Indian Rupee, USD/INR, Nifty 50, Inflation and RBI Fee Hike Bets? - Speaking FactorsIndian Rupee and Nifty 50 having splendid eff

Indian Rupee, USD/INR, Nifty 50, Inflation and RBI Fee Hike Bets? – Speaking Factors

- Indian Rupee and Nifty 50 having splendid efficiency this yr to this point

- However, inflation expectations are growing, and so are RBI charge hike bets

- USD/INR eyeing 2019 inflection zone as Nifty 50 turns to face new highs?

Advisable by Daniel Dubrovsky

How are you going to overcome frequent pitfalls in FX buying and selling?

Indian property have been gaining notable consideration inside the Rising Markets house as of late. The Indian Rupee has been persistently strengthening towards the US Greenback this yr, outperforming neighboring ASEAN friends just like the Singapore Greenback. The Nifty 50, India’s benchmark inventory market index, is up 7.15% year-to-date, in comparison with the S&P 500’s 4.15% on the time of writing.

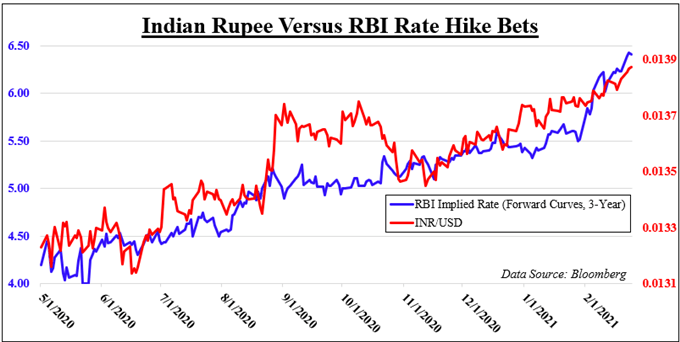

What has been driving these tendencies and may they proceed forward? For USD/INR, the pair has been very intently following what’s going on in Reserve Financial institution of India charge expectations. Within the chart under, Rupee positive aspects have been following a notable hawkish shift in the place merchants assume the RBI will take its benchmark repo charge in the long term. Native ahead curves (3-year) have it at about 6.4%, in comparison with at present’s 4.0%.

A lot of the hawkish shift occurred over the previous month, significantly after India’s authorities introduced a surprisingly huge funds value 9.5% of fiscal 2021 GDP. Rising progress expectations are definitely attracting traders from the world over. Native internet overseas fairness funding (12-month rolling sum) lately touched (USD)26165.6 million, essentially the most since 2013 – based on information from Bloomberg.

May INR merchants be getting forward of themselves? RBI Governor Shaktikanta Das reiterated the central financial institution’s dedication to protecting liquidity ample within the banking system. Furthermore, he doesn’t anticipate a spike in inflation, with costs to stay inside a 6% threshold. Supportive fiscal and financial coverage could proceed benefiting the Nifty 50. However, softer-than-expected CPI prints may end in a repricing, significantly for INR.

Instantly forward, all eyes are on fourth-quarter Indian GDP information due Friday. Development is predicted to rise simply 0.5% y/y, however that’s in comparison with a -7.5% end result within the third quarter. Higher-than-expected outcomes could proceed supporting the INR and Nifty 50. Try the DailyFX Financial Calendar for updates on these outcomes after they cross the wires.

Indian Rupee Versus RBI Fee Hike Bets

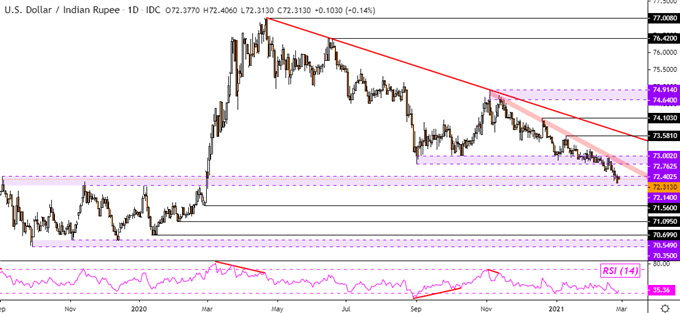

Indian Rupee Technical Evaluation

USD/INR prolonged losses after taking out the 72.7625 – 73.0020 help zone, now going through the previous 72.1400 – 72.4025 resistance zone from 2019. A drop by means of it might open the door to ultimately reaching the 70.3500 – 70.5490 help zone on the every day chart under. Within the occasion of a bounce, preserve an in depth eye on a falling zone of resistance from September which can reinstate the main focus to the draw back.

Advisable by Daniel Dubrovsky

How are you going to overcome frequent pitfalls in FX buying and selling?

USD/INR Every day Chart

USD/INR Chart Created in TradingView

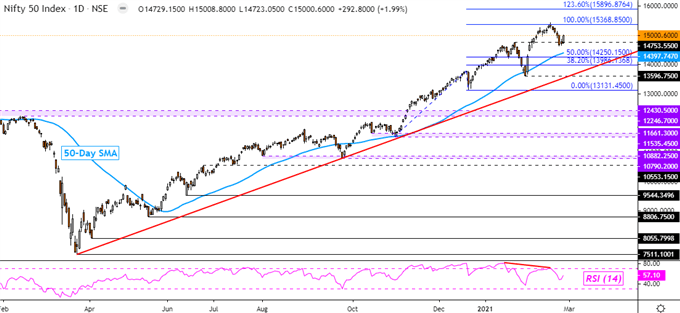

Nifty 50 Technical Evaluation

The Nifty 50 seems to have discovered help across the 14753 inflection level, the excessive established in January. This has left costs as soon as once more focusing on the 100% Fibonacci extension stage at 15368. The flip decrease earlier this month occurred as detrimental RSI divergence unfolded, an indication of fading upside momentum. Pushing above 15368 would expose the 123.6% stage at 15896. In any other case, additional losses place the concentrate on the 50-day Easy Shifting Common.

Nifty 50 Every day Chart

Nifty 50 Chart Created in TradingView

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the feedback part under or @ddubrovskyFX on Twitter

component contained in the

component. That is most likely not what you meant to do!nnLoad your software’s JavaScript bundle contained in the component as an alternative.www.dailyfx.com