Wall Street posted modest declines overnight (DJIA -0.38%; S&P 500 -0.20%; Nasdaq -0.18%), following its return from the holiday break. Late last

Wall Street posted modest declines overnight (DJIA -0.38%; S&P 500 -0.20%; Nasdaq -0.18%), following its return from the holiday break. Late last week, the Fear and Greed Index has reverted back to ‘extreme greed’ territory, which may point to near-term overextended price levels. That said, seasonality over the past 20 years remains in favour for a continuation of the upward trend, with the month of July delivering the second-highest average return and positive frequency across other months.

The Fed minutes came with not too much of a surprise, largely serving as a reinforcement for the Fed’s hawkish stance, which were presented in the series of Fedspeak beforehand. The additional colour is that ‘almost all’ Fed officials indicated that further tightening is likely, but settled at a pause at the previous meeting to buy time in assessing the lagged impact of current policies.

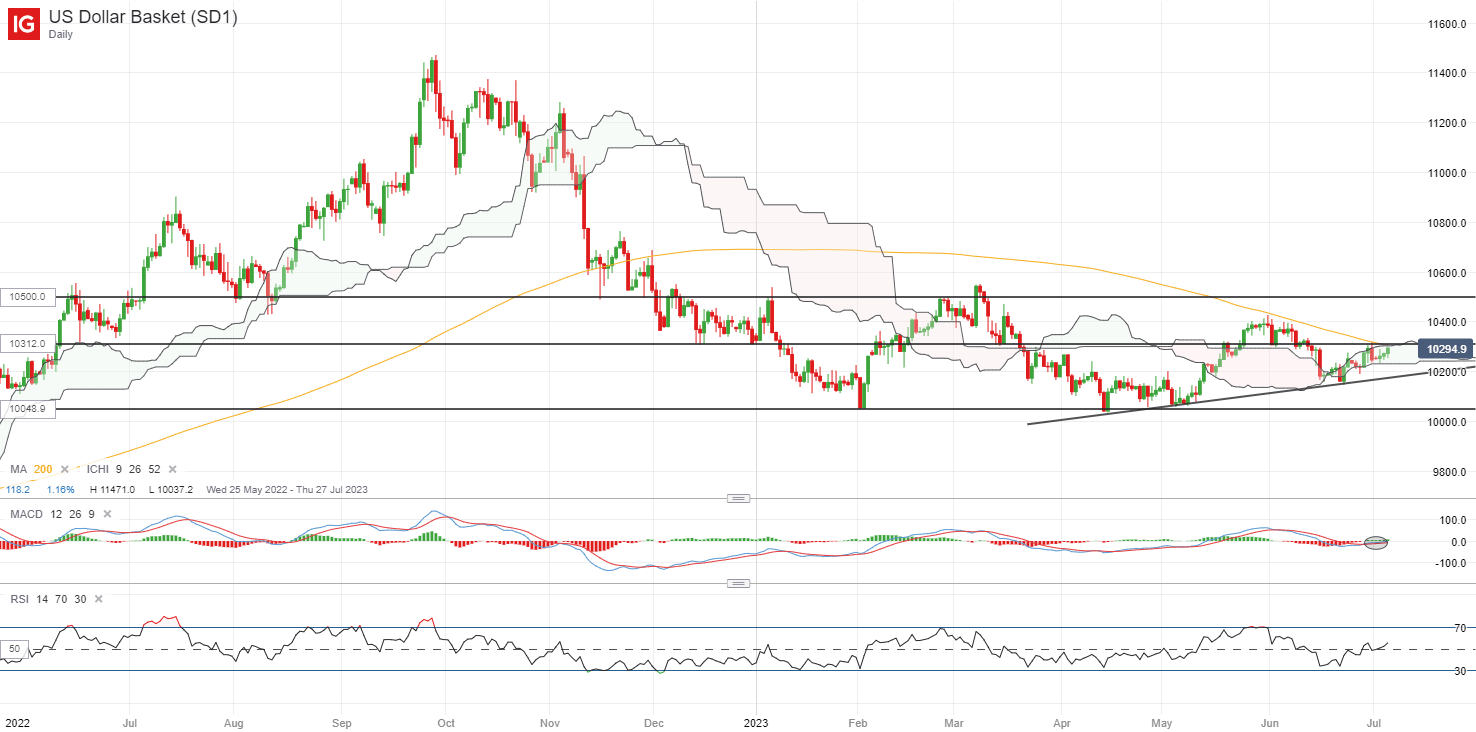

Rate expectations remain largely unswayed by the Fed minutes, with a continued lean towards an additional 25 basis-point rate hike after July to conclude the Fed’s hiking process. Nevertheless, US Treasury yields found their way higher, with the 10-year yields surging to a new three-month high. The US dollar received an uplift (+0.2%) overnight as well, seemingly headed back to retest the key 103.12 level of resistance once more. The formation of higher highs and higher lows since mid-June reflects buyers attempting to take back some control, while the RSI has defended its key 50 level thus far. Further upmove above the 103.12 level could place a retest of its May 2023 high in sight.

