This article provides an in-depth exploration of the technical outlook for gold and silver prices, offering valuable insights into price action dynami

This article provides an in-depth exploration of the technical outlook for gold and silver prices, offering valuable insights into price action dynamics and sentiment. For a holistic view that includes the fundamental forecast, download the comprehensive second quarter trading guide.

Recommended by Diego Colman

Get Your Free Gold Forecast

Gold Price Q2 Technical Outlook

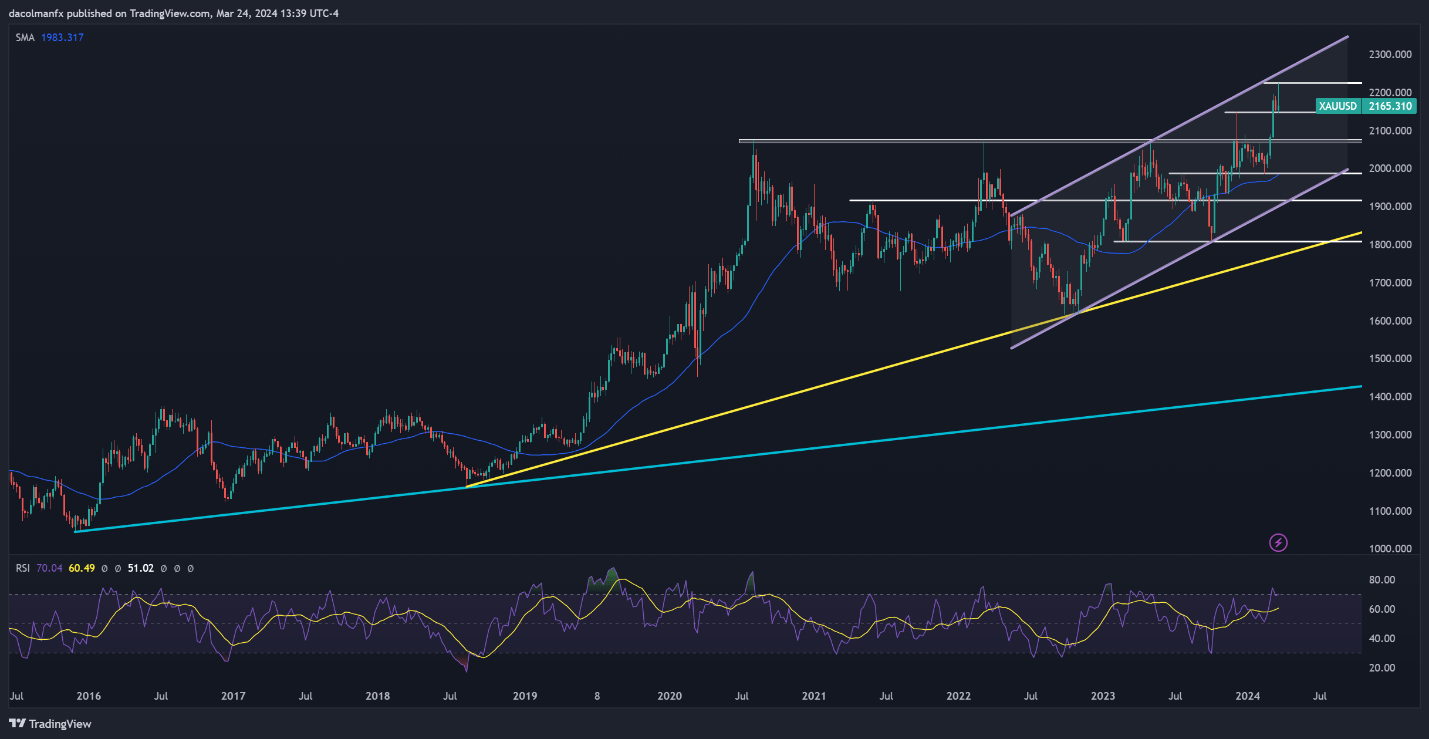

Gold kicked off the first quarter of 2024 with solid gains, extending the positive momentum established in the latter part of 2023. During this upturn, XAU/USD soared to new all-time highs, decisively breaking past the $2,150 mark, and eventually reaching a peak of $2,222. Although prices have since experienced a slight retreat, the precious metal remains near record zone at the time of writing.

While bullion’s technical profile continues to be bullish, with a clear pattern of higher highs and higher lows, caution is advised, with the 10-week RSI indicator signaling possible overbought conditions. When markets become overextended in a short period of time, corrective pullbacks often follow, even if they turn out to be temporary or relatively minor.

In the event of a bearish shift, support can be identified at $2,145, followed by $2,070, as displayed in the weekly chart attached. Bulls will need to vigorously defend this technical floor; failure to do so may result in a retracement towards the 200-day simple moving average near $1,985. Further down, attention will turn to channel support at $1,920, then to $1,810.

On the other hand, if bulls maintain control of the steering wheel and manage to propel prices higher in the coming days and weeks, initial resistance awaits at the $2,222 record high. While buyers may face difficulty breaching this barrier decisively, a successful breakout could invigorate upside pressure, paving the way for a move towards channel resistance at $2,255.

