Euro (EUR/USD, EUR/GBP) News and AnalysisEU Bond Spreads on the Move as ECB Officials Call for ‘Fiscal Discipline’Yesterday the Italian government app

Euro (EUR/USD, EUR/GBP) News and Analysis

EU Bond Spreads on the Move as ECB Officials Call for ‘Fiscal Discipline’

Yesterday the Italian government approved a budget for 2024 that entails tax cuts, increased spending and plans to borrow to fill the gap, despite market concerns over the country’s indebtedness.

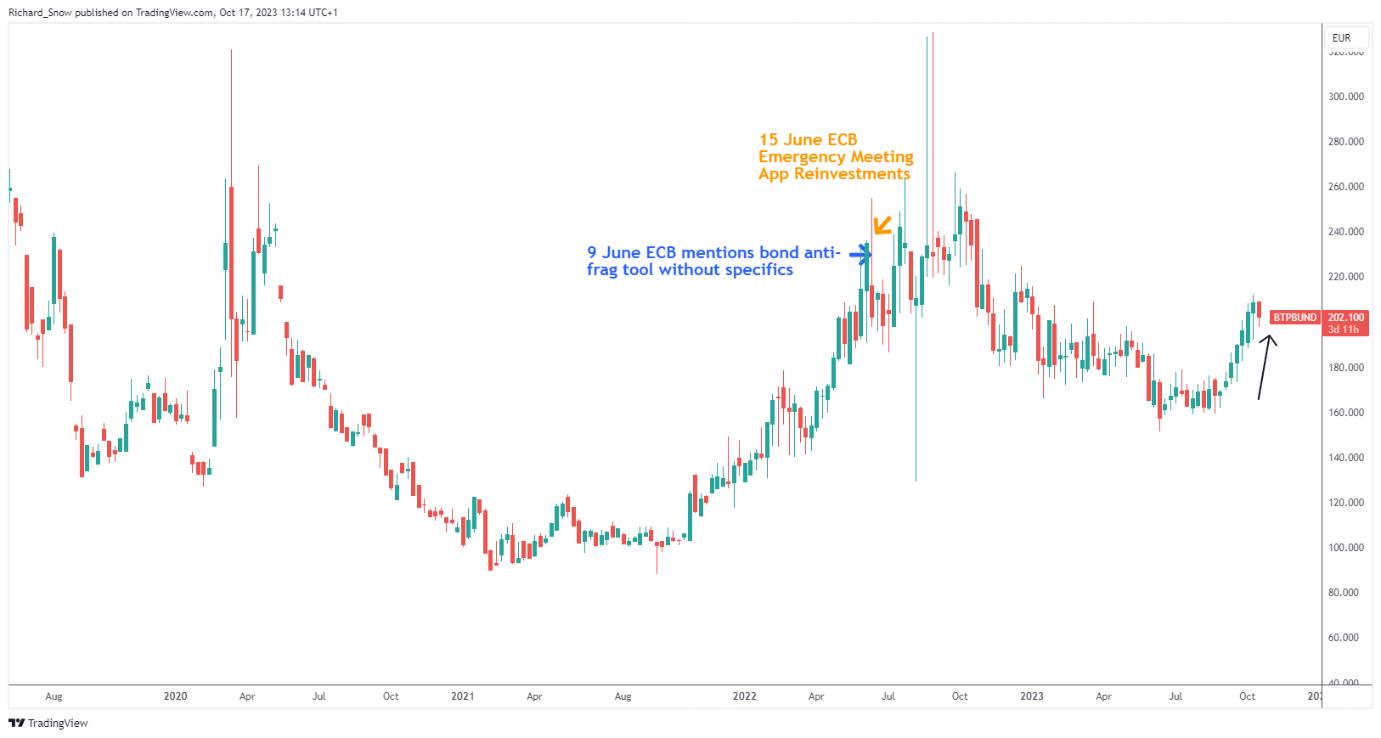

In recent trading sessions investors have been demanding a higher premium on Italian government debt which can be seen in the BTP-Bund spread below. the chart shows the difference in yield between the historically riskier Italian bonds and the more stable German equivalent where the spread now exceeds 200 basis points meaning it’s more expensive for the Italian government to borrow money.

The budget has been approved after calls from major European Central Bank representatives, Vasle and Nagel for ‘fiscal discipline’ in order to contain widening spreads. In order to get inflation back to target monetary policy and fiscal policy need to work in unison. Increased government spending always runs the risk of elevating general price pressures, something the ECB is looking to avoid as it holds rates at a record 4% ahead of next week’s ECB rate setting meeting.

