S&P 500, Nasdaq 100 Value Evaluation & InformationS&P 500 | Momentum Weakens as Lockdown Dangers RiseNasdaq 100 | Bea

S&P 500, Nasdaq 100 Value Evaluation & Information

- S&P 500 | Momentum Weakens as Lockdown Dangers Rise

- Nasdaq 100 | Bearish Divergence Holds

S&P 500 | Momentum Weakens as Lockdown Dangers Rise

The S&P 500 buying and selling beneath its 200DMA had been temporary, after the index discovered help from the 50DMA. That stated, momentum indicators proceed to weaken, regardless of yesterday’s bounce again, which in flip may see positive factors restricted and capped beneath 3110, which marks the 76.4% Fibonacci retracement. Market contributors will proceed to watch the virus case rely, significantly within the southern states of America, which have needed to halt plans of reopening and thus see lockdown dangers resurface. Elsewhere, eyes can even be on month/quarter-end rebalancing shifts, whereby Citi has signalled a powerful rotation from European and Japanese equities into fastened revenue.

| Change in | Longs | Shorts | OI |

| Each day | -5% | 9% | 4% |

| Weekly | 15% | 10% | 11% |

S&P 500 Value Chart: Each day Time Body

Supply: IG

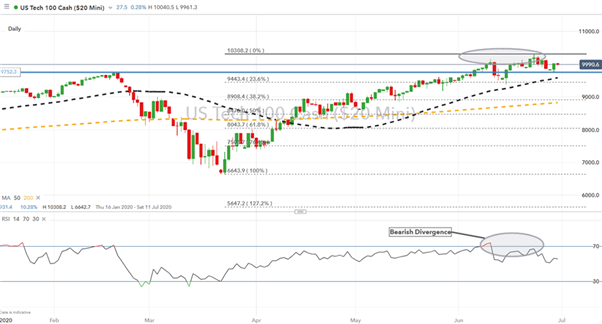

Nasdaq 100 | Bearish Divergence Holds

For the reason that pullback from its report excessive, the Nasdaq 100 has remained beneath strain, significantly because the bearish RSI divergence holds. Given the aforementioned considerations of lockdown dangers resurfacing on a state-wide foundation, dangers seem like skewed to additional weak point. As such, bears search for a retest of the pre-COVID report excessive sitting at 9750, which additionally marks yesterday’s low. That stated, the broad uptrend stays intact for the Nasdaq 100 as central banks hold monetary situations free. With this in thoughts, buyers can be inserting an in depth eye on Fed officers, most notably Powell and Brainard, wherein the latter might elaborate additional on Yield Curve Management (YCC).

Advisable by Justin McQueen

Buying and selling Foreign exchange Information: The Technique

Nasdaq 100 Value Chart: Each day Time Body

Supply: IG

— Written by Justin McQueen, Market Analyst

Comply with Justin on Twitter @JMcQueenFX