Aussie Dollar (AUD/USD) AnalysisRisk sentiment props up AUD with US CPI data on the horizonUS CPI expected to redirect attention to the disinflation n

Aussie Dollar (AUD/USD) Analysis

- Risk sentiment props up AUD with US CPI data on the horizon

- US CPI expected to redirect attention to the disinflation narrative after consecutive months of stubborn price pressures

- AUD/USD reveals key resistance levels in the event CPI heads lower

- Get your hands on the Aussie dollar Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free AUD Forecast

Risk Sentiment Props up AUD with US CPI Data on the Horizon

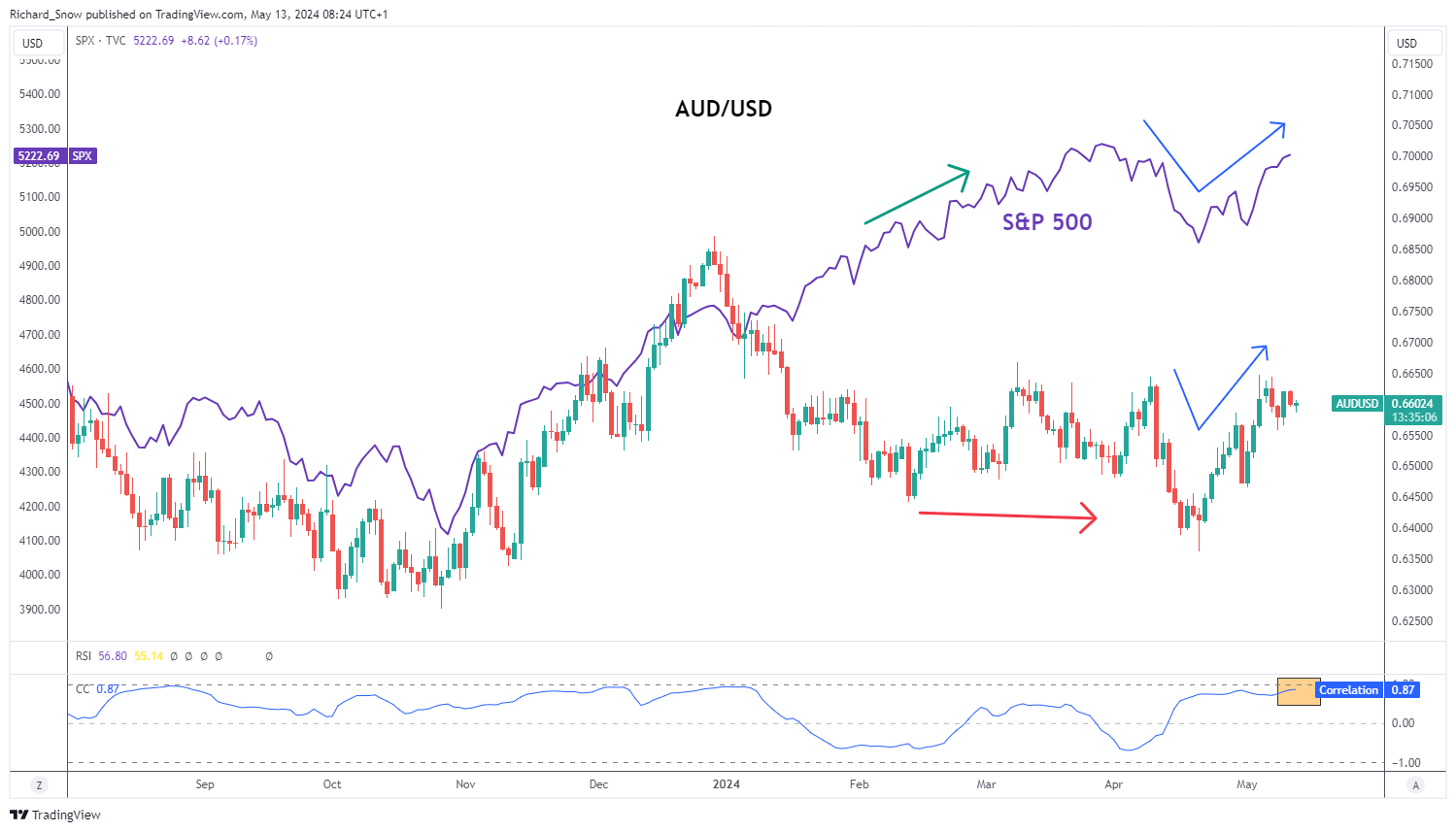

In the early stages of 2024, the typical positive relationship between the S&P 500 and the Aussie dollar began to break down. Stocks continued higher while strong US inflation and robust growth buoyed the US dollar, weighing on AUD which and sending AUD/USD sideways, or at times, lower.

However, the typical positive relationship appears to be getting back on track as both paths appear to be moving in lockstep – something that the correlation coefficient index reveals at the bottom of the chart (using a 20 day rolling correlation). A correlation coefficient of 1 means two markets are perfectly in lockstep and the current reading of 0.87 reveals a solid recovery of late. Therefore, as the S&P 500 is on track to test its all-time high, AUD may benefit from the continued risk on move.