While spreads have accelerated higher from the recent lows, they remain within a manageable level. However, the real risk appears in the form of ratings agencies which will judge whether the budget places Italy at greater risk of defaulting on bonds carrying higher borrowing costs.

BTP-BUND Spread (Italian 10-year yield – German 10-year yield) Weekly Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

USD Safe Haven Appeal, Sticky Inflation and Strong Economy to Weigh on EUR/USD

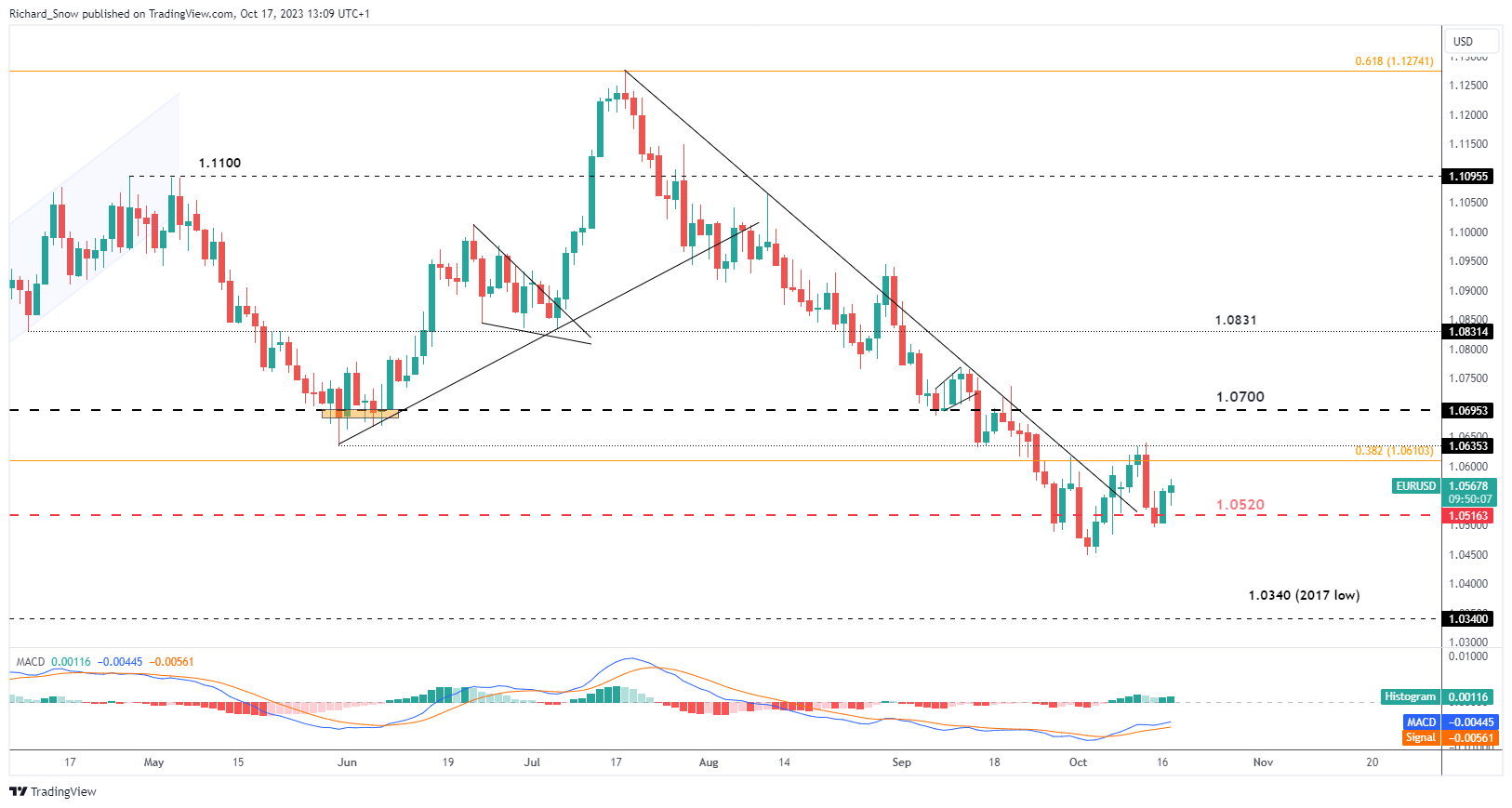

EUR/USD rose yesterday and trades near the prior day close. However, EUR/USD upside has remained limited despite a broad dollar selloff in early October. The pair is yet to make a conclusive upside breakout with many fundamental factors posing an issue to a bullish reversal.

