Protected-havens are on the rally at the moment as U.S./China relations take one other massive step again. Earlier, the U.S. State Division ordere

Protected-havens are on the rally at the moment as U.S./China relations take one other massive step again. Earlier, the U.S. State Division ordered closure of China’s Houston, Texas consulate. Citing the Houston facility as being a “spy middle,” authorities closed the workplace efficient instantly. Robust feedback from Chinese language international ministry spokesman Wang Wenbin shortly ensued:

“China Calls for the U.S. revoke the unsuitable resolution. If the U.S. went forward, China would take crucial countermeasures.”

In keeping with U.S. officers, the transfer was made to forestall additional theft of mental property and protect nationwide safety. At this level, buyers are taking heed of the event and diving into safe-havens. As of this writing (about 1:15 PM EST), GOLD is up $23.00 per ounce to $1867.00. Additionally, the Swiss franc is extending its two-month rally vs the USD.

Protected-Havens Rally Versus The Buck

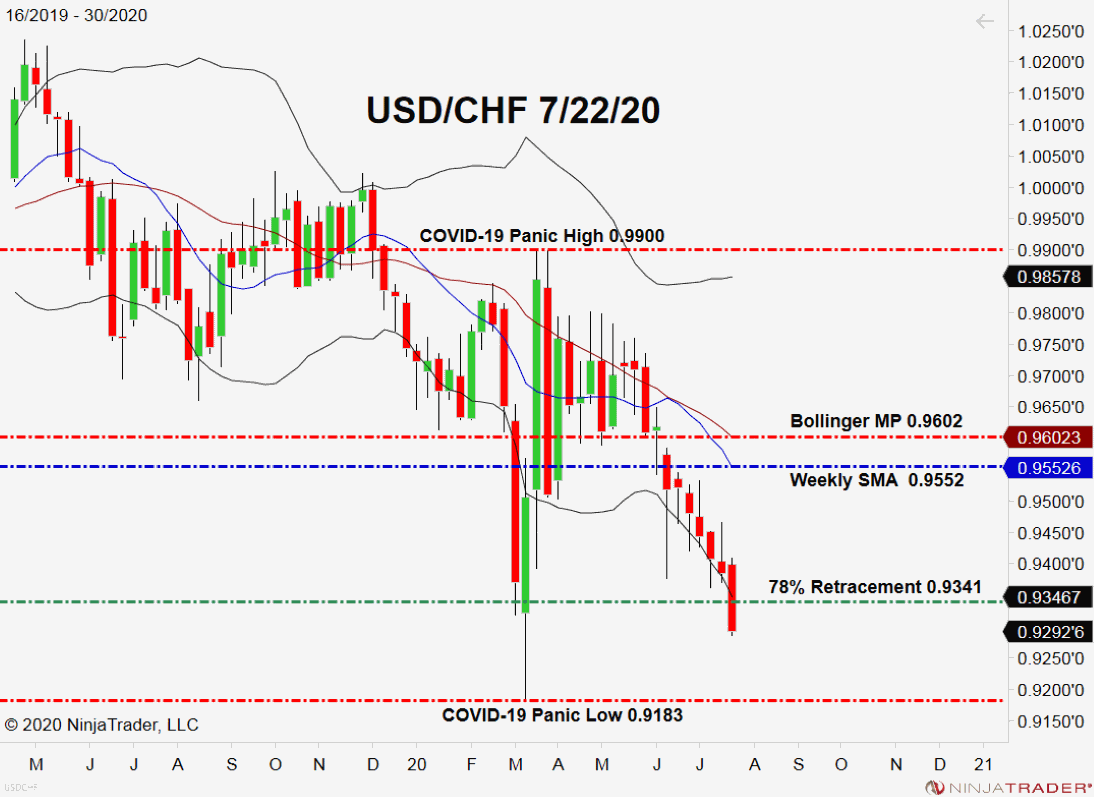

The USD/CHF is firmly in bearish territory, plunging beneath the important thing 78% Retracement macro help degree (0.9341). This degree was not remotely efficient as a protracted entry level, with charges falling unencumbered decrease.

+2020_30+(10_26_35+AM).png)

Transferring ahead, the subsequent help degree up for the USD/CHF is the COVID-19 panic low of 0.9183. This is a crucial threshold and one that’s prone to be examined sooner slightly than later. Until we see a extra hawkish tone from the FED per week from at the moment, this market is able to proceed the prevailing downtrend.

Overview: July hasn’t been good for USD bulls, as many of the majors have managed to rally vs the Buck. Now, with investor angst rising amid a ratcheting up of U.S./China tensions, it appears to be like like safe-havens are in and the greenback is out.