Hamburg, Germany based Retail FX and CFDs brokerage operator NAGA Group AG (ETR:N4G) has released a statement regarding its preliminary

Hamburg, Germany based Retail FX and CFDs brokerage operator NAGA Group AG (ETR:N4G) has released a statement regarding its preliminary 2023 full year results, indicating that the company exceeded expectations following a very strong fourth quarter.

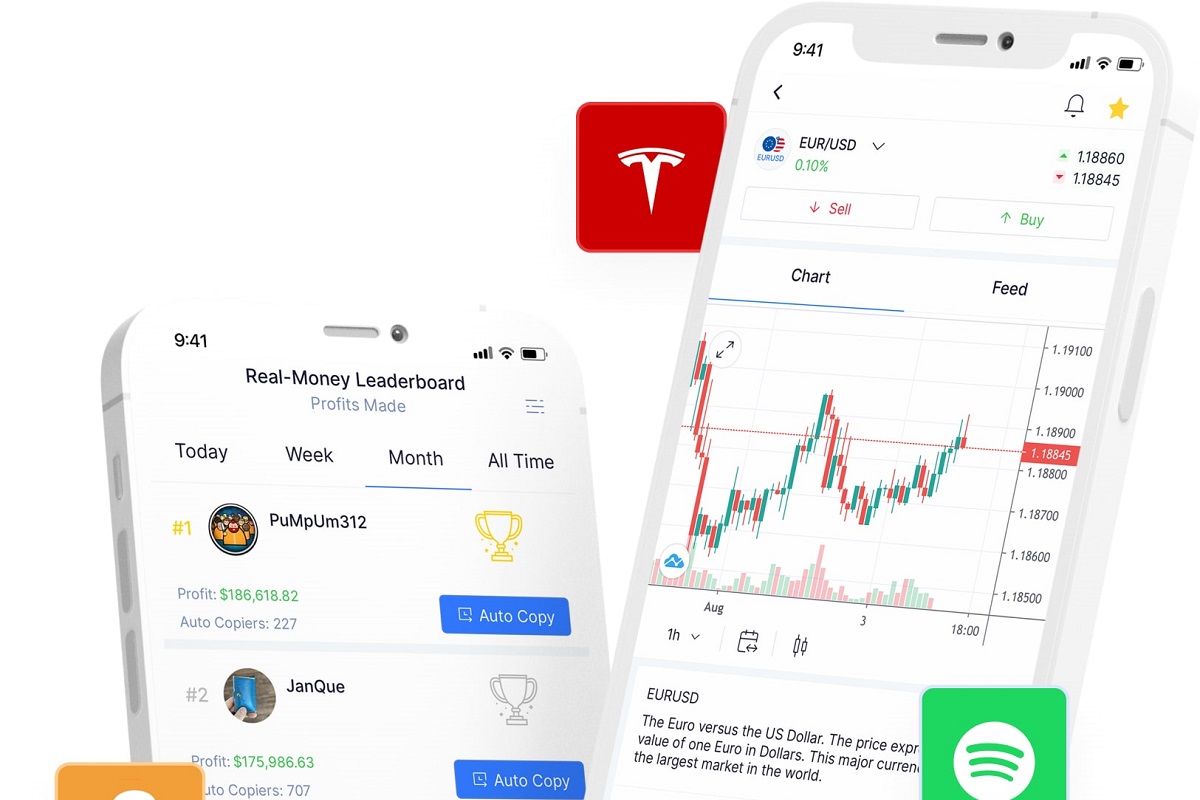

The social trading focused broker, which operates CySEC licensed NAGA Markets (nagamarkets.com) and offshore Seychelles domiciled NAGA Capital (naga.com), said that its Revenues for 2023 came in at €45.5 million, or just under USD $50 million. The group’s EBITDA for the year totaled about €7 million. NAGA noted that both figures were well above analysts’ most recent expectations, which had forecasted average sales of €38.5 million and EBITDA of €5.2 million for 2023.

In 2022 NAGA brought in Revenues of €57.6 million – 21% higher than in 2023 – but out-of-control costs saw the company post a net loss of €37 million for the year in 2022, leading to a series of cost cutting measures (more on that below).

NAGA Group agreed to merge with Capex.com late last year, in a deal that will see Capex.com and its shareholders led by Founder and CEO Octavian Patrascu inject capital and acquire control of 75% of the merged entity. At the time of the announcement the parties already disclosed that NAGA’s Revenues were expected to be $50 million for 2023 (and Capex.com’s $40 million), so the Revenue figure shouldn’t really come as a surprise to the market.

During 2023 NAGA said it saw over 132,000 account openings (FY22: 243,000), and more than 9.2 million trades (FY22: 8.6 million), with 4.8 million being “copy” trades (FY22: 3.5 million). Client trading volume at NAGA totaled €143 billion for 2023 (FY22: €137 billion), or about USD $13 billion monthly. Active users at the end of the year crossed 21,000 (FY 2022: 18,700). As a result, all unique user metrics have shown a strong uptrend with higher average activity, deposit size and lifetime value.

On the cost side, NAGA said it successfully focused on operational and marketing efficiency, and lowered overall expenses significantly. Marketing expenses stood at €5.5 million (FY2022: €28.5 million), leading to the company’s best ever gross Cost Per Acquisition of €447 (FY22: €1510) per new capitalized trading account.

NAGA CEO, Michael Milonas commented:

NAGA CEO, Michael Milonas commented:

“We are delighted that our disciplined approach and continuous efforts to make NAGA profitable yielded such strong results. We have seen an improved quality of customers, a well as improved platform stability and strong user metrics which make us confident for the following months. Especially in the light of our recently announced Merger, NAGA will play a crucial role to deliver strong results in the upcoming year paired with Capex.com fast growing user and revenue base creating a new, exciting equity story for the Group”.

Following the 19th of December 2023 and the announcement of the merger between NAGA and Capex.com as noted above, Octavian Patrascu is expected to take the office of NAGA Group CEO in the coming days following a successful subscription by him of the vast majority of the 8,226,000 convertible notes issued together with the injection of close to USD $9 million into NAGA. Mr. Patrascu will, in the course of the coming weeks, be unveiling his plans for the technology roadmap and the evolution of NAGA.

In addition, NAGA as well as Capex.com also plan to release forecasts and guidance in the upcoming weeks for the financial year 2024 as initial steps for the M&A transaction are underway, although the transaction is still subject to customary closing conditions and regulatory approvals.

fxnewsgroup.com

COMMENTS