The NASDAQ Composite Index is main the equities cost at this time, posting an almost 2% intrasession acquire. On the halfway level of the session,

The NASDAQ Composite Index is main the equities cost at this time, posting an almost 2% intrasession acquire. On the halfway level of the session, the DJIA DOW (+85), S&P 500 SPX (+30), and NASDAQ (+205) are all within the inexperienced. Regardless of a contested election and a file stage of COVID-19 U.S. hospitalizations, buyers proceed piling into American equities.

Yesterday night, stories started surfacing that COVID-19 infections are dramatically surging in the US. On Tuesday, the U.S. surpassed 1 million new confirmed circumstances for November. Additionally, 61,964 individuals are mentioned to be hospitalized on account of the virus. Each are file highs for the contagion, which first surfaced in late-February.

In the present day marks the observance of Veteran’s Day in the US. Other than this morning’s MBA Mortgage Functions (Nov. 6) launch, the financial calendar is vacant. MBA Mortgage Functions got here in at -0.5%, down from 3.8%. Given the season and election uncertainty, this detrimental determine ought to come as little shock.

On the NASDAQ, it’s all techniques go for Veteran’s Day. Values are up, and that’s excellent news for tech bulls.

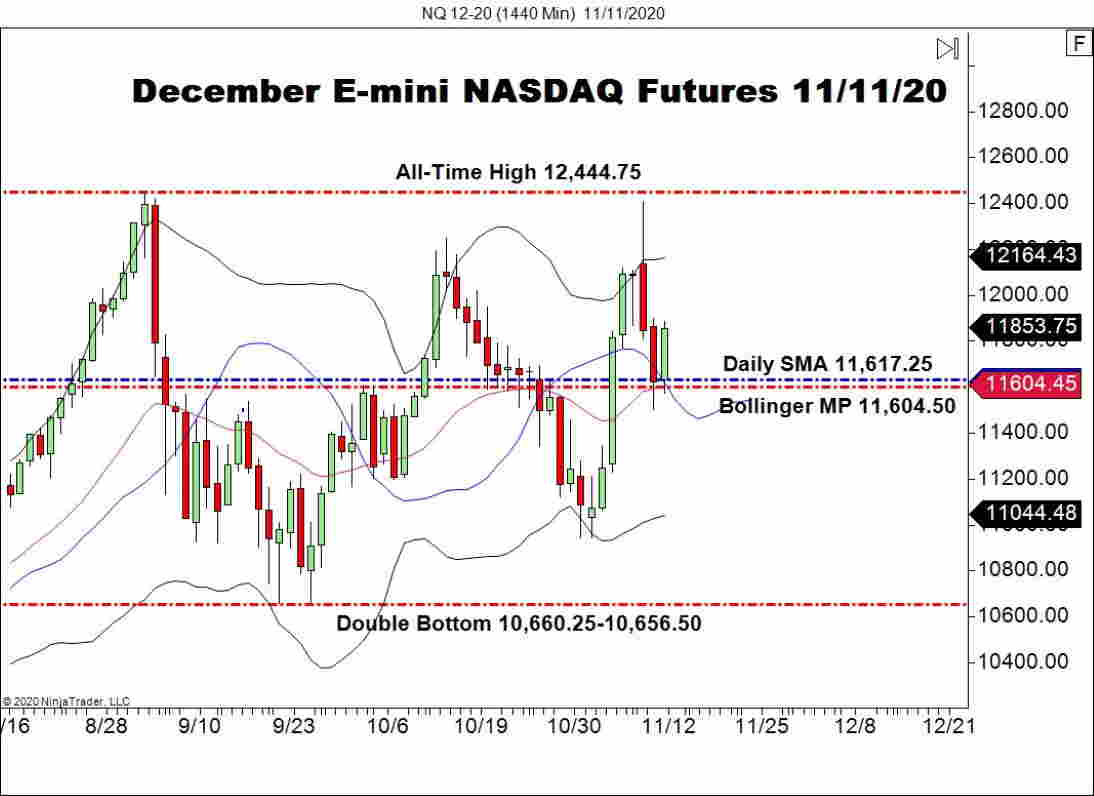

December E-mini NASDAQ Futures On The Bull

All through 2020, the NASDAQ has carried out nicely whereas the opposite indices lagged. Now, it’s large tech and progress corporations making an attempt to snap a brief shedding streak.

++11_11_2020.jpg)

Overview: Regardless of the COVID-19 spike and reasonable election uncertainty, equities proceed to grind larger. For the December E-mini NASDAQ, it appears like discount hunters have as soon as once more stepped in. At press time, final week’s uptrend stays intact, with values very close to the 12,000 deal with. Barring a significant shock shaking the foundations of this market, a bullish bias shall be warranted for the close to future.