USD/CAD has been on a powerful bearish development for greater than a 12 months, for the reason that USD began turning bearish final March. This pa

USD/CAD has been on a powerful bearish development for greater than a 12 months, for the reason that USD began turning bearish final March. This pair has misplaced greater than 26 cents from high to backside, however we noticed a pullback larger earlier this 12 months. By the top of the April the retrace ended and the bearish development resumed once more.

We now have been promoting the retraces larger in the course of the decline in opposition to transferring averages, which have been nice promoting indicators. As we speak, we noticed one other pullback larger, however the 50 SMA (yellow) is performing as resistance on the H4 chart once more, so we determined to open one other promote sign. The CAnadian inflation report was launched some time in the past and it was one other constructive one, which ought to assist the CAD additional

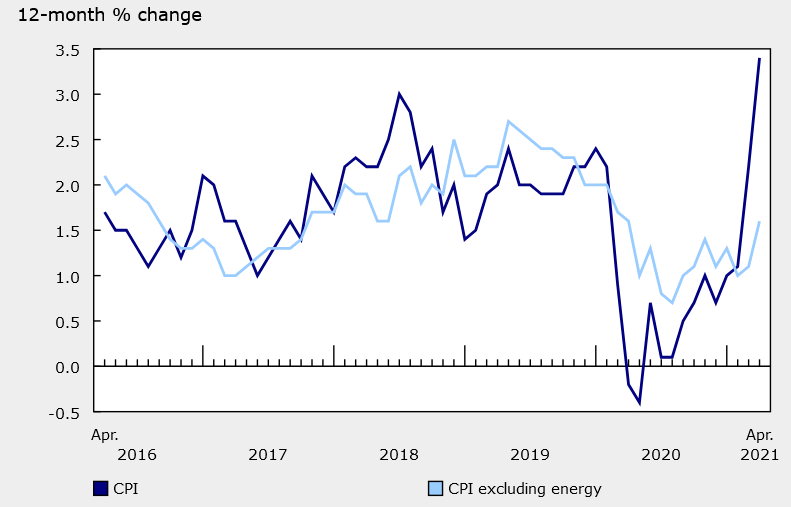

Canada CPI for April 2020

- CPI MoM April 0.5% versus 0.2% estimated

- March CPI was 0.5%

- Core CPI MoM 0.5% versus 0.3% earlier

- CPI YoY 3.4% versus 3.1% estimated

- Highest year-over-year studying since Could 2011

- Full report

Core measures:

- Core CPI widespread 12 months on 12 months 1.7% versus 1.7% estimate

- Core median YoY 2.3% versus 2.1% estimate

- Core trimmed 2.3% versus 2.2% estimate

There are additionally some skews within the report. Transportation costs rose 9.4% as gasoline costs jumped and other people started reserving journey once more. The y/y rise in gasoline costs was 62.5% — the best on document.