The just lately gazetted Statutory Instrument (SI) 127 of 2021 has been met with fierce criticism from numerous quarters and it has resulted in

The just lately gazetted Statutory Instrument (SI) 127 of 2021 has been met with fierce criticism from numerous quarters and it has resulted in a sudden hike in USD costs of products and providers.

College of Kent regulation lecturer Alex Magaisa mentioned the regulation will result in the growth of the overseas foreign money black market. Magaisa posted on his Fb web page:

SI 127 of 2021: Rule by the hammer – it doesn’t work

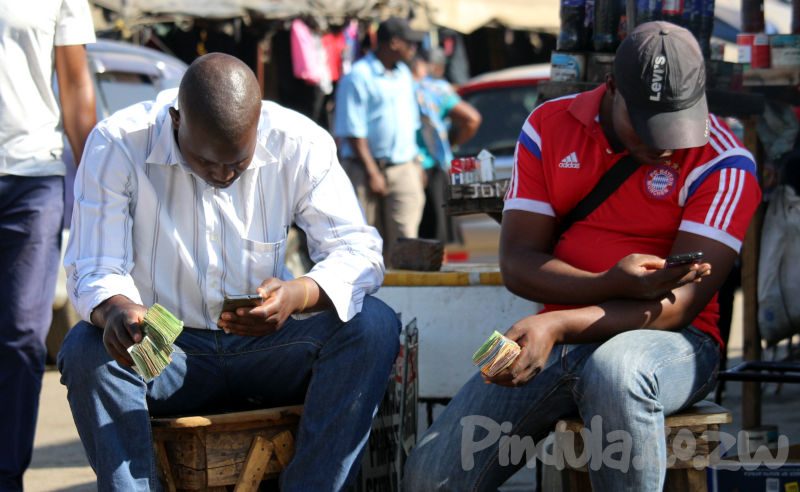

1. One basic rule that I’ve learnt purely by expertise as a Zimbabwean is that there’s a optimistic correlation between extra decrees to manage the overseas foreign money (foreign exchange) market and the growth of the parallel (black) market in foreign exchange, items and providers.

2. In different phrases, the extra the federal government tries to command & management the formal market by decree, the extra the casual/parallel market grows. That is partly as a result of financial actors search to keep away from the debilitating & punitive influence of the formal market decrees. And once they do the parallel market expands.

3. It additionally grows as a result of formal market controls create alternatives for arbitrage. This occurs as a result of the formal market, entry of which is restricted to some, affords low-cost foreign exchange which might be bought at larger charges both instantly on the foreign exchange parallel market or as items on the market.

4. It’s normally the case that beneficiaries of those low-cost schemes are PEPs (Politically Uncovered Individuals) or enablers to make use of the BSR nomenclature. They merely purchase foreign exchange from the federal government & promote it on the parallel market. It’s a trick that’s been used for many years. The Willowgate Scandal in 1988 was primarily based on the identical ideas.

5. PEPs purchased imported automobiles at low-cost charges from a authorities firm & bought them on the parallel marketplace for enormous income. It’s been occurring at an ideal scale since 2000, resulting in file hyperinflation in 2007-08. The federal government thinks extra controls will resolve it. That is wishful considering.

6. If the federal government have been a physician, its prognosis can be awfully unhealthy. The difficulty lies within the previous legal guidelines of provide & demand. There’s extra demand for foreign exchange which may’t be met by provide. If there have been sufficient foreign exchange provides, there can be no want for these stringent decrees. We do earn foreign exchange however there’s an excessive amount of corruption and leakages. Few people profit however the economic system and most of the people endure.

7. So long as the federal government allocates itself the position of supplying foreign exchange at artificially low charges, there’s all the time a possibility for arbitrage as a result of there’s somebody on the market who wants foreign exchange or items & is ready to pay a better charge for them. The federal government, subsequently, is the provider to the parallel market that it’s purportedly attempting to manage.

8. Authorities is now attempting to direct the market utilizing SI 127 however as all the time occurs, the market will devise methods to dodge these guidelines. The principal dodge brokers are the PEPs. One prediction is that as a result of SI 127 is a tool for value controls, we’ll find yourself with a scarcity of sure items in formal retailers, however an abundance of them on the road however bought at parallel market charges. Simply return to 2007/Eight and bear in mind what occurred.

9. Those that can afford it should hoard items at managed charges and promote them on at parallel market charges on the road. The formal retailers would possibly even direct items to the parallel market. “The road” is each literal & metaphorical. For the reason that managed charge is rigged, authorities has successfully imposed value controls. It by no means ends properly. It all the time ends in tears.