SNB: Preserving a price bullet within the chamber – Foreign exchange Information Preview Posted on Septemb

SNB: Preserving a price bullet within the chamber – Foreign exchange Information Preview

Posted on September 22, 2020 at 3:19 pm GMTMarios Hadjikyriacos, XM Funding Analysis Desk

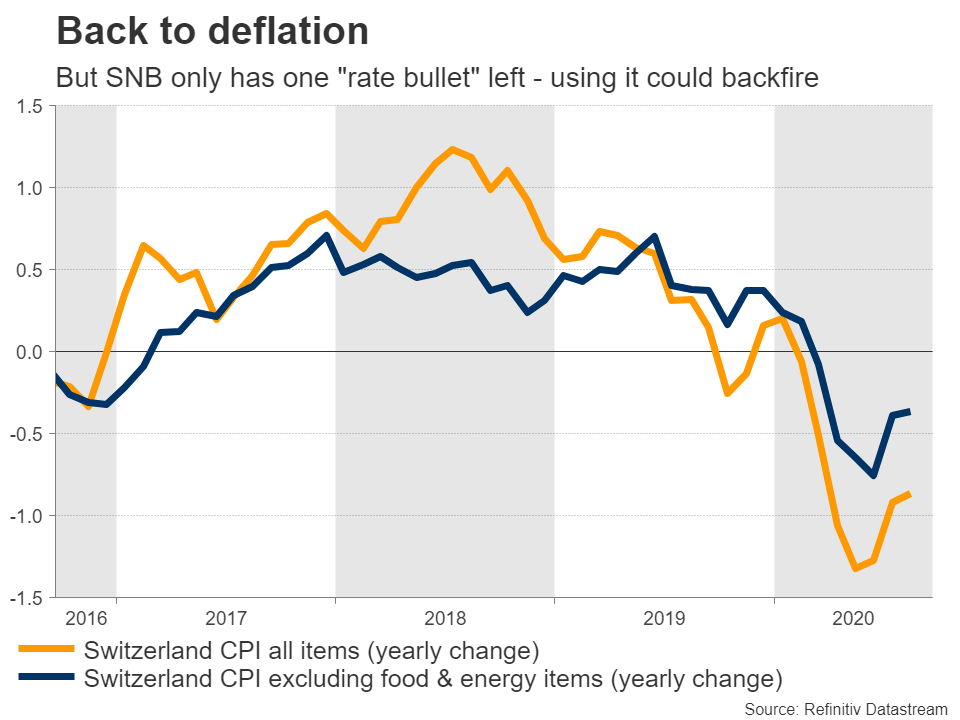

The Swiss Nationwide Financial institution (SNB) will conclude its assembly at 07:30 GMT Thursday, and with Switzerland having fallen again into deflation, markets are pricing in a 30% probability for a small price minimize. That stated, the SNB already boasts the bottom charges worldwide, so it’s unlikely to chop any deeper as operating out of coverage ammunition would threat producing a damaging expectations loop. As a substitute, it’s going to most likely stick to very large FX interventions. The franc might tick larger on the information, however any rally may not be sustained for lengthy.

Dropping the battle

Deflation is what a central financial institution is there to stop these days, so one can say the SNB hasn’t been doing its job very nicely this 12 months. Switzerland recorded its seventh straight month of falling costs in August, elevating fears that the SNB is dropping its battle with inflation for good.

Falling costs might make customers extra prone to postpone giant spending choices, in hopes of getting a cheaper price sooner or later. But when sufficient individuals assume like that, consumption tends to break down and the financial system enters a recession, making a nasty state of affairs worse.

As such, it could usually be excessive time for the SNB to chop charges to encourage borrowing, hoping to raise demand and inflation again up. True sufficient, cash markets are pricing a one-in-three probability of a 10-basis factors price minimize at this assembly.

Can’t be left with out ammo

The issue is that the SNB has very restricted room for extra stimulus, as Switzerland already has the bottom rate of interest globally at –0.75%. Whereas it might theoretically minimize just a little additional, there’s most likely solely a single minimize left within the SNB’s arsenal.

