USD/JPY used to be on a strong bullish trend throughout this year until late October, as the Bank of Japan (BOJ) and the Ministry of Finance of Japan

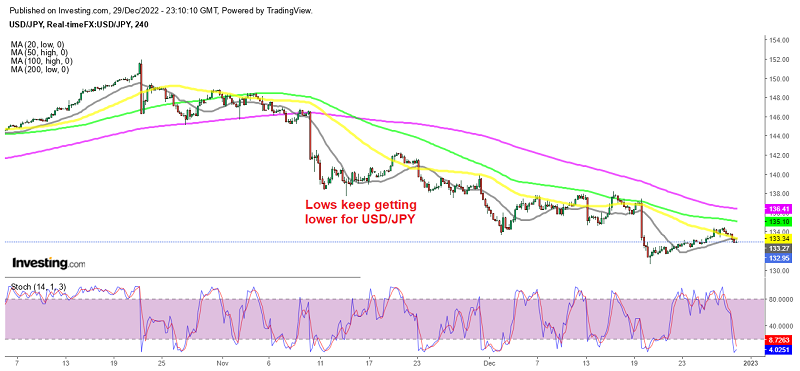

USD/JPY used to be on a strong bullish trend throughout this year until late October, as the Bank of Japan (BOJ) and the Ministry of Finance of Japan intervened in October and reversed the trend. Although the USD has also turned bearish which has helped fuel the bearish momentum as well. Early last week the BOJ changed its policy, although it did not move interest rates and we saw another bearish leg in this pair, sending it around 700 pips lower.

Since then USD/JPY has been retracing higher, until sellers returned again yesterday. Although, it is the end of the year and it isn’t the best of times to scrutinize any market moves amid thinner liquidity conditions. The USD turned softer yesterday and this pair was leading the downside, as sellers looked to snap a run of four straight days of gains for the pair.

In the bigger picture, the technical predicament points to a consolidation of sorts after the plunge last Tuesday following the surprise BOJ policy tweak. On the H4 chart above, we see that this pair has been making lower highs as retraces higher keep failing to turn into a bullish trend. The latest retrace seems to be over now with the price falling below moving averages again.

USD/JPY Daily Chart – The 20 SMA Has Turned Into Resistance

The retrace up seems to be over

The daily chart shows a bounce off from the 200 SMA (purple) which turned into support for some time, but it was eventually broken after the BOJ announcement last Tuesday. Now it seems like the 20 SMA (gray) has turned into resistance at the top, after rejecting the price yesterday.

In the bigger picture, a lot of it will come down to any chatter about a further pivot in the policy by the BOJ. I mean, one can reasonably expect policymakers to keep defending their current ultra loose policy but at the end of the day, actions speak louder than words. And in turn, their credibility is most certainly at stake in 2023. If there is even the slightest indication of the BOJ turning the corner and angling its crosshair towards fighting inflation, USD/JPY may very well look towards 100 or 110 again pretty fast.

USD/JPY

news.google.com