NASDAQ 100 & USD/JPY FORECAST:Nasdaq 100 gains and threatens to break above major technical resistance after U.S. inflation data comes on the soft

NASDAQ 100 & USD/JPY FORECAST:

- Nasdaq 100 gains and threatens to break above major technical resistance after U.S. inflation data comes on the soft side

- USD/JPY takes a turn to the downside amid lower U.S. Treasury yields following an encouraging U.S. CPI report

- This article looks at key price levels to watch on the Nasdaq 100 and on the USD/JPY‘s technical charts

Recommended by Diego Colman

Get Your Free Equities Forecast

Most Read: AUD/USD Trapped in Lateral Channel, US CPI Could Spark Volatility Later this Week

The Nasdaq 100 rallied on Wednesday, supported by falling U.S. Treasury yields following lower-than-anticipated U.S. inflation data. By way of context, April headline CPI clocked in at 4.9% y-o-y, versus 5.0% expected, hitting a two-year low and offering comfort that the trend is lower.

The slowdown in price pressures could give the Fed cover to officially pause its hiking cycle at its June meeting, in line with what it signaled earlier this month. While this scenario could favor risk assets, the broader economic outlook will have to cooperate, otherwise, stocks will remain on shaky footing.

For the equity market to perform well in the coming months, the economy has to be healthy: only then can corporate earnings grow across sectors and industries in a significant way. If a recession looms on the horizon, it would be quite difficult for stocks to stay buoyant.

Source: TradingEconomics

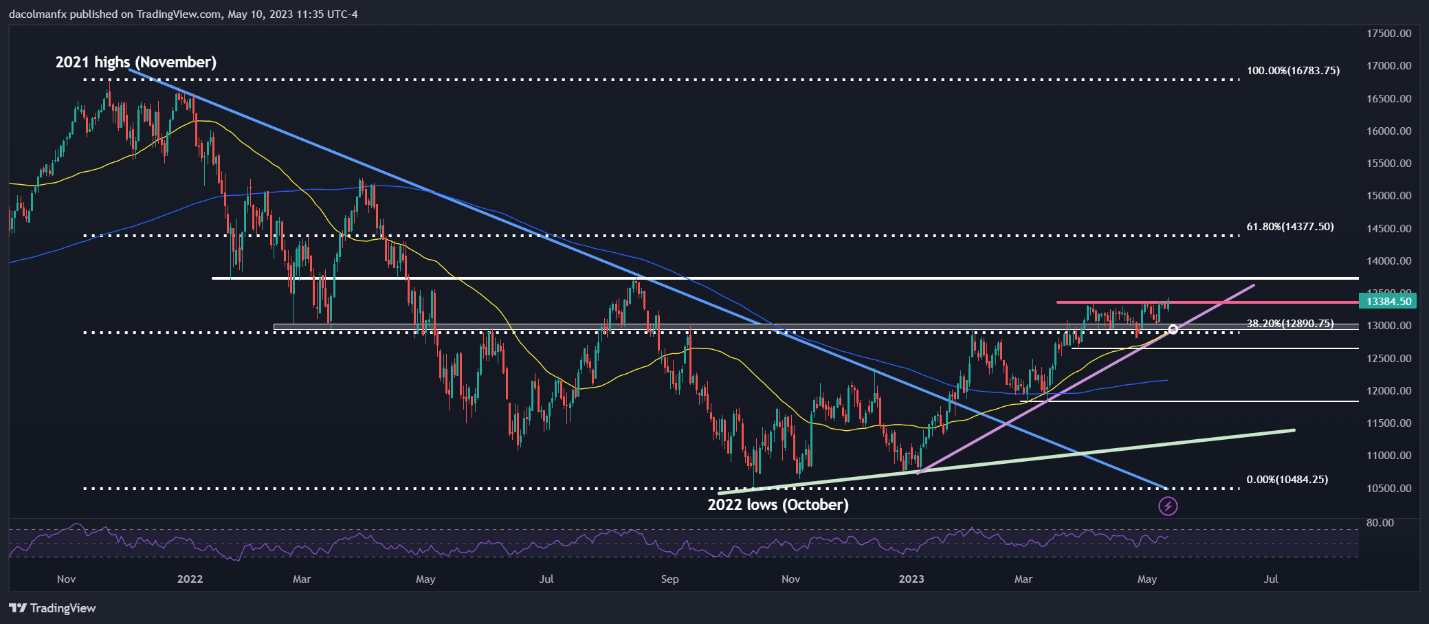

In terms of technical analysis, the Nasdaq 100 is testing major technical resistance near 13,350 at the time of writing. The tech index pushed above this barrier earlier today, but bulls were unable to sustain the upward run, with prices returning below this threshold in afternoon trading.

For positive impetus to gather pace, a clean and decisive break above 13,350 is needed. If buyers manage to achieve this feat, the Nasdaq 100 could soon reclaim the 13,740 level. Conversely, if prices get rejected from resistance, bears could regain the upper hand, setting the stage for a pullback toward 13,000.

Recommended by Diego Colman

Improve your trading with IG Client Sentiment Data

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Chart Prepared Using TradingView

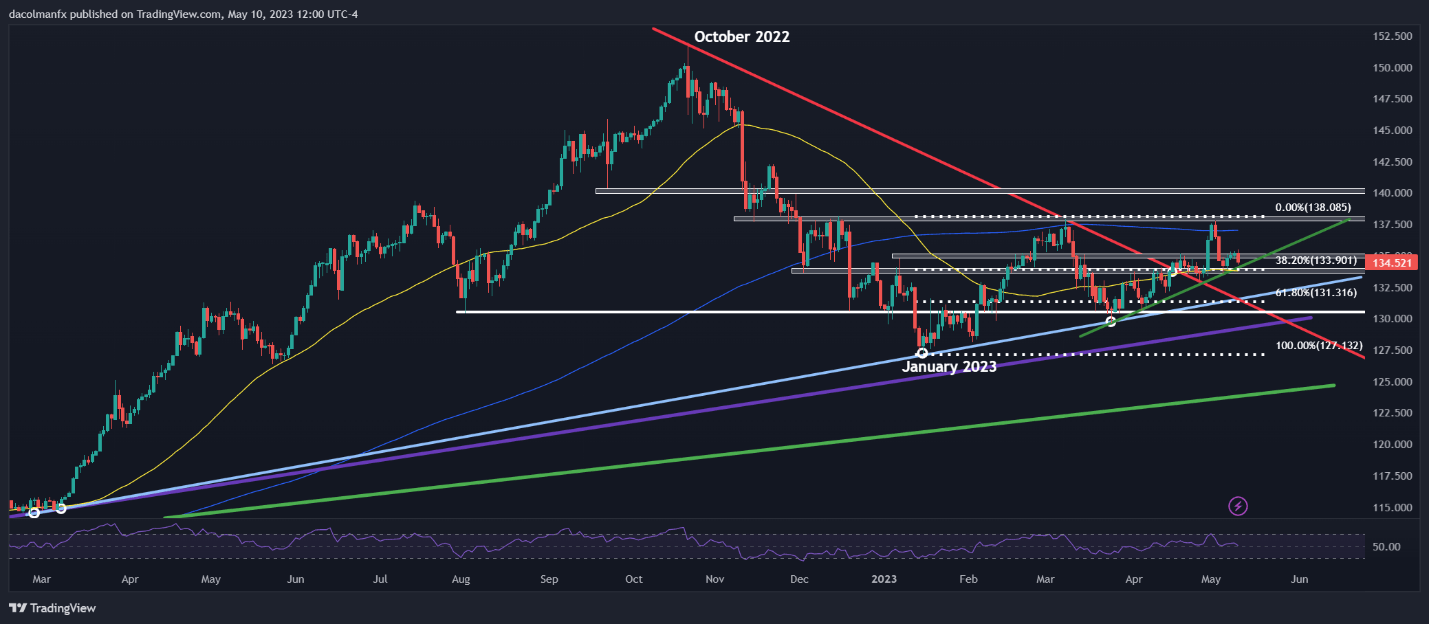

Elsewhere, USD/JPY was sharply lower on Wednesday, down about 0.5% to 134.52 in early afternoon trading, pressured by the broad-based retrenchment in U.S. Treasury rates in the aftermath of the encouraging U.S. inflation report from last month.

With U.S. consumer prices failing to surprise to the upside and on a steady downward path, markets could soon move to discount more aggressive monetary policy easing for the forecast horizon, especially if the U.S. economic outlook worsens, reinforcing the drop in bond yields. This could be positive for the rate-sensitive Japanese yen.

From a technical perspective, after Wednesday’s slide, USD/JPY is hovering slightly above cluster support at 133.85/133.75, where the 50-day simple moving average aligns with a short-term rising trendline and the 38.2% Fib retracement of the January/March rally. If the bulls fail to fend off the attack and this floor caves in, we could see a move toward 131.55 in short order.

On the flip side, if buyers manage to repel sellers from current levels and spark a bullish turnaround, initial resistance appears at 135.25, followed by 137.00 – near the 200-day simple moving average.

| Change in | Longs | Shorts | OI |

| Daily | -3% | -2% | -2% |

| Weekly | 20% | -10% | 1% |

USD/JPY TECHNICAL CHART

USD/JPY Chart Prepared Using TradingView

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com