For nearly a year, there have been numerous predictions and scenarios suggesting a potential recession in the US economy in 2023. Some of the reasons

For nearly a year, there have been numerous predictions and scenarios suggesting a potential recession in the US economy in 2023. Some of the reasons cited for these predictions include the FED’s fast interest rate hikes which have taken rates to 5.25%, which has had a negative impact on residential housing, leading to a recession in this sector. Additionally, manufacturing is still going through a contraction, auto sales stagnated, and market-based indicators also pointed toward a possible recession.

One significant indicator was the deep inversion of the yield curve, which has historically preceded a recession every time since 1968. It’s worth noting that we are still within the typical 6 to 15-month window following such an inversion when a recession might occur.

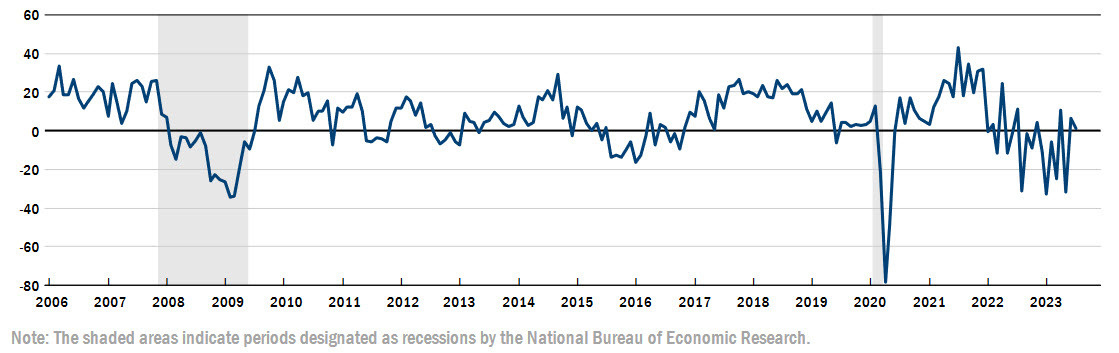

This might look somewhat unexpected given the circumstances, but despite these signs, the US economy seems to be showing signs of strength rather than weakness, and despite the strong decline in the USD after the soft inflation numbers, the reports were positive for the economy overall, since it means that consumers will spend more and other sectors will recover as well. This indicates that the situation remains uncertain, and various economic factors must be closely monitored to accurately assess the potential risks. Today’s New York Empire Manufacturing Index remained positive despite a cool off, while expectations were for a contraction in activity.

Empire FED July Manufacturing Index

- July manufacturing index +1.1 points vs -4.3 expected

- June manufacturing index was +6.6 points

Details

- New orders +3.3 points versus +3.1 last month

- Shipments +13.4 points versus +22.0 last month

- Prices paid +16.7 points versus +22.0 last month

- Employment +4.7 points versus -3.6 last month

- Prices received +3.9 points versus +9.0 last month

- Inventories -4.9 points versus -6.0 last month

- Six month outlook +14.3 points vs +18.9 last month

This is a good report, with a slight beat on the headline and a continued fall in the prices paid component. The index for future business conditions edged down to 14.3, indicating that while conditions are expected to improve, optimism remained subdued.

EUR/USD Live Chart

EUR/USD

www.fxleaders.com