 will get breached, then 106.77 comes as a first bearish goal, adopted by 106.02.

Provided that 108.02 is cleared, then the bulls might prolong till 108.53 and, in a while, to 109.27 and 109.66.

Ranges to maintain an eye on:

D1: 107.00 108.05 109.08 106.12

H4: 107.34 108.02 106.77 106.02 109.27 109.66

If you have got any questions, feedback, or opinions concerning the US Greenback, be happy to submit them utilizing the commentary type beneath.