However utilizing it might backfire. First, a 10 bp price minimize can be nearly meaningless within the large image – it’s too small. Extra importantly, the SNB doesn’t need to be seen as having used completely all its firepower.

If markets sense the central financial institution is fully out of coverage choices, that might give rise to a damaging expectations loop, the place long-term borrowing prices rise as a result of buyers know there’s nothing left to push them down. That tightens monetary circumstances, making the Financial institution’s inflation-lifting job even tougher. It’s analogous to capturing your self within the foot.

Plus, lowering charges any additional would infuriate the nation’s business banks, that are already complaining that their trade has been decimated exactly as a result of of damaging rates of interest.

Intervening additional time

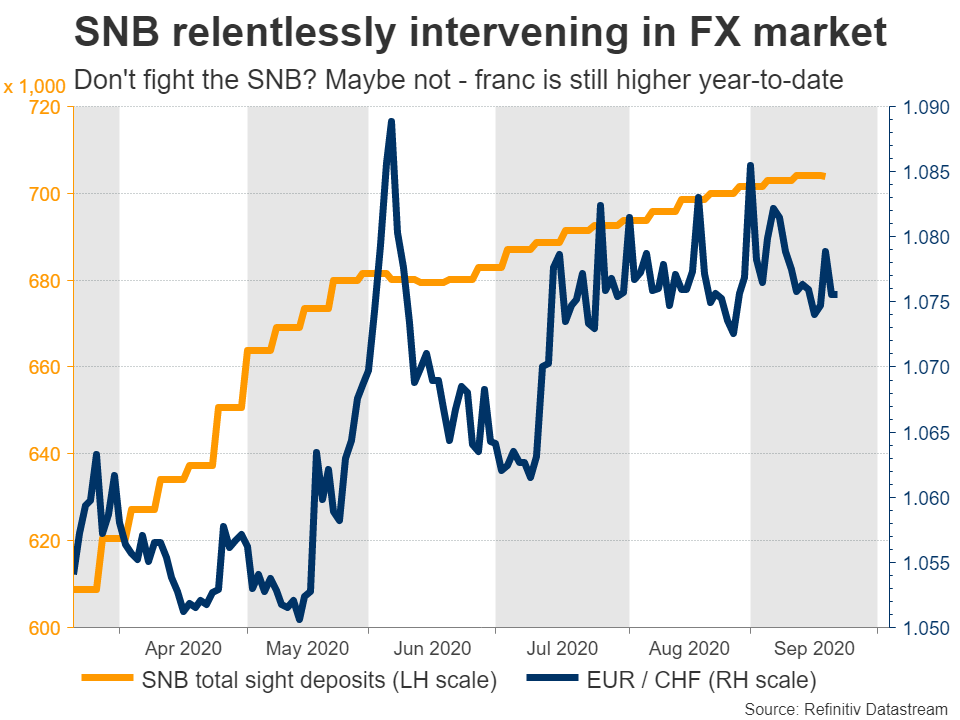

Contemplating all this, the SNB is prone to follow what has been its main coverage software in recent times: foreign money intervention. A stronger foreign money holds down inflation and makes exports much less aggressive overseas, so the central financial institution frequently intervenes within the FX market to weaken the franc, which tends to realize in instances of world turmoil due to its haven standing.

And intervene it has. Judging by the relentless enhance in whole sights deposits – a gauge of FX intervention – the SNB has been very lively this 12 months. And but, the franc continues to be larger year-to-date each towards the greenback and the high-flying euro.

Upside dangers on the choice?

