NZD/USD, GBP/NZD, NZD/JPY - Outlook:NZD/USD is holding above key support after RBNZ held rates steady.GBP/NZD has pulled back from stiff resistance;

NZD/USD, GBP/NZD, NZD/JPY – Outlook:

- NZD/USD is holding above key support after RBNZ held rates steady.

- GBP/NZD has pulled back from stiff resistance; NZD/JPY’s range appears to be reinforced.

- What is the outlook and the key levels to watch in NZD/USD, GBP/NZD, and NZD/JPY?

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

The New Zealand dollar appears to be holding above strong support against the US dollar even as the Reserve Bank of New Zealand held interest rates steady at its meeting on Wednesday.

The New Zealand central bank held benchmark rates steady at a 15-year high, in line with expectations, but the accompanying statement was less hawkish than expected. RBNZ said the policy needs to remain restrictive to ensure inflation returns to its 1%-3% target, echoing the global higher-for-longer narrative, but stopped short of suggesting further increases were on the table.

Diverging economic growth and monetary policy outlooks between the US and New Zealand imply that any upside in NZD/USD could be limited. The growth outlook in New Zealand has deteriorated in recent months, compared with a material improvement in US economic growth expectations in recent months. Moreover, the US Federal Reserve has left the door open for one more rate hike before the year-end.

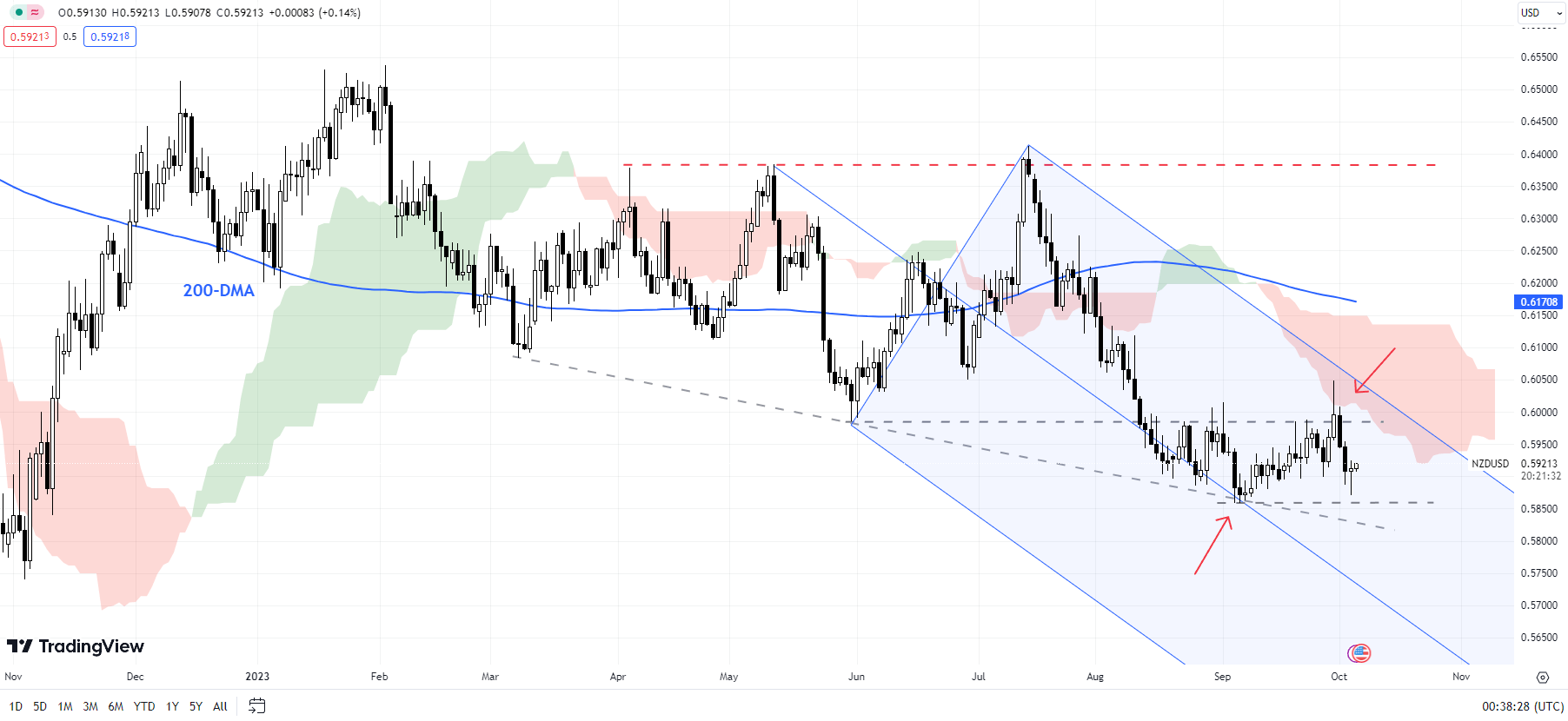

NZD/USD Weekly Chart

Chart Created Using TradingView

NZD/USD: Holding the above channel support

On technical charts, NZD/USD is holding above key converged support, including a downtrend line from March, the median line of a declining pitchfork channel since May, and the September low of 0.5860. In order to confirm that an interim low is in place, NZD/USD needs to break above immediate resistance at 0.6000-0.6050, including the June low and the end-September high. Until then, the path of least resistance could be sideways to down. Any break above could push the pair up toward the 200-day moving average (now at about 0.6170).

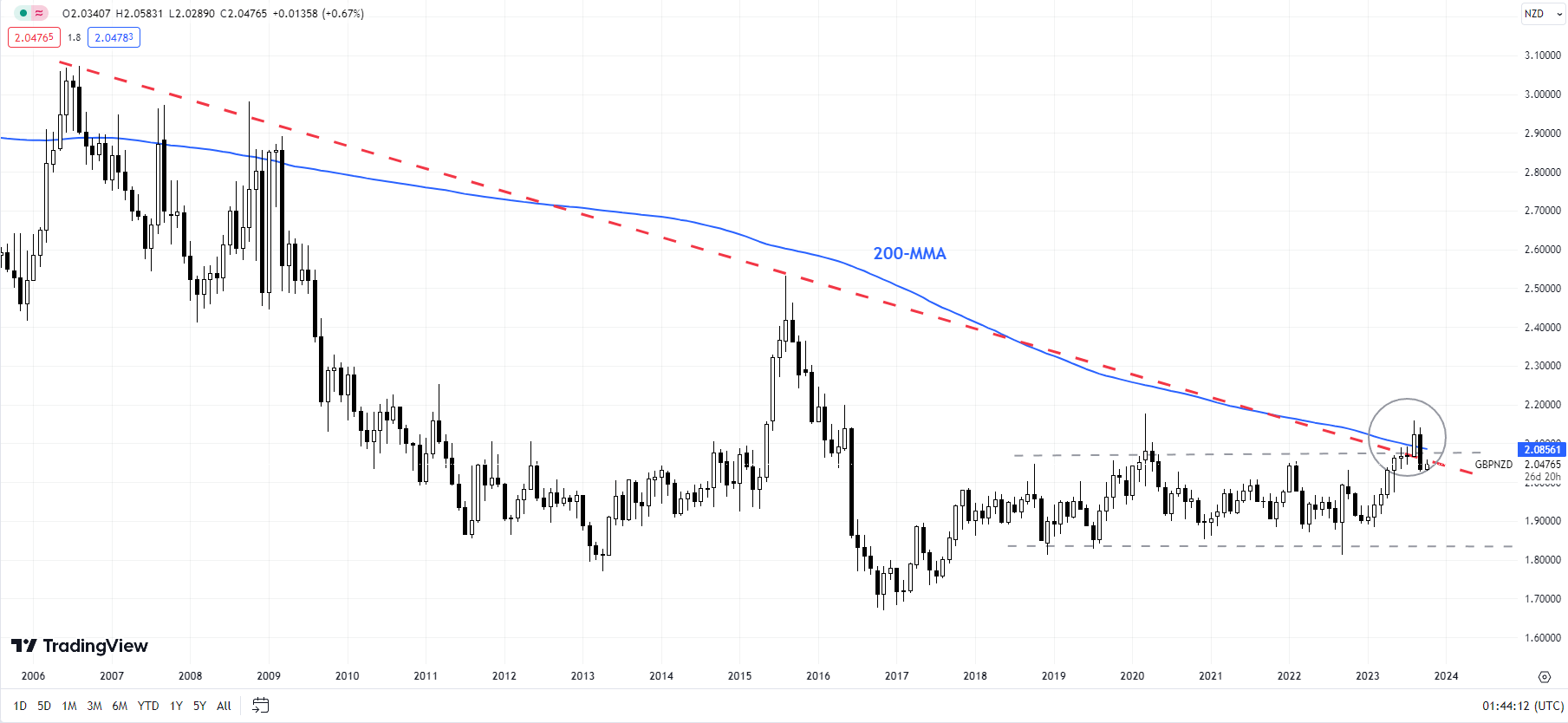

GBP/NZD Monthly Chart

Chart Created Using TradingView

GBP/NZD: Retreats from strong resistance

GBP/NZD has retreated from strong resistance on the 200-month moving average, roughly coinciding with the 2020 high and a downtrend line from 2006. The fall below the Ichimoku cloud on the daily charts is a sign that the upward pressure has faded in the interim. Strong support is on the 200-day moving average (now at about 2.0150).