The one potential hurdle this week is US CPI, which is expected to show a return to the disinflation narrative but markets will be focused on a much more nuanced measure of inflation, month-on-month (MoM) core CPI. Month-on-month core CPI has trended around the 0.4% mark- twice that which is believed to bring inflation back down to the 2% target. Early estimates have the figure at 0.3% but markets may look even closer as this figure tends to be rounded up or down. For example, a 2.6% reading may receive a bearish repricing in USD with 0.34% being met with a more bullish response despite the fact that both figures will show as 0.3%.

AUD/USD Compared to S&P 500 (Correlation Recovering)

Source: TradingView, prepared by Richard Snow

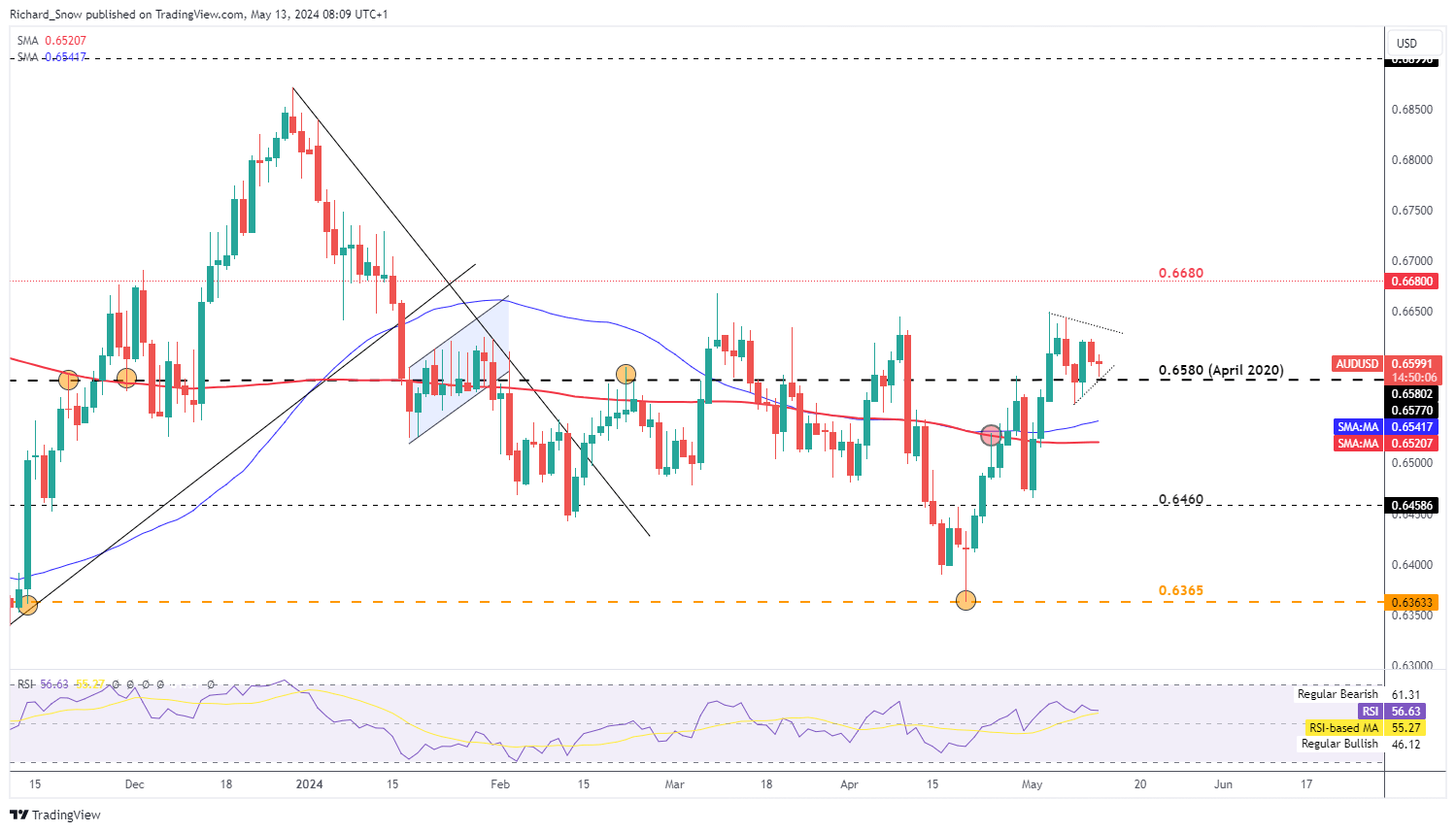

AUD/USD Reveals Key Resistance Levels in the Event CPI Heads Lower

AUD/USD has risen above the 200-day simple moving average (SMA) with ease and appears to be holding above the April 2020 high of 0.6580 where price action has consolidated in recent days.

The main challenge for AUD/USD bulls from here is breaching the zone of resistance that has appeared around recent swing highs at 0.6645. Even if that is achieved, the 0.6680 level is not too far away – another level that has capped AUD/USD upside. However, the recent consolidation forms what looks like a bull pennant – a typical bullish pattern.

With a bit of help from the US inflation report (lower than expected CPI), AUD/USD may find the catalyst to really test and possibly break through these levels of resistance. Support remains at 0.6580.

AUD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

Recommended by Richard Snow

Traits of Successful Traders

Interest rates in Australia are expected to remain on hold for the year due to stubborn inflation concerns. This may help buoy the currency in the absence of a negative shift in global risk sentiment.

Implied Interest Rate Hikes via Interest Rate Markets

Source: Refinitiv, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS