JAPANESE YEN FORECAST:USD/JPY rises modestly following the Fed’s decision on WednesdayAttention now turns to Bank of Japan’s monetary policy announcem

JAPANESE YEN FORECAST:

- USD/JPY rises modestly following the Fed’s decision on Wednesday

- Attention now turns to Bank of Japan’s monetary policy announcement

- BoJ is expected to keep its ultra-loose stance unchanged, creating additional headwinds for the Japanese yen

Recommended by Diego Colman

Get Your Free JPY Forecast

Most Read: Fed Pauses for Now but Signals Higher Peak Rate, Gold Prices Shift into Reverse

USD/JPY moved slightly upwards on Thursday, despite broad-based U.S. dollar weakness, triggered by falling U.S. Treasury yields. In early afternoon trading, the pair was up around 0.25% to 140.35, well off the Asian session highs, when it briefly rose above 141.50 and reached its best levels since November 2022, following the Fed’s decision to signal a higher terminal rate at its June FOMC meeting.

Looking ahead, the Bank of Japan’s monetary policy announcement on Friday (Thursday night US time) will be the next major volatility catalyst worth watching. In terms of expectations, the BoJ is seen maintaining its ultra-accommodative stance, keeping its benchmark interest rate and yield curve control program unchanged.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

BoJ’s Governor Kazuo Ueda, who took the reins of the institution in April, has repeatedly warned against a premature exit from expansionary policies, indicating that a precipitous pivot to a tighter setting could have a detrimental impact on employment and wage growth, complicating efforts to achieve stable inflation of 2.0% over the long term. It will be a blow to Ueda’s credibility to flip-flop overnight.

With BoJ not ready to withdraw stimulus and the FOMC on course to lift borrowing costs possibly two more times in 2023, USD/JPY is likely to remain biased to the upside in the near term. Although markets appear skeptical of the Fed’s plans to resume hikes later this year, yield differentials between the U.S. and Japan continue to favor U.S. dollar strength for now.

While excessive Japanese yen weakness may force the government to step in to curb rampant speculation, USD/JPY has not yet crossed the threshold for intervention. However, should the pair break above 145.00, traders should be more concerned, as last year the authorities began selling dollars when the exchange rate flirted with 146.00 and 152.00.

Recommended by Diego Colman

Improve your trading with IG Client Sentiment Data

USD/JPY TECHNICAL ANALYSIS

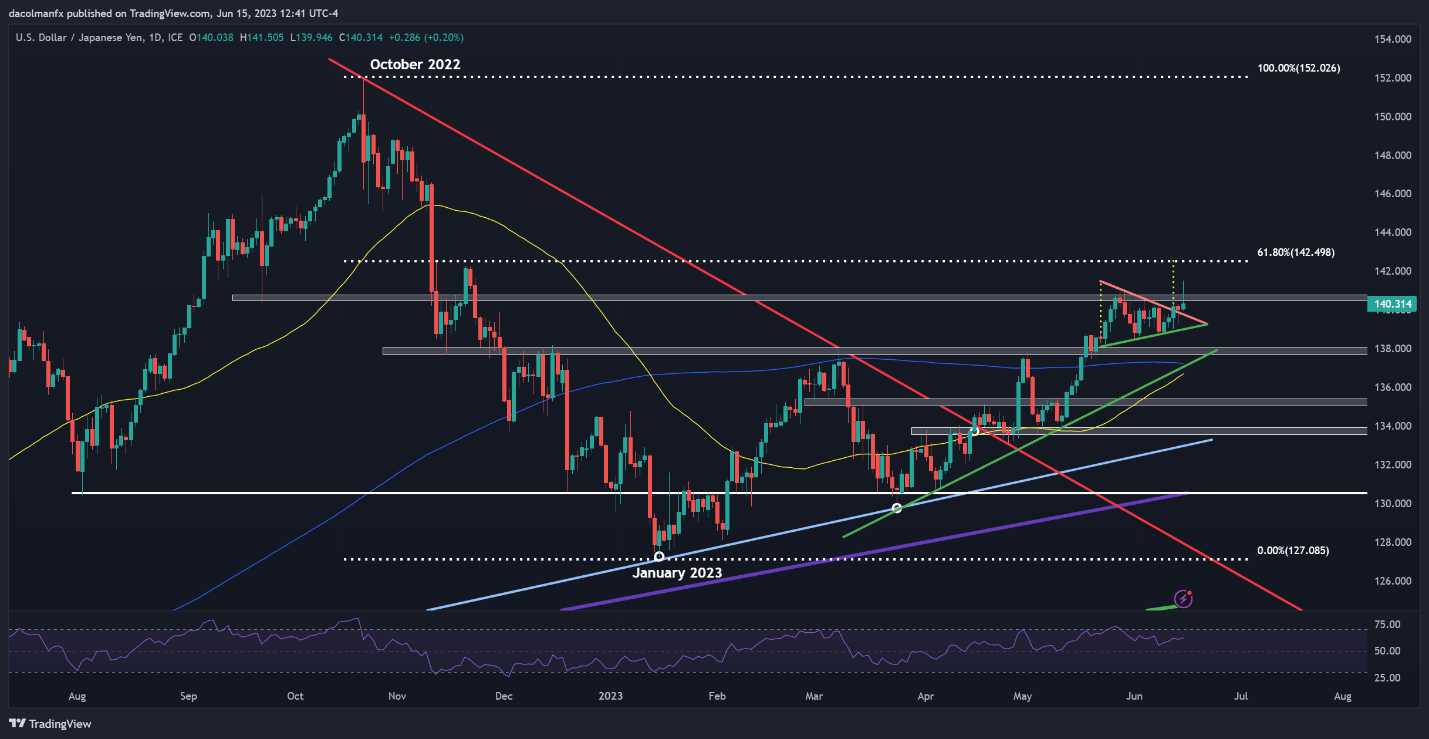

USD/JPY has been coiling inside a symmetrical triangle in recent weeks, often seen as a continuation pattern according to technical analysis. The coiling phase ultimately resolved to the upside, with prices breaking out of the triangle and briefly hitting their highest level in nearly seven months.

While the breakout has been sustained so far, the upward impetus is weakening. Be that as it may, the broader bias remains constructive, but to be confident in the bullish thesis, a move and weekly close above 140.40/140.70 is required. If this scenario plays out, USD/JPY could gather steam to challenge 142.50, the 50% Fib retracement of the Oct 2022/Jan 2023 sell off.

On the flip side, if sellers regain control of the market and push prices below 139.75, we could see a pullback toward 139.00. On further weakness, the focus shifts to the psychological 138.00 level, prior to the 200-day simple moving average and short-term rising trendline at 137.25.

Recommended by Diego Colman

How to Trade USD/JPY

USD/JPY TECHNICAL CHART

USD/JPY Chart Prepared Using TradingView

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com