The recent safe haven appeal bodes well for the dollar amidst the conflict in the Middle East, last week’s inflation data for the period of September also revealed stickier price pressures than anticipated, and consensus estimates for third quarter GDP growth in the US stands at an impressive 4.1%. A resilient U.S. economy means that the Fed’s ‘higher for longer’ narrative is likely to outweigh recent dovish concerns that higher US yields are helping to further tighten financial conditions.

1.0700 remains a tripwire before any bullish reversal can even be entertained while support comes in at 1.0520, followed by the swing low.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free EUR Forecast

EUR/GBP Surges After UK Wage Growth Slowed in August

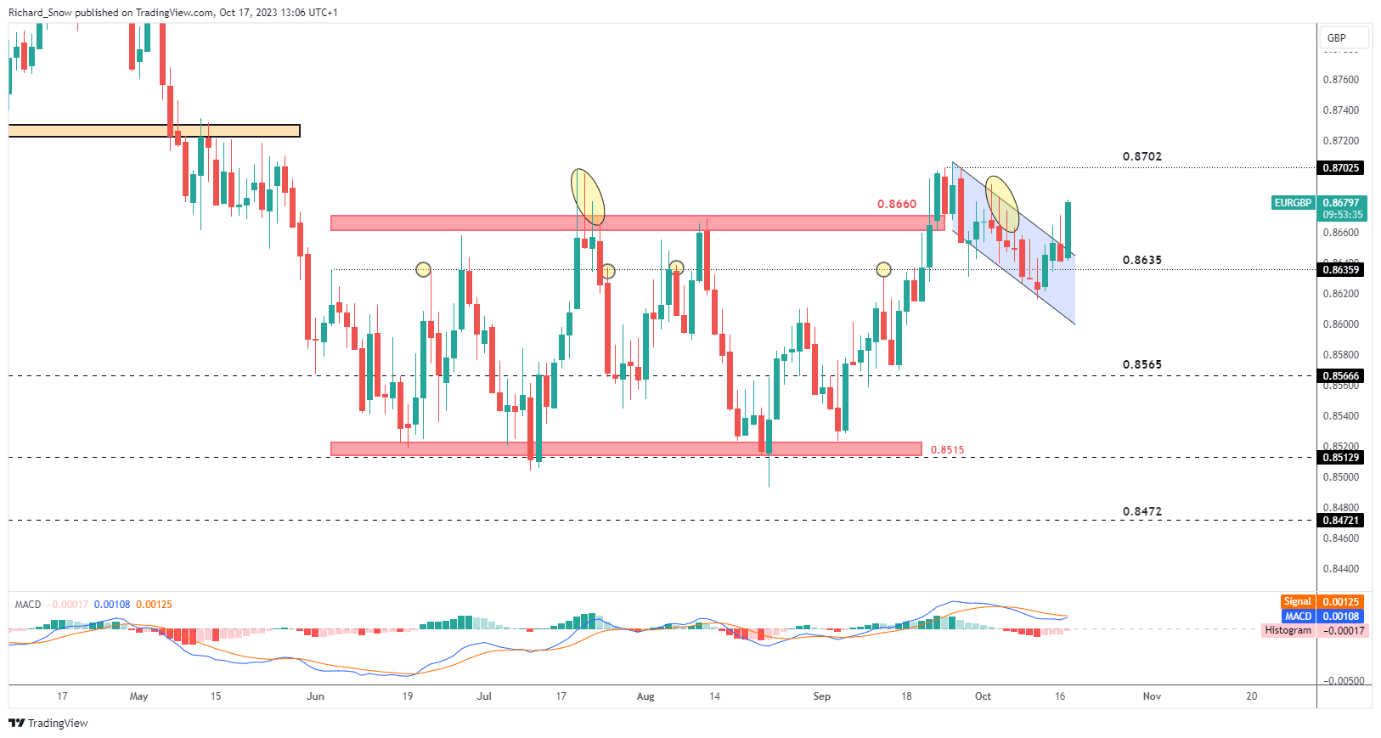

Earlier this morning UK wage growth increased at a slower pace than anticipated. Three-month average earnings in the UK increased 8.1% for the month of August, which is down from last month’s excessive 8.5% and lower than the 5.3% estimate.

The Bank of England often refers to the level of wages influencing price pressures and the fact that we’ve seen a turn lower alongside rising unemployment data, will represent a small victory for the Monetary Policy Committee.

Resistance now appears at 0.8702 but price action could pullback first before attempting another advance. Support lies at 0.8635.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Traits of Successful Traders

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS