New Zealand Dollar, NZD/USD, RBNZ, CPI, Cyclone Gabrielle, NZX50 Index - Talking PointsThe New Zealand Dollar saw a volatility uptick after the RBNZ

New Zealand Dollar, NZD/USD, RBNZ, CPI, Cyclone Gabrielle, NZX50 Index – Talking Points

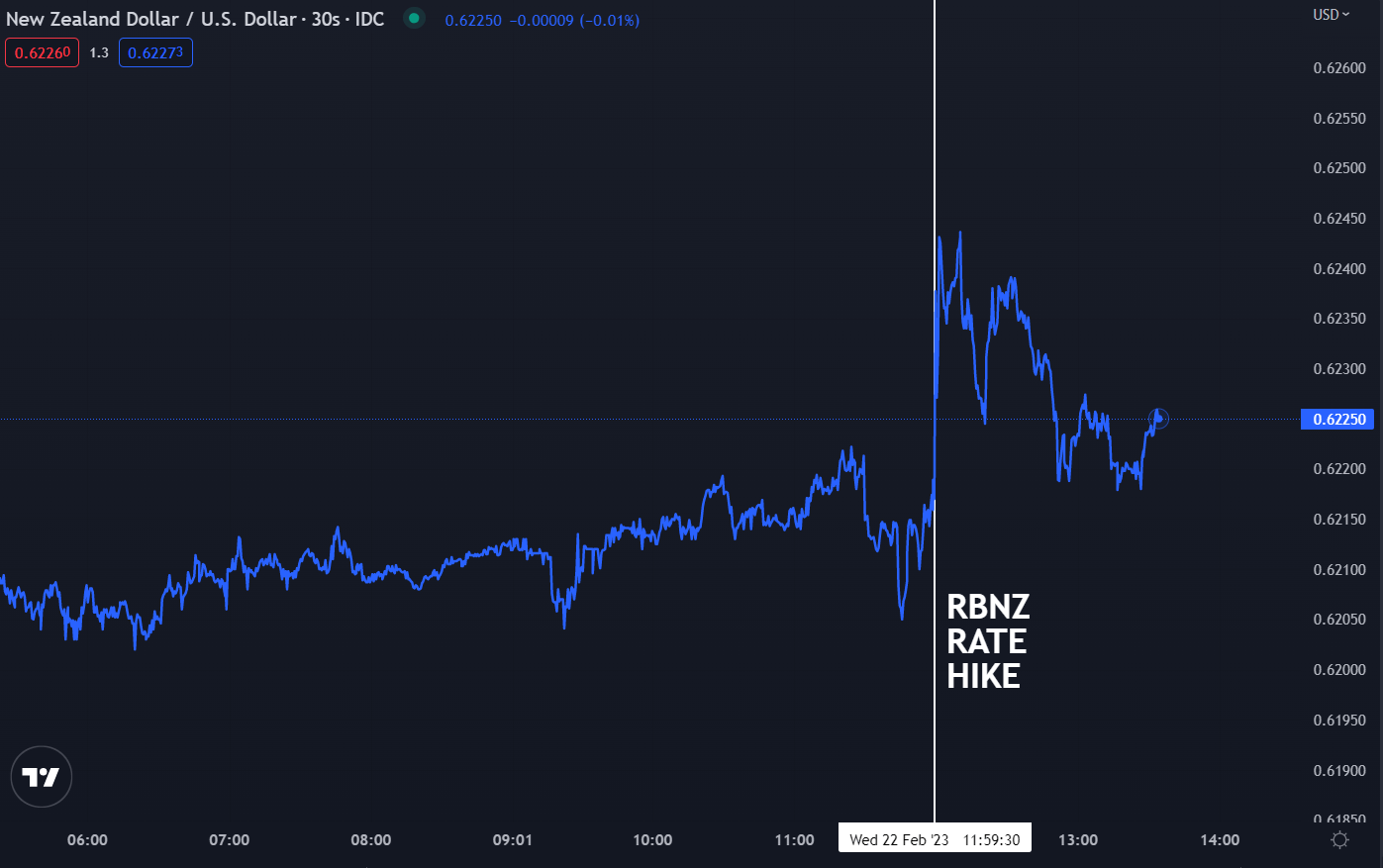

- The New Zealand Dollar saw a volatility uptick after the RBNZ hike

- The 50 basis point lift comes despite local headwinds from brutal storms

- Fighting inflation and a robust economy appears to be the focus for the RBNZ

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The New Zealand Dollar was catapulted higher after the Reserve Bank of New Zealand (RBNZ) raised the official cash rate (OCR) target by 50 basis points (bp) to 4.75% from 4.25%.

The hike was less than the last jumbo lift of 75 bp in November and was mostly anticipated. The overnight index swaps (OIS) market had priced in 45 bp prior to the decision. Most economists surveyed by Bloomberg forecast a 50 bp increase.

The OIS market is pricing a peak in the rates of around 5.40% later this year. The RBNZ see the cash rate topping out at 5.5%. The immediate reaction saw the Kiwi ratchet up from around 0.6410 to over 0.6440

The tightening of monetary policy comes at a time when the aftermath of cyclone Gabrielle that wreaked havoc on the North Island last week is still being assessed.

NZ Prime Minister Chris Hipkins has described the cyclone as the country’s most damaging natural disaster in at least a generation. The cyclone followed a torrential rainstorm around Auckland, the largest city on the island nation.

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

It would seem that the RBNZ is resolute in taming price pressures. NZ Inflation remains stubbornly high at 7.2% year-on-year to the end of the fourth quarter. The bank has an inflation target band of 1-3%.

In the post-decision press conference, the RBNZ Governor Adrian Orr said that the bank see the impact of the severe weather event as adding to inflation. They anticipate that the re-build will add 1% to GDP over the coming years than would otherwise be the case.

He said that a 25, 50 or 75 bp shift up were options that were all on the table, although the discussion was mostly around 50 or 75 bp hike.

A tight labour market is above the RBNZ’s own measure of the maximum sustainable level of employment. The unemployment rate remains near multi-generational lows at 3.4%.

The RBNZ see immigration picking up again and that may alleviate some labour pressures, but that may also add to broad based inflationary pressures.

The RBNZ has been one of the sharper central banks in terms of being the first to cut rates at the start of the pandemic and then among the leaders when it came to hiking to stare down inflation.

New Zealand’s S&P/NZX 50 equity index continued to slide lower on the news following losses seen earlier this week.

The upcoming press conference might provide more clues on the future direction of rates and by extension, NZD/USD.

NZD/USD REACTION TO RBNZ RATE HIKE

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com