NZD/USD, AUD/NZD, EUR/NZD, GBP/NZD - Outlook:NZD/USD could be in the process of setting an interim base.China data released Wednesday beat expectatio

NZD/USD, AUD/NZD, EUR/NZD, GBP/NZD – Outlook:

- NZD/USD could be in the process of setting an interim base.

- China data released Wednesday beat expectations, boosting the risk-sensitive NZD.

- What is the outlook for NZD/USD, EUR/NZD, GBP/NZD, and AUD/NZD?

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

The New Zealand dollar recouped early losses on Wednesday against the US dollar after the Chinese economy grew faster than expected. Industrial output and retail sales also beat expectations, keeping alive hopes that growth in the world’s second-largest economy could be bottoming. For more details, see “Australian Dollar Jumps After China GDP Beat; What’s Next for AUD/USD?” published October 18.

NZD is attempting to regain some of Tuesday’s sharp losses caused after New Zealand inflation moderated more than expected in the third quarter, reducing the need for further imminent tightening. Inflation remains well above the Reserve Bank of New Zealand’s target of 1%-3%, suggesting interest rates could remain higher for longer to ensure inflation returns to the target range. Moreover, escalating tensions in the Middle East have kept risk appetite in check, weighing on the risk-sensitive NZD.

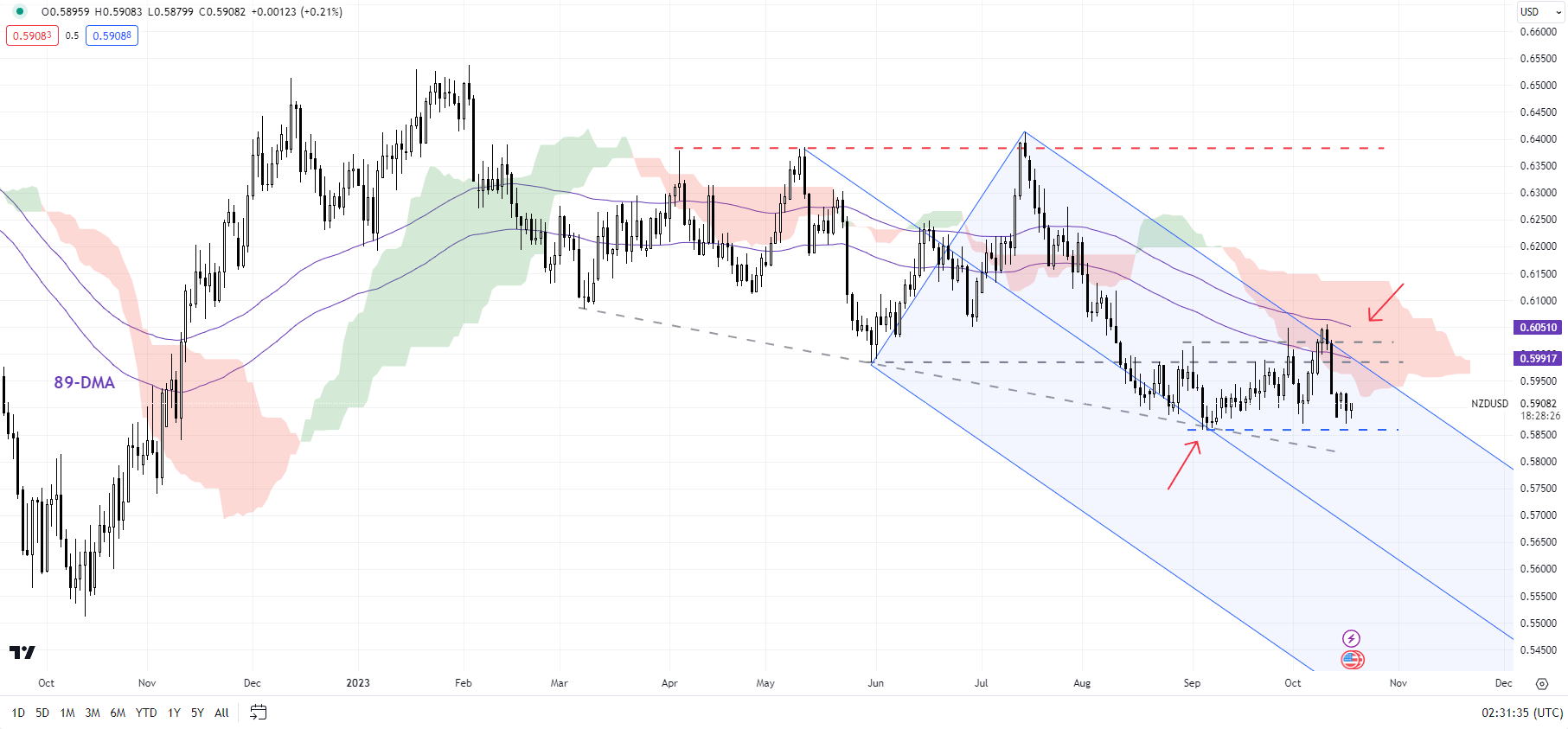

NZD/USD Daily Chart

Chart Created Using TradingView

NZD/USD: Setting a base?

On technical charts, NZD/USD’s hold in recent weeks above the September low of 0.5850 is an encouraging sign for bulls. However, NZD/USD needs to cross above the immediate hurdle at 0.6000-0.6050, including the early-September high and the early-October high, for immediate downside risks to fade. Such a break could pave the way toward the 200-day moving average (now at about 0.6150). On the downside, a crack under 0.5850 could open the door toward the November 2022 low of 0.5750.

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in NZD/USD’s positioning can act as key indicators for upcoming price movements.

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

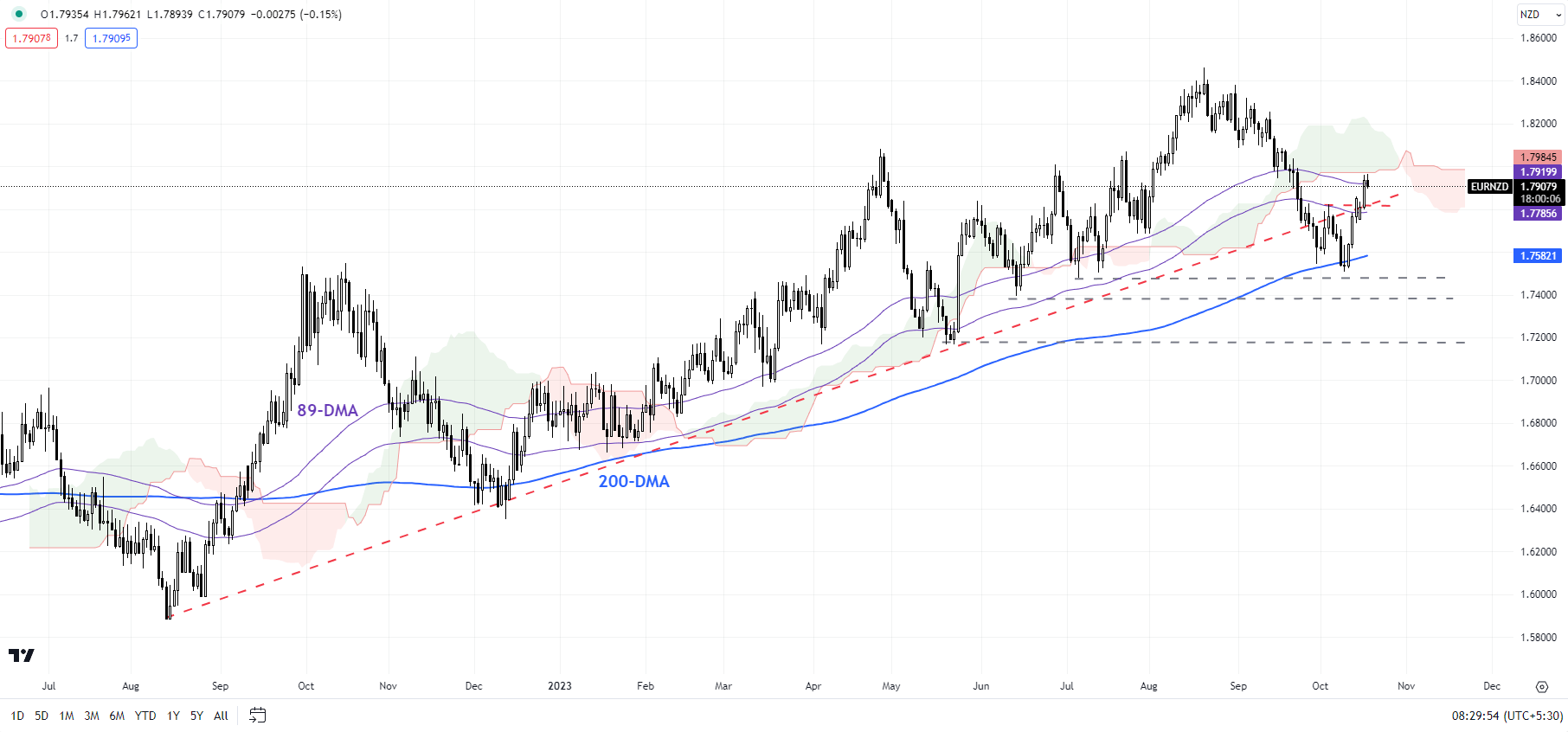

EUR/NZD Daily Chart

Chart Created Using TradingView

EUR/NZD: 200-DMA holds for now

EUR/NZD has rebounded from quite a strong cushion on the 200-day moving average. However, the upside could be capped as it nears a vital ceiling on the 89-day moving average, coinciding with the upper edge of the Ichimoku cloud on the daily charts. EUR/NZD would need to clear the cloud, at minimum, for the immediate downside risks to dissipate. Next support is at the June low of 1.7400 followed by the May low of 1.7150.

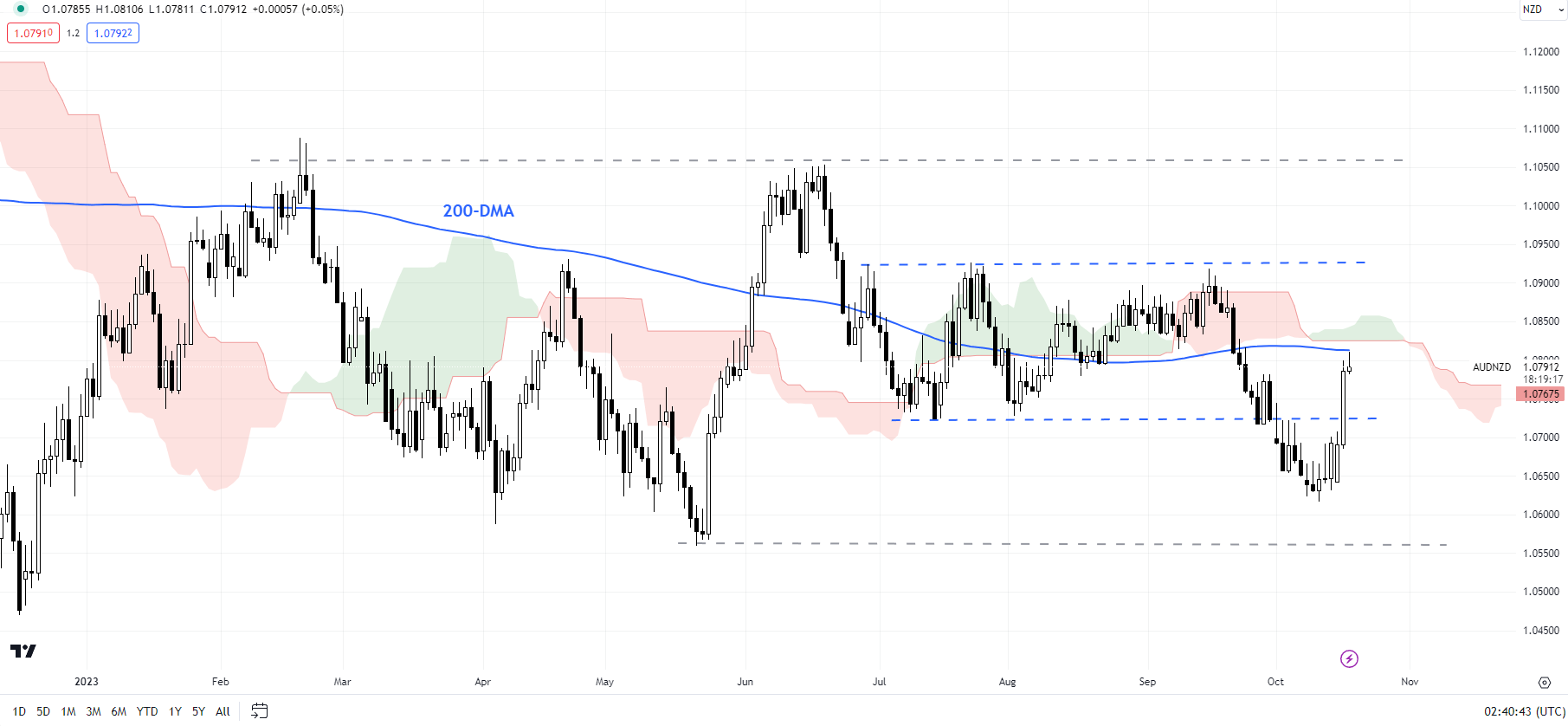

AUD/NZD Daily Chart

Chart Created Using TradingView

AUD/NZD: In search of a clear direction

The failure to hold losses after last month’s break below key support at the July low of 1.0720 confirms that AUD/NZD remains largely directionless. The broader range established is 1.05-1.11. A break above 1.11 or a break below 1.05 is needed for AUD/NZD to start trending again.