Source: IG charts

Ahead, the US ISM services PMI will be on the radar, which is expected to show a slight uptick to 51.0 following the surprise underperformance in May. With the Fed having their eyes on the core services ex-shelter prices, further signs of progress in the services sector’s prices data will provide more conviction for an impending rate pause. The lead-up to the US non-farm payroll report this week will also leave US job openings data in focus today, along with the initial jobless claims and ADP report. Any resilience on that front could point to strength in the US labour market which supports soft-landing hopes, but much will still revolve around a continued moderation in wage pressures, which will only be presented in the US non-farm report tomorrow.

Asia Open

Asian stocks look set for a negative open, with Nikkei -0.94%, ASX -0.63% and KOSPI -0.58% at the time of writing. Despite the stellar record of outperformance in the China’s Caixin services PMI since the start of the year (outperform 5 out of 6 occasions), the latest data has disappointed with a lower-than-expected read (53.9 versus 56.2 forecast). That joined the list of economic data pointing to a more lacklustre growth picture in the world’s second largest economy, which suggests more to be done in the second half of the year. The relatively quiet economic calendar in the region will leave Australia’s trade balance in focus ahead.

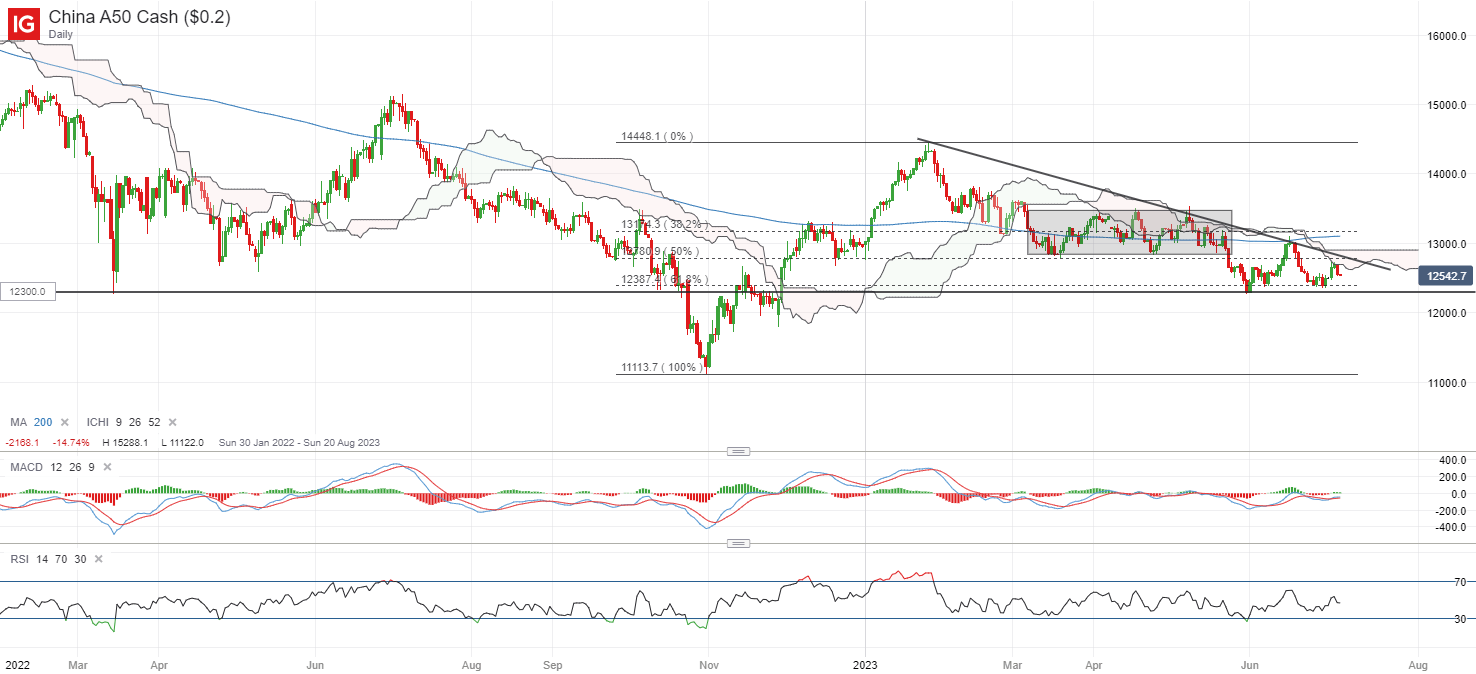

The China A50 index continues to show a downward trend in place thus far, trading on a series of lower highs and lows since the start of the year. On the upside, a downward trendline and Ichimoku cloud resistance seems to be in the way, with the RSI still hovering below the key 50 level. Further downside may leave the 12,300 level on watch as near-term support, with any failure to hold the level potentially paving the way towards the 11,700 level next.

