Here's what it is advisable to know on Wednesday, July 15: The market temper is upbeat after Moderna reported progress in gro

Here’s what it is advisable to know on Wednesday, July 15:

The market temper is upbeat after Moderna reported progress in growing a vaccine for coronavirus. Considerations concerning the unfold of the illness in America, the Financial institution of Canada’s resolution, and tensions round Hong Kong are eyed.

Moderna occasions: A vaccine candidate by Moderna has seen promising outcomes, with excessive ranges of antibodies and no vital secondary results in sufferers. The publication of progress within the New England Journal of Drugs boosted shares worldwide and weighed on the safe-haven US greenback.

US President Donald Trump has ordered an finish Hong Kong’s particular standing in retaliation to China’s new safety regulation in opposition to the territory. Beijing vowed to hit again with sanctions of its personal. The UK will part out the utilization of Huawei expertise.

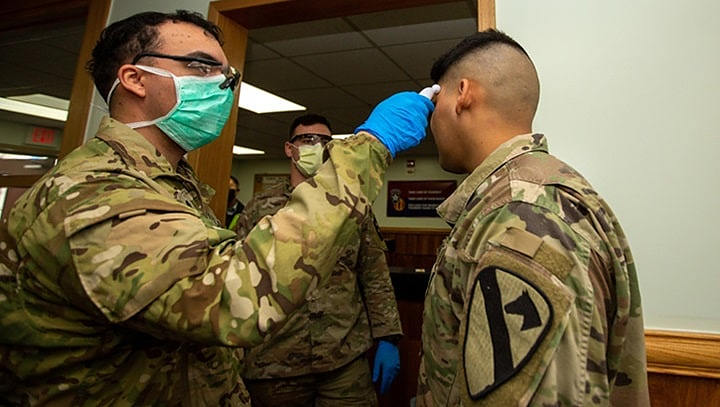

Coronavirus instances have surpassed 3.four million within the US and deaths surpassed 136,000. California, which introduced a sweeping shutdown, has seen a file variety of instances, and so has Texas, which has solely taken small measures. Figures from these states and Florida are eyed.

The Financial institution of Japan left its coverage unchanged, as anticipated. Governor Haruhiko Kuroda and his colleagues reiterated their dedication to behave with out hesitation. The financial institution continues aiming for having 10-year bond yields at round 0%. The Tokyo coronavirus panel raised the an infection alert price to three, the best degree.

The Financial institution of Canada is ready to depart the rate of interest unchanged at 0.25%. Tiff Macklem, the brand new governor, is ready to keep up his cautious tone.

See Financial institution of Canada Preview: Knowledge confirms a backside, policymakers to stay cautious

US industrial output and the Empire State Manufacturing Index are of curiosity after inflation figures for June beat expectations. Traders are awaiting Thursday’s all-important Retail Gross sales launch for June.

EUR/USD is buying and selling on excessive floor round 1.14 as German Chancellor Angela Merkel and Spanish Prime Minister Pedro Sánchez dedicated to shifting ahead with the EU Fund. A full summit begins on Friday. The stress to log off the accord can also be coming from the European Central Financial institution.

See ECB Preview: EUR/USD is dependent upon Lagarde’s fearless nudging of the Frugal 4

GBP/USD is buying and selling just under 1.26 because the gradual reopening of the financial system continues. Gross Home Product development disillusioned with only one.8% in Might, a sluggish bounce from the downfall in March and April. Client Worth Index statistics for June are set to indicate stability.

AUD/USD is flirting with the 0.70 degree forward of the discharge of Australian job figures for June and China’s GDP for the second quarter. Melbourne stays below lockdown. NZD/USD is buying and selling round 0.6550 forward of New Zealand’s inflation figures.

Gold is buying and selling above $1,800, consolidating earlier good points. WTI Oil is hovering round $40 forward of stock knowledge.

Cryptocurrencies are steady with Bitcoin buying and selling just under $9,300, Ethereum round $250, and XRP slightly below $0.20.