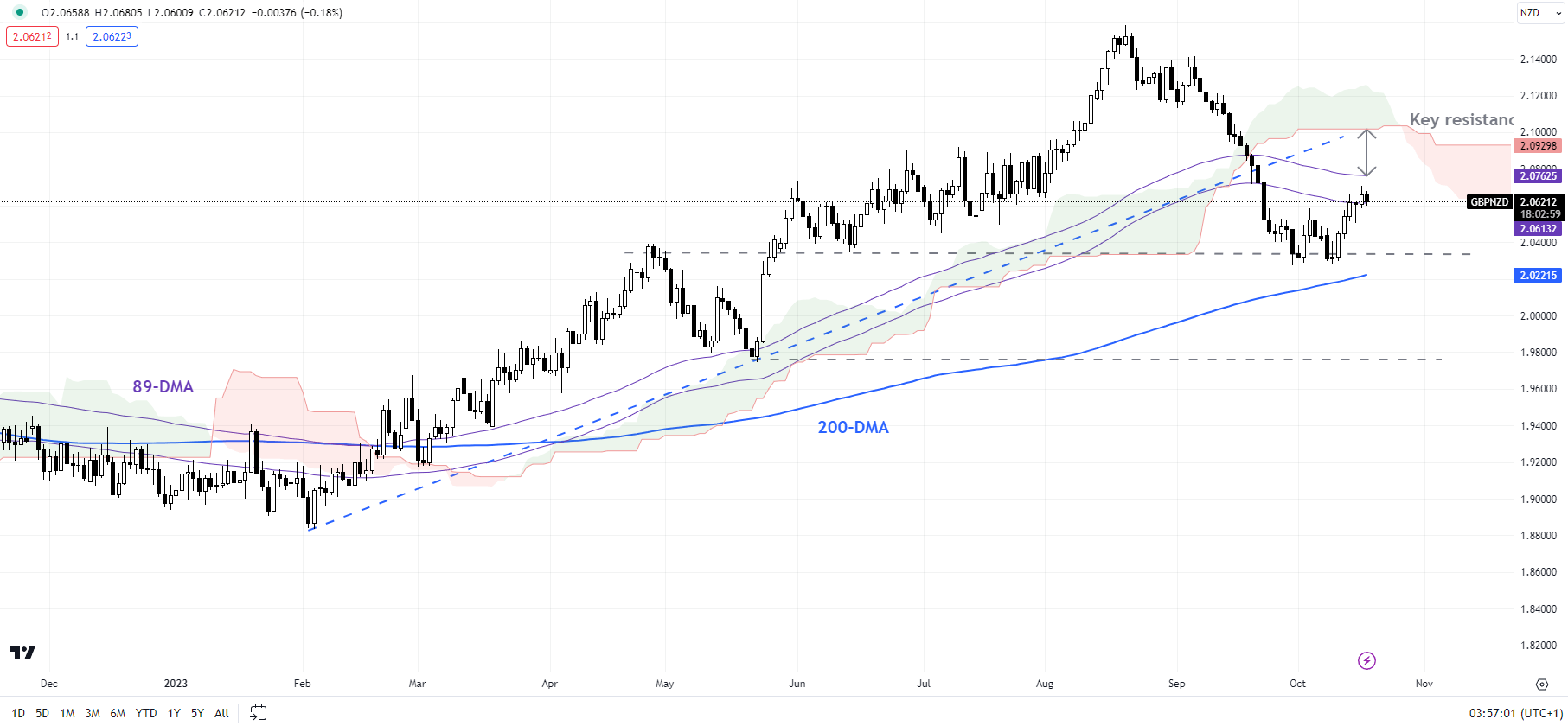

GBP/NZD Daily Chart

Chart Created Using TradingView

GBP/NZD: Rebound could run out of steam

GBP/NZD’s rebound could soon run out of steam as it nears stiff resistance on the 89-day moving average, slightly under another significant hurdle on the Ichimoku cloud on the daily charts. This follows a break below key support on an uptrend line from February, confirming that the upward pressure has faded in the interim. Any break below the September low of 2.0275 could open the way toward the May low of 1.9750.

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS