MATIC worth is consolidating inside a symmetrical triangle sample awaiting a breakout. A decisive shut above both of the development strains lead

- MATIC worth is consolidating inside a symmetrical triangle sample awaiting a breakout.

- A decisive shut above both of the development strains leads to a 40% transfer.

- Transactional information reveals stacked obstacles that would deter Polygon’s upswing.

The MATIC worth is in a consolidation sample with no inherent bias. Therefore a breakout from this part might push the token’s worth in both path.

MATIC worth awaits a breakout

The MATIC worth slid into consolidation, creating decrease highs and better lows as a result of aggressive but diminishing stress from each consumers and sellers. By connecting the swing highs and lows utilizing development strains, a symmetrical triangle sample types.

This technical formation forecasts a 40% breakout, which is the space between the swing excessive and low created on March 11 and 12.

Since this setup has no bias, a decisive shut above $0.38 will lead to a 40% bull run to $0.54. However, a breakdown of the decrease development line at $0.31 will kickstart a downward development to $0.19.

An elevated vendor exercise on the present worth will rapidly push Polygon towards the decrease development line. Nonetheless, a breakout right here will spell hassle for the MATIC worth. A 13% drop to the speedy demand barrier at $0.27 coinciding with the 200 SMA on the 6-hour chart appears probably.

If this degree is pierced by overwhelming promoting stress, Polygon might certainly slide 30% to faucet the supposed goal at $0.19.

MATIC/USD 6-hour chart

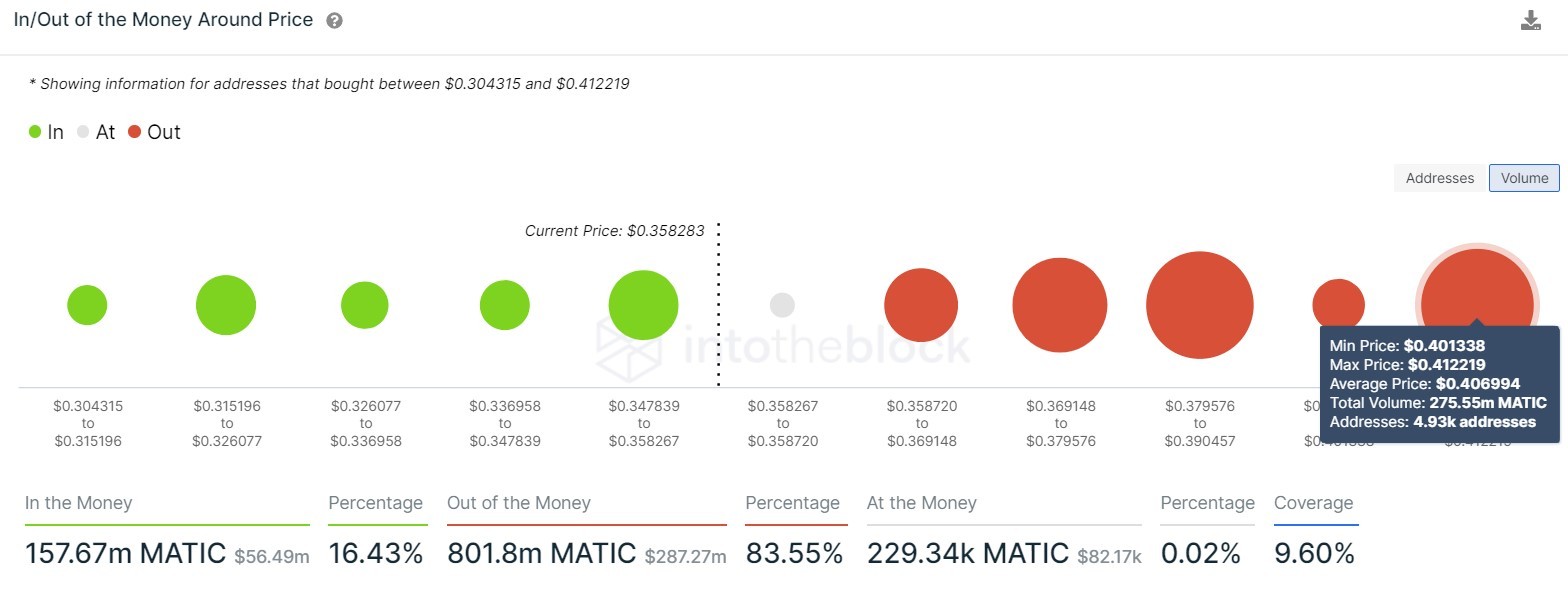

Including credence to the bearish outlook is a slew of underwater traders, as seen in IntoTheBlock’s In/Out of the Cash Round Value (IOMAP) mannequin. IOMAP reveals that 13,200 addresses that maintain almost 800 million MATIC tokens are “Out of the Cash” and would possibly break even, dampening the bullish momentum.

MATIC IOMAP chart

Moreover, the variety of whales holding between 100,000 to 1,000,000 MATIC tokens has decreased by 8.5%, from 979 to 118. Following the same development are the traders that maintain 1,000,000 to 10,000,000 MATIC tokens. These market individuals have minimize down their publicity to MATIC tokens by 13.5% since March 11.

Such a drastic discount means that the whales aren’t optimistic concerning the MATIC worth’s bullish potential.

%20%5B08.11.40,%2004%20Apr,%202021%5D-637531009103662580.png)

MATIC whale holder distribution chart

Whereas the downward breakout appears set in stone, it could possibly be altered by a powerful surge in consumers or new capital flowing into the MATIC markets. If this momentum manages to push the value previous the $0.40 provide barrier and create the next excessive round $0.45, it’s going to invalidate the bearish outlook.

In actual fact, such a transfer would possibly catalyze a run-up to $0.54.