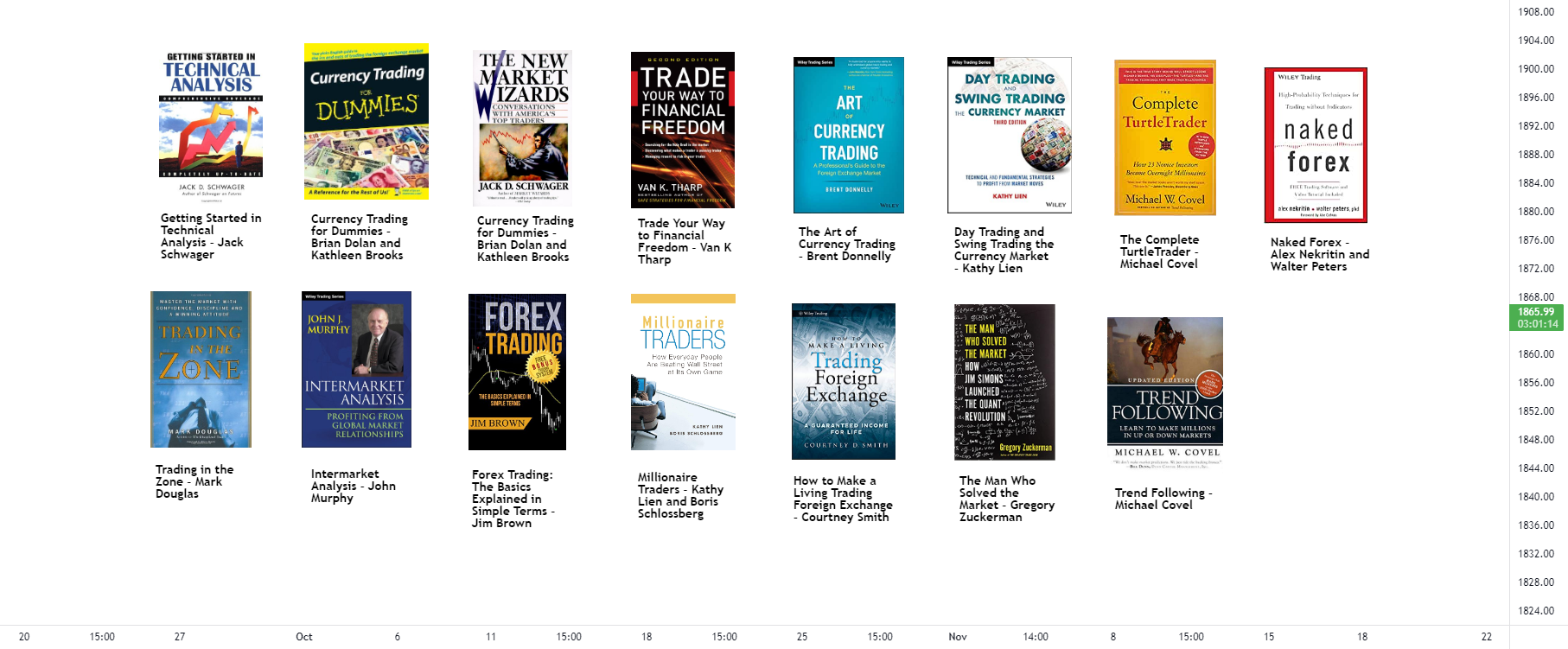

Getting Started in Technical Analysis – Jack Schwager Applicable to all financial markets and not just forex, this book provides an easy-to-unders

Applicable to all financial markets and not just forex, this book provides an easy-to-understand overview for using technical analysis. This includes chart patterns, trendlines , indicators, and support and resistance levels. Technical analysis uses price charts as the primary input for making trading decisions. For beginner traders, this book could be a good place to start for learning terminology and basic market analysis concepts.

Currency Trading for Dummies – Brian Dolan and Kathleen Brooks

The ‘For Dummies’ book series introduces complex topics in a simple way. This book provides everything a beginner needs to know about the forex market, including understanding currency pairs, how forex operates, helpful tools, risk-management, how to succeed and the characteristics of successful traders.

This book is more focused on the basics, and not as much on actual forex trading strategies, so click the link to learn more in-depth practises.

The New Market Wizards – Jack Schwager

The author interviews multiple successful traders, asking them about their trading system and what makes them profitable. This trading book is an eye opener for different trading styles and how they can all be effective. There is no single right way. Each trader interviewed found what worked for them and then perfected the method. Also consider reading Unknown Market Wizards by the same author.