Elevate your gold trading skills with our exclusive “How to Trade Gold” guide. Download it now for free and master the art of trading this precious metal like a seasoned expert!

Recommended by Diego Colman

How to Trade Gold

Gold (XAU/USD) Weekly Chart

Source: TradingView, Prepared by Diego Colman

Silver Price Q2 Technical Outlook

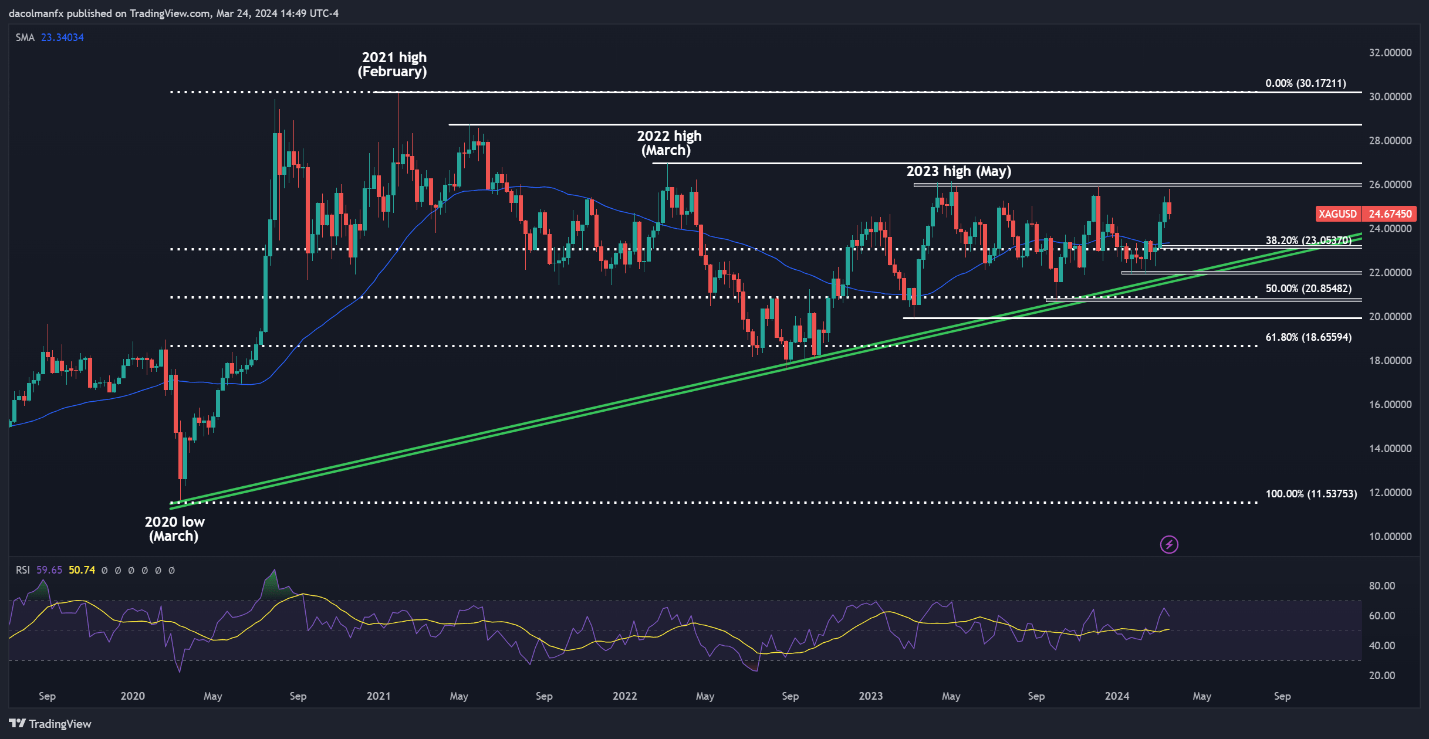

Silver also climbed during the first quarter, although its gains paled in comparison to gold’s impressive surge. In any case, XAG/USD has arrived at the gates of an important resistance near the psychological $26.00 threshold following the recent rally, an area where bullish advances were repeatedly halted in 2023, as seen in the weekly chart below.

Drawing from historical patterns, there’s a high likelihood that XAG/USD may encounter rejection once more at this technical ceiling, where seller activity seems concentrated. However, should a breakout unfold, there’s scope for a move towards $26.95, which represents the high point of 2022. Subsequent strength would direct attention to $28.75, the peak of May 2021.

Alternatively, if the bearish scenario plays out and silver gets knocked back down from its current position, cluster support spans from $23.30 to $23.05. Here, the 200-day simple moving average aligns with the 38.2% Fibonacci retracement of the upward movement witnessed from 2020 to 2021. Below this floor, long-term trendline support at $22.00 emerges as the key focus, with $20.85 as the next target.

Wondering how retail positioning can shape silver prices? Our sentiment guide provides the answers you seek—don’t miss out, download it now!

| Change in | Longs | Shorts | OI |

| Daily | -1% | -3% | -1% |

| Weekly | 7% | 3% | 6% |

Silver (XAG/USD) Weekly Chart

Source: TradingView, Prepared by Diego Colman

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS