Tomorrow, Three July 2020 will likely be a quiet day on Wall Road as U.S. inventory markets are closed in observance of Independence Day. Neverthe

Tomorrow, Three July 2020 will likely be a quiet day on Wall Road as U.S. inventory markets are closed in observance of Independence Day. Nevertheless, at the moment is something however quiet as a plethora of financial knowledge has grabbed headlines. American equities are responding positively, with the DJIA DOW (+245), S&P 500 SPX (+30), and NASDAQ (+108) all posting good positive factors.

Through the pre-market hours, a number of jobs experiences have been launched to the general public. Listed here are the highlights:

Occasion Precise Projected Earlier

Persevering with Jobless Claims (June 19) 19.290M 19.000M 19.231M

Preliminary Jobless Claims (June 26) 1.427M 1.355M 1.482M

Nonfarm Payrolls (June) 4.8M 3.0M 2.699M

The important thing remark from this knowledge set is the huge achieve in Nonfarm Payrolls for June, opposite to the rise in Persevering with and Present Jobless Claims. At this level, it’s plain that the improved COVID-19 unemployment advantages are artificially boosting jobless claims. Ought to these applications expire per the 31 July deadline, unemployment roles will drop dramatically within the coming months.

Information Drives Shares Up, Doesn’t Do A lot For The EUR/USD

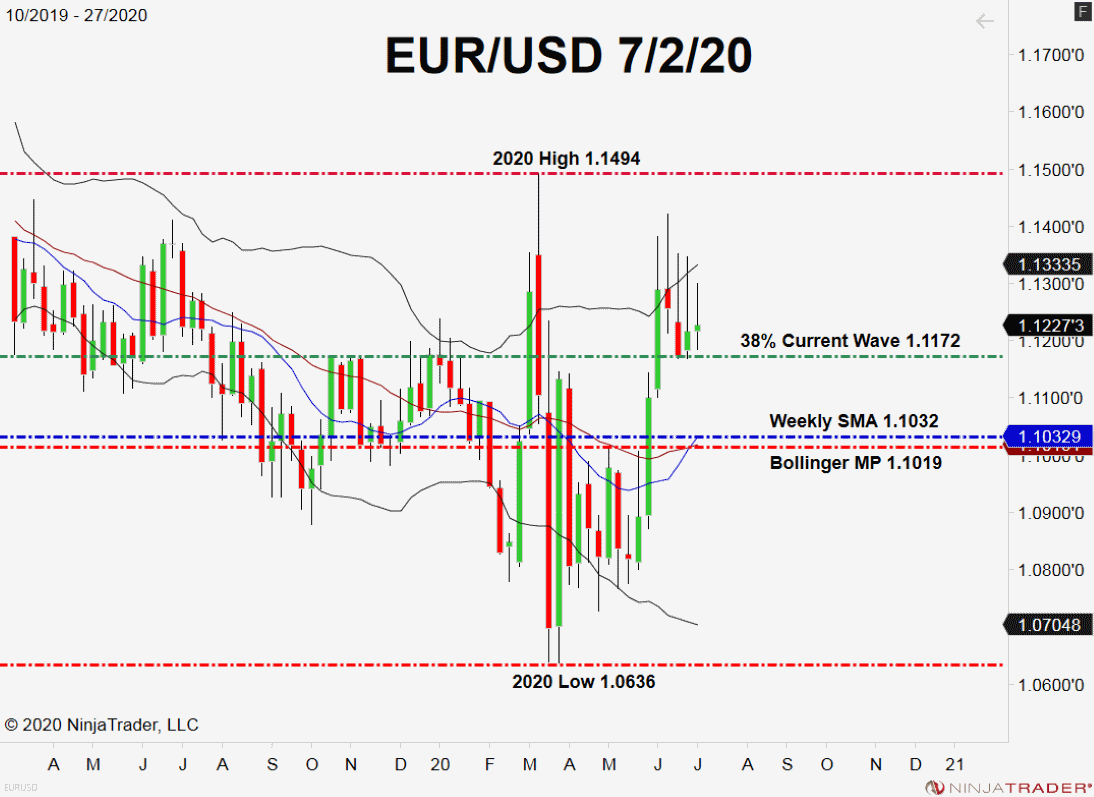

Just about all week lengthy, the EUR/USD has traded sideways as we enter the “doldrums of summer season.” This isn’t a lot of a shock as many liquidity suppliers are already off on trip.

+2020_27+(10_51_45+AM).png)

Overview: The important thing stage to observe within the EUR/USD is the 38% Present Wave Retracement at 1.1172. So long as charges are agency above this space, an intermediate-term bullish bias is warranted.

To revisit this morning’s labor market knowledge, it’s essential to notice the quickly dropping Unemployment Fee (June). June’s determine got here in at 11.1%, effectively beneath expectations (12.3%) and the earlier launch (13.3%). Bear in mind, U.S. Unemployment stood beneath 4% going into the COVID-19 disaster. Barring one other financial lockdown, the official Unemployment Fee could be very more likely to transfer towards this determine because the 12 months wears on.