Source: IG charts

On the watchlist: Gold prices continue to show signs of exhaustion

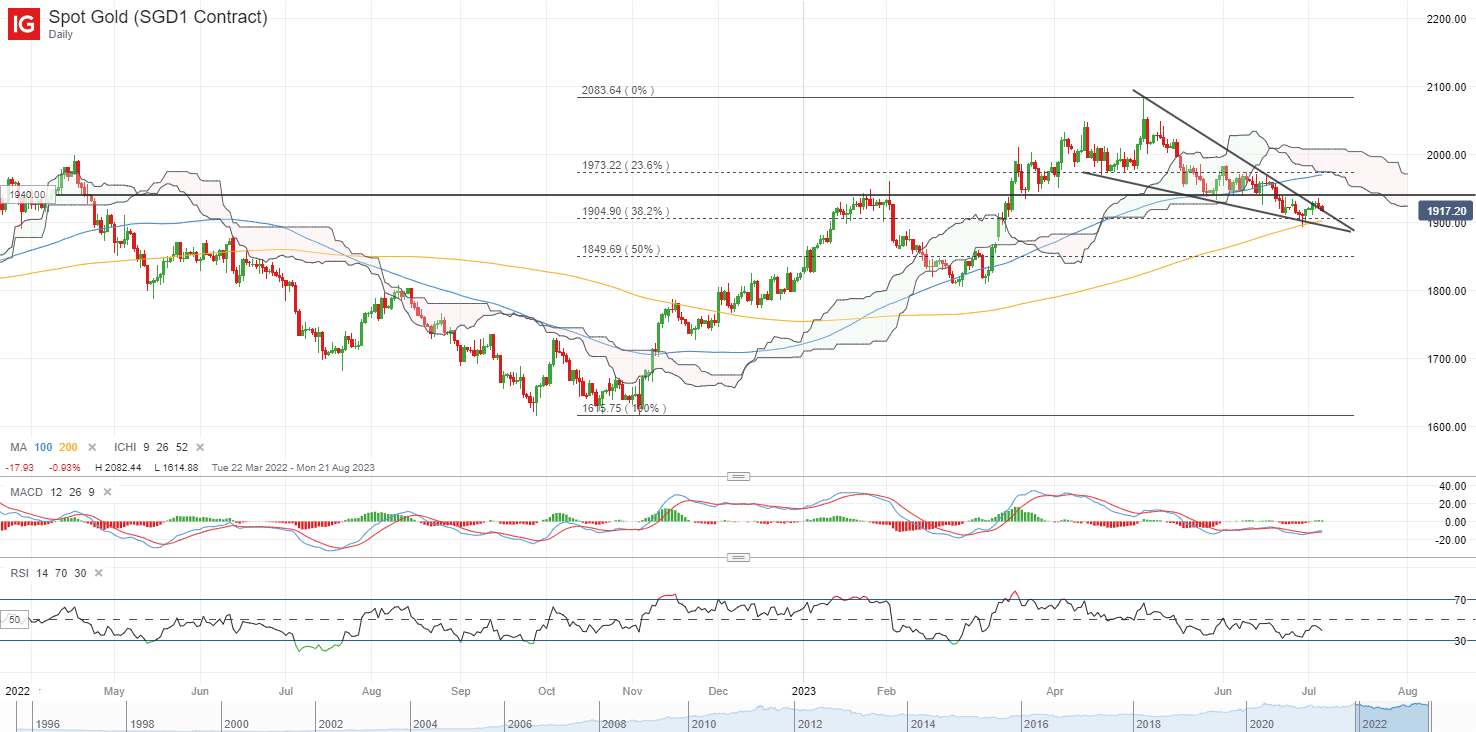

An upmove in US Treasury yields and a stronger US dollar has not been well-received by gold prices overnight, which failed to find much conviction for a move back above the US$1,940 level. Thus far, abating recession concerns have curtailed safe-haven flows, while rate expectations continue to price for rate cuts only in 2024, with the pushback in rate-cuts timeline compared to the start of the year driving some unwinding in gold from previous bullish build-up.

On the technical front, its RSI continues to hover below the key 50 level as a reflection of sellers in control, reinforced by a breakdown of previous key support confluence at the US$1,940. Further downside may leave the US$1,900 level on watch, where previous dip-buying drove the formation of a bullish pin bar last week on the daily chart. Failure to hold this level could pave the way to retest the US$1,850 level next.

Source: IG charts

Wednesday: DJIA -0.38%; S&P 500 -0.20%; Nasdaq -0.18%, DAX -0.63%, FTSE -1.03%

Article written by IG Strategist Jun Rong Yeap

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com