Trade Your Way to Financial Freedom – Van K Tharp

This book is applicable to all trader, not just within the FX market. It focuses on how to design a trading plan and making sure your strategies are well thought out and tested. As you accumulate knowledge and ideas about how you wish to trade, this book helps you figure out how to use that knowledge to create a personalised plan for how you will trade. View this as a workbook, with most of the chapters laying out steps to complete before moving on.

The Art of Currency Trading – Brent Donnelly

This book provides the inside scoop on how a bank trader places trades and manages risk. The book primarily focuses on fundamental analysis, as opposed to technical analysis , which looks at news and economic conditions to help determine where prices could go. The author provides several forex strategies as well as guidance on managing risk and position sizing. The author uses a conversational style, so a real benefit of this forex trading book could be seeing how a professional thinks and dissects a trade.

Day Trading and Swing Trading the Currency Market – Kathy Lien

Kathy Lien frequently appears on Bloomberg and CNBC to provide forex analysis. This book focuses on both fundamental and technical analysis trading methods to help traders on their trading journey. It covers methods that can be used for short-term trades (day trading) and longer-term trades (swing trading). The book has been updated since its original release in 2008, and it is now in its third edition.

The Complete TurtleTrader – Michael Covel

This book tells the story of a trader who made a bet with his business partner that he could make anyone a successful trader if they were given a proven strategy. The trader funded and trained a group of recruits that he called ‘turtles’. Many of the students/turtles from the experiment did in fact go on to be highly successful traders, and the trend-following strategy that they were taught is revealed in this trading book.

You can also learn more about trend trading in our complete guide.

Trading in the Zone – Mark Douglas

Trading isn’t only about strategies. A trader needs to have the discipline and patience to implement a strategy effectively, and that falls under psychology. This book teaches traders how to sync their strategies with the markets without letting emotions cause major mistakes. Conflicting beliefs are also addressed to stop traders sabotaging their own success, helping to build confidence in their method and themselves.

Intermarket Analysis – John Murphy

Intermarket analysis is the study of how markets interact to predict where prices may head next. For example, if bonds and stocks are doing well in certain countries, this may affect related currencies. If the US dollar is strong, this may affect commodity prices. The book provides a framework for understanding how forex prices move in relation to other assets.

Forex Trading: The Basics Explained in Simple Terms – Jim Brown

At 91 pages, this is a short forex trading book, introducing traders to forex and how the market operates. It also provides practical tips on selecting a forex broker, how to place trades and basic strategies. The strategies are meant for beginners and can be built on or added to as the trader progresses. This book is an entry point. The author has two other books for traders who enjoy his writing style and wish to continue their education.

View our article on forex trading for beginners for a similar overview of how to get started on our platform.

Millionaire Traders – Kathy Lien and Boris Schlossberg

Like The New Market Wizards, this book is a collection of interviews with traders that are under the radar and not well-known but that have had great success. The interviews reveal how they achieved their success and are centred around traders who started out small but over time were able to grow their account exponentially. It’s an inspiring book for new traders as it not only shows it can be done, but how to do it.

How to Make a Living Trading Foreign Exchange – Courtney Smith

The book introduces six strategies for forex trading. The strategies vary in that some can be used for longer-term trades, while others can be used for day trading. Methods are provided for determining when short-term price reversals are occurring, as well as longer-term ‘major’ turning points. The book also touches on risk-management and trading psychology .

The Man Who Solved the Market – Gregory Zuckerman

This book may be of interest to traders who like to (or want to) automate their trading strategies. It is the story of Jim Simons and how he started Renaissance Technologies. His quantitative fund has a long track record of greater than 50% yearly returns, which is almost unheard of in the hedge fund world. A quantitative fund, or ‘quant’, analyses price data and if a profit opportunity is revealed in the data an automated program will attempt to exploit it.

Trend Following – Michael Covel

The book outlines nearly everything anyone would want to know about trend following trading strategies. Such strategies could be employed in any market, including currencies. The book discusses why trend following strategies have stood the test of time and includes interviews with successful trend following traders. At well over 600 pages, it is an extended and thorough read, not a quick one.

Naked Forex – Alex Nekritin and Walter Peters

The basis of this forex trading book is that ‘price is king’. Since price is what profits and losses are based on, it is the only thing that matters. It is the only tool discussed in the book, which includes trading strategies that are based solely on price action and for which the use of technical indicators is not required. In addition to strategies, the book discusses how to understand what kind of trader you are so you can trade based on your own psychology.

This text is from cmcmarkets, I share it with you because I thought it was a very good article and I wanted to share it with you, I hope it helps you.

todayuknews.com