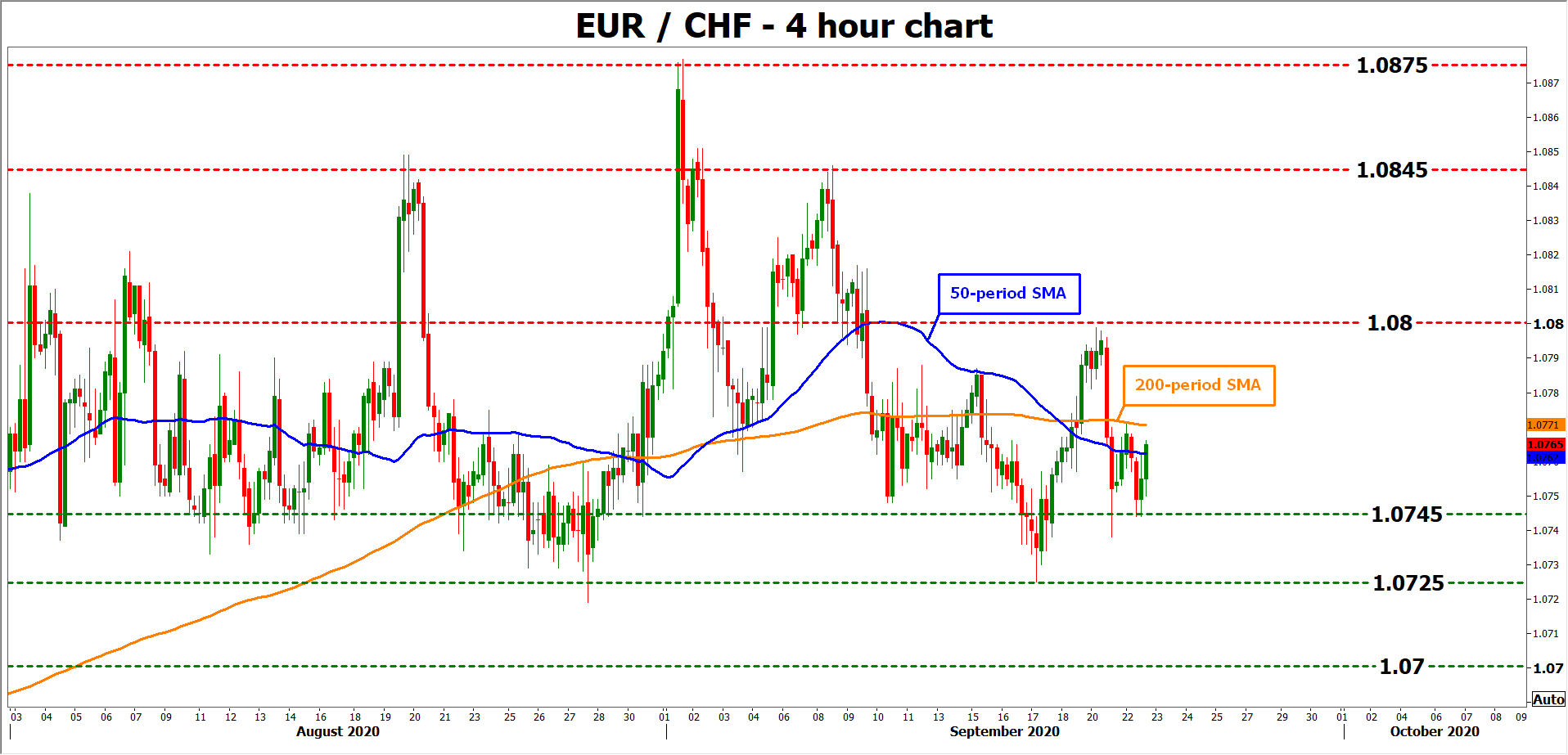

Making an allowance for the ~30% probability for a right away minimize, if charges are left on maintain, the foreign money might spike barely larger on the choice as these expectations are confirmed unsuitable. Past that, the franc’s path can be decided primarily by how world threat urge for food evolves, and particularly whether or not the newest inventory market correction continues.

Within the large image, merchants who’re lengthy the franc ought to at all times keep in mind that they’re ‘combating the SNB’, having the extra threat of being caught on the unsuitable aspect of foreign money intervention.

Taking a technical take a look at euro/franc, one other wave of declines might stall initially close to the 1.0845 zone, the place a draw back break would open the door for a check of 1.0725.

On the upside, a transfer again above 1.0800 might see scope for extensions in direction of the 1.0845 area.

EURCHFUSDCHF