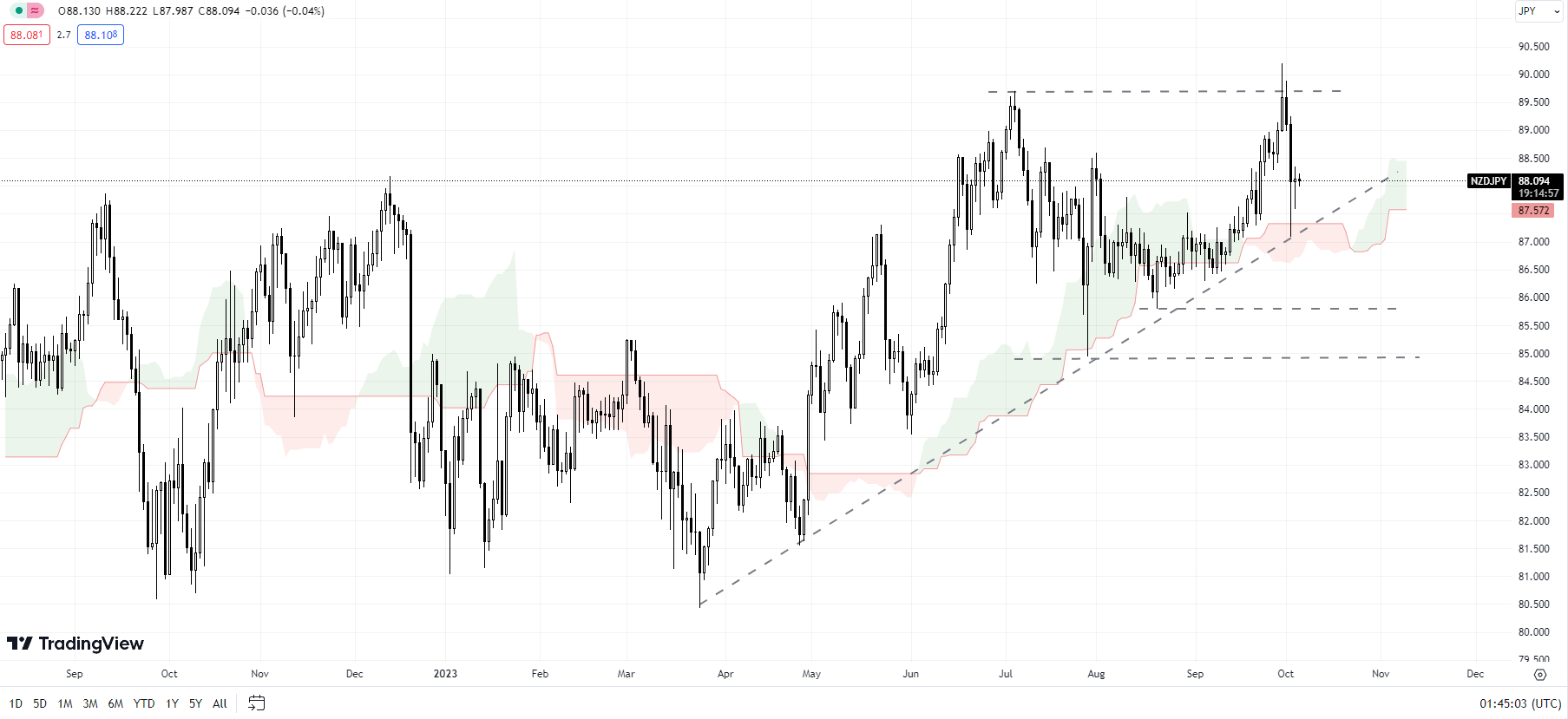

NZD/JPY Daily Chart

Chart Created Using TradingView

NZD/JPY: Range reinforced

The sharp retreat in recent sessions reinforces that NZD/JPY remains within the two-month range of 85.00-90.00. This follows a failure last month to break above the July high of around 90.00. Further downside could be limited to the August low of 85.85, with strong support on the 200-day moving average, near the July low of 85.00.

Recommended by Manish Jaradi

Get Your Free Gold